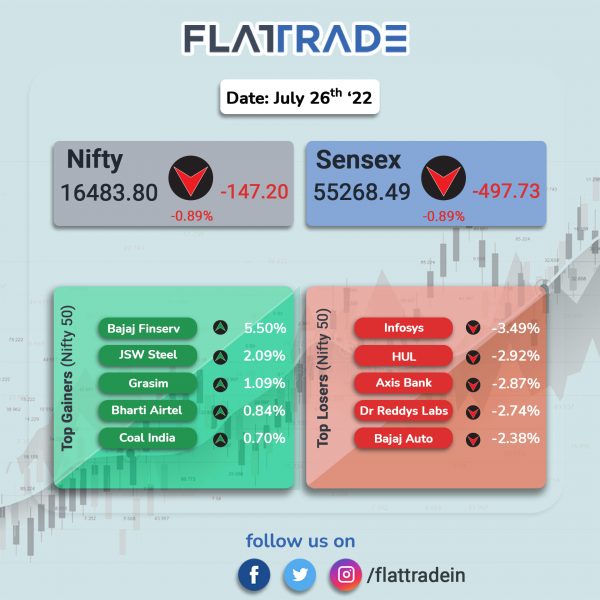

Major equity indices fell ahead of the US Federal Reserve’s monetary policy outcome on Wednesday due to looming recession fears as well as losses in IT, FMCG, auto, and pharma stocks. The Sensex fell 0.89% and the Nifty lost 0.88%.

Top losers among Nifty sectoral indices were IT [-2.83%], FMCG [-1.39%], Auto [-1.18%], Pharma [-1.18%], Realty [-1.01%]. Top gainer was Media [0.86%].

The broader markets underperformed. The Nifty Smallcap fell 1.25% and the BSE Smallcap lost 1.2%.

Indian rupee slipped 5 paise to 79.78 against the US dollar on Tuesday.

Stock in News Today

Bajaj Auto: The company’s consolidated sales rose 7.65% to Rs 7,768.89 crore in Q1FY23, as against Rs 7216.57 crore during the previous quarter ended June 2021. Its net profit declined 0.58% to Rs 1163.33 crore in the quarter ended June 2022 as against Rs 1170.17 crore during the quarter ended June 2021.

Asian Paints: The company posted a consolidated net profit of Rs 1016.93 crore in Q4FY22, compared with Rs 568.60 crore in the year-ago period. Its revenue stood at Rs 8,606.94 crore in the quarter under review from Rs 5,585.36 crore in the same period last year. Its EBITDA increased to Rs 1,555.95 crore Q1FY23 from Rs 913.56 crore in the same period last fiscal.

Ujjivan Small Finance Bank: The lender reported a net profit of Rs 202.94 crore in Q1FY23 compared with a net loss of Rs 233.48 crore in the year-ago period. Its interest income rose to Rs 905.37 crore in the reported quarter as against Rs 641.66 crore in the same period last fiscal. The company’s net interest margin stood at 9.6% compared with 8% on-year. The lender’s net NPA fell to 0.11% in the reported quarter, compared with 0.61% in Q4FY22.

Sun Pharmaceutical: The drugmaker said it has expanded the scope of its partnership with Cassiopea regarding a medication to treat acne. It has signed addendums to the licence and supply agreements for WINLEVI (clascoterone) cream 1%, expanding the territory to include Japan, Australia, New Zealand, Brazil, Mexico and Russia.

Tatva Chinta: Shares of the company fell 4.73% after the company reported a net income of Rs 9.8 crore in Q1FY23 from Rs 23.12 crore in the year-ago period. Its revenue fell Rs 88.40 crore in the reported quarter from Rs 106.83 crore in Q1FY22. EBITDA declined to Rs 15.22 crore in the quarter under review from Rs 26.28 crore in the same period last fiscal.

SpiceJet: The carrier said that the defects that were identified in 10 planes have been rectified. The 53 spot checks carried out by DGCA on 48 SpiceJet aircraft did not find any major significant safety violation. SpiceJet also rectified the malfunctions identified in 10 planes by the DGCA and all ten aircraft are back in operation.

Sonata Software: Shares of the company slumped over 5% after the company reported a consolidated net profit of Rs 107.76 crore in Q1FY23, up 7% from Rs 101 crore in the year-ago period. Its consolidated revenue was up 22% at Rs 1,778.86 crore in Q1FY23, from Rs 1,463.63 crore in the same quarter last year.

The company also approved merger of its North America subsidiary Sopris Systems with Sonata Software North America. The company approved and recommended a bonus issue of one equity share for every three equity shares held by shareholders as on the record day.

TTK Healthcare: The company’s net profit rose to Rs 600.86 crore in the quarter ended June 2022 as against Rs 6.00 crore during the quarter ended June 2021. Sales rose 12.78% to Rs 192.62 crore in the quarter ended June 2022 as against Rs 170.79 crore in the year-ago period.

Symphony: The company’s consolidated net profit surged to Rs 29 crore in Q1FY23 from Rs 6 crore in Q1FY22. Revenue from operations increased by 43% YoY to Rs 329 crore during the quarter. Shares of the company jumped 3.74%.

Tanla Platforms: Shares of the company tanked 20% after it reported lower-than-expected first-quarter results. The company’s consolidated revenue in Q1FY23 fell 6% to Rs 800.14 crore as against Rs 853.05 crore in the year-ago preiod. Its net profit declined 29% to Rs 100.41 crore in Q1FY23 as against Rs 141 crore in the corresponding quarter last fiscal. It posted an EBIT of Rs 121.41 crore in the quarter, down 30% from Rs 173.92 crore in the corresponding quarter last year.

Tejas Networks: Shares of the company slipped after it reported first-quarter results. The company posted a consolidated loss at Rs 6.64 crore for the quarter ended June 2022, against a profit of Rs 7.55 crore for the corresponding period last fiscal. Revenue declined 12.8% YoY to Rs 125.76 crore in Q1FY23.