Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.05% lower at 16,470.50, signalling that Dalal Street was headed for a flat-to lower opening on Wednesday.

Asian shares were mixed as Japanese stocks were up, tracking the US markets which rose after Alphabet posted strong results and Microsoft gave an upbeat outlook, while Chinese markets fell. Japan’s Nikkei 225 index rose 0.14% and Topix edged up 0.05%. China’s Hang Seng dropped 1.42% and CSI 300 index fell 0.45%.

Indian rupee slipped 5 paise to 79.78 against the US dollar on Tuesday.

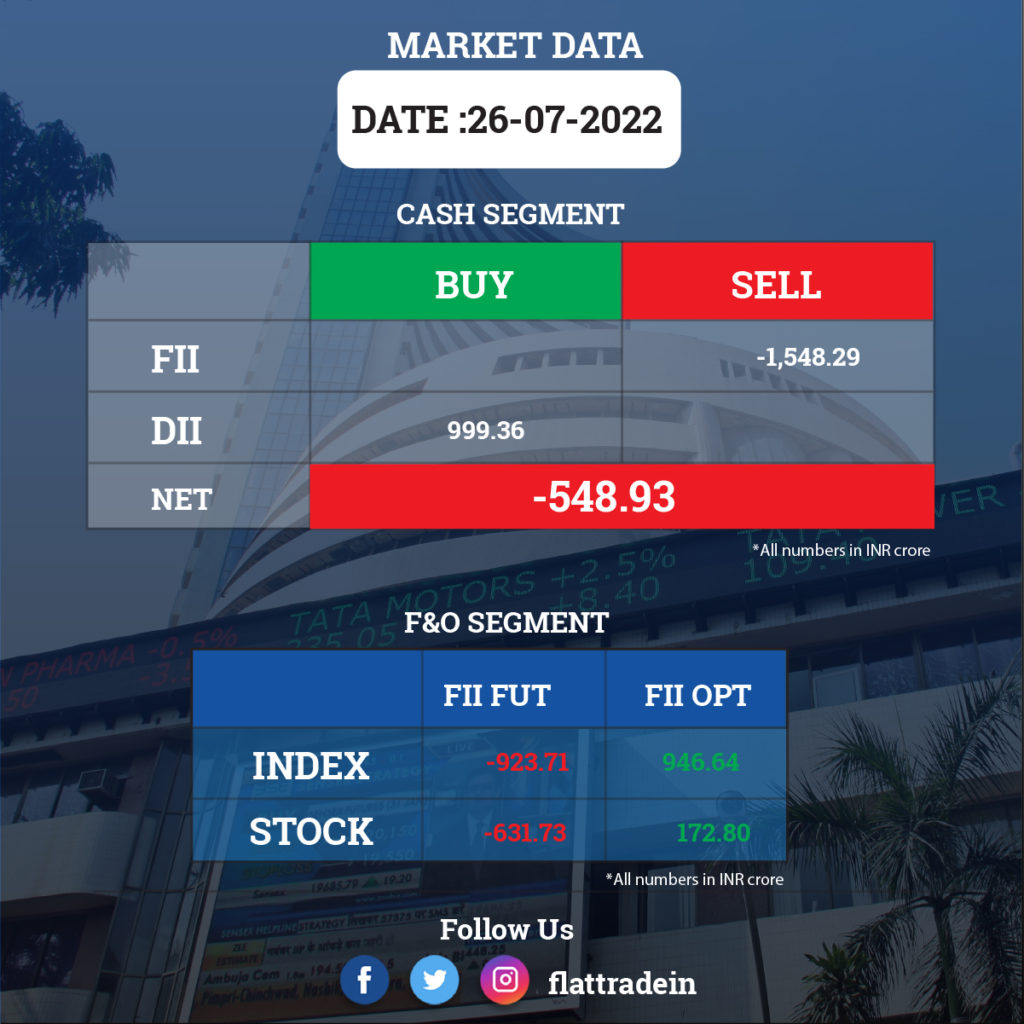

FII/DII Trading Data

Upcoming Results

Maruti Suzuki India, Tata Motors, Bajaj Finance, Biocon, Colgate-Palmolive, Aarti Drugs, CG Power and Industrial Solutions, Clean Science and Technology, Coromandel International, Dixon Technologies, EIH, Fino Payments Bank, Home First Finance Company India, JK Lakshmi Cement, Latent View Analytics, Laurus Labs, Novartis India, Poonawalla Fincorp, Schaeffler India, TeamLease Services, United Breweries, VIP Industries, and Welspun India will be reporting June quarter earnings on July 27.

Stocks in News Today

Larsen & Toubro(L&T): The engineering and infrastructure behemoth reported 45% jump in consolidated net profit attributable to owners at Rs 1,702 crore for the quarter ending June 2022 with strong execution witnessed in the infrastructure segment. It had reported a net profit of Rs 1,174 crore in Q1FY22. The company’s revenue rose 22% to Rs 35,853 crore in Q1FY23 as compared to Rs 29,335 crore in Q1FY22.

International revenues during the quarter, at Rs 13,235 crore, constitute 37% of the total revenue. The company won orders worth Rs 41,805 crore at the group level in the reported quarter, up 57% over corresponding quarter of the previous year.

Tata Power: The company posted a nearly 90 per cent jump in its consolidated net profit to Rs 883.54 crore in Q1FY23 driven by higher income. It had posted a net profit of Rs 465.69 crore in the same quarter of FY22. Its total income increased to Rs 14,638.78 crore in April-June FY23 from Rs 10,310.21 crore in the year-ago period. The company said it plans a consolidated capex of Rs 14,000 crore in 2022-23, including a Rs 10,000 crore investment in the renewable energy sector.

KPIT Technologies: The company reported a 41 per cent growth in the June quarter net profit at Rs 85.4 crore on higher revenues and wider profit margins. Its total income grew 21.41 per cent to Rs 701 crore for the reported quarter as against Rs 577 crore in the year-ago period. Its operating profit margin widened to 19.4 per cent as compared to 17.3 per cent in the same period a year ago. The company reiterated its guidance of registering an 18-21 per cent revenue growth in FY23.

United Spirits: The Diageo-controlled liquor reported over five-fold jump in its consolidated net profit to Rs 261.1 crore in Q1FY23, compared with a net profit of Rs 50.3 crore in the same quarter a year ago. Its revenue from operations was up 15.6 per cent to Rs 7,131.3 crore during the quarter under review as against Rs 6,168.5 crore in the corresponding period of the previous fiscal.

Wipro: The IT services provider has announced a new five-year strategic engagement with Nokia, the world’s leading multinational, networking, telecommunications and consumer electronics company. The new agreement builds on a partnership originally established over 20 years ago.

ONGC: The company has signed a memorandum of understanding with Greenko ZeroC for two years to pursue opportunities in Renewables, Green Hydrogen, Green Ammonia and other derivatives of green hydrogen.

Relaxo Footwears: The company’s consolidated revenue was up 34% to Rs 667.15 crore in Q1FY23 from Rs 497.13 crore in the year-ago period. Its consolidated net profit jumped 25% to Rs 38.67 crore in the reported quarter as against Rs 30.96 crore in the corresponding quarter last fiscal. Its EBITDA rose 30% to Rs 86.12 crore in Q1FY23, from Rs 66.07 crore in Q1FY22.

Aditya Birla Sun Life AMC: The company reported a 33.6 per cent year-on-year decline in consolidated profit at Rs 102.84 crore for the quarter ended June 2022, dented by a loss at other income, and tepid topline growth. Revenue from operations grew by 0.44 per cent to Rs 304.50 crore compared to the year-ago period. Its quarterly average assets under management witnessed growth of 2 per cent YoY to Rs 2.81 lakh crore in Q1FY23.

Indian Energy Exchange (IEX): The company said that the trade volume grew 10 per cent to 23.4 billion units in June quarter due to rise in power consumption in the country during the period. The growth in volumes was driven by substantial increase in electricity consumption as well as the preference by distribution utilities to meet their short-term supply requirements in a competitive and flexible manner through IEX.

Jet Airways: The company started the process for hiring pilots for Airbus’ A320 aircraft as well as Boeing’s 737NG and 737Max planes. The airline intends to recommence commercial operations in the current quarter ending September. Currently, the airline has just one operational aircraft, B737NG, in its fleet.

Union Bank of India: The company reported a 32 per cent rise in standalone net profit to Rs 1,558.46 crore for the quarter ended June 2022, helped by a fall in bad loans. It had posted a standalone net profit of Rs 1,180.98 crore in the year-ago quarter. Its total income during the reported period rose to Rs 20,991.09 crore against Rs 19,913.64 in the same quarter of FY22. Net NPA declined to 3.31 per cent in Q1FY23, from 4.69 per cent in Q1FY22.

Shoppers Stop: The clothing retail store chain posted a consolidated net profit of Rs 22.83 crore in Q1FY23, compared to a net loss of Rs 104.89 crore in the year-ago period. Its revenue from operations during the reported quarter stood at Rs 948.44 crore, up over four-fold from Rs 205.23 crore in Q1FY22.

India Grid Trust: The company posted consolidated net profit to Rs 83.72 crore for the April-June quarter, driven by higher income.It had posted a net profit of Rs 80.91 crore in the same quarter of FY22. Its total income increased to Rs 586.41 crore in April-June of FY23 from Rs 564.99 crore in the year-ago period. The company said Jyoti Kumar Agarwal has been appointed as the company’s new CEO and Whole-Time Director role effective July 1, 2022, and Divya Bedi Verma took up the role of the CFO.