Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.23 per cent lower at 16,581, signaling that Dalal Street was headed for a negative start on Tuesday.

Asian stocks were mixed as traders were concerned over higher inflation and looming economic recession ahead of earnings from big technology companies FOMC meeting. Japan’s Nikkei 225 index fell 0.25 per cent and Topix slipped 0.06 per cent. China’s Hang Seng rose 0.43 per cent and CSI 300 index was up 0.82 per cent.

Indian rupee jumped 13 paise to 79.73 against the US dollar on Monday.

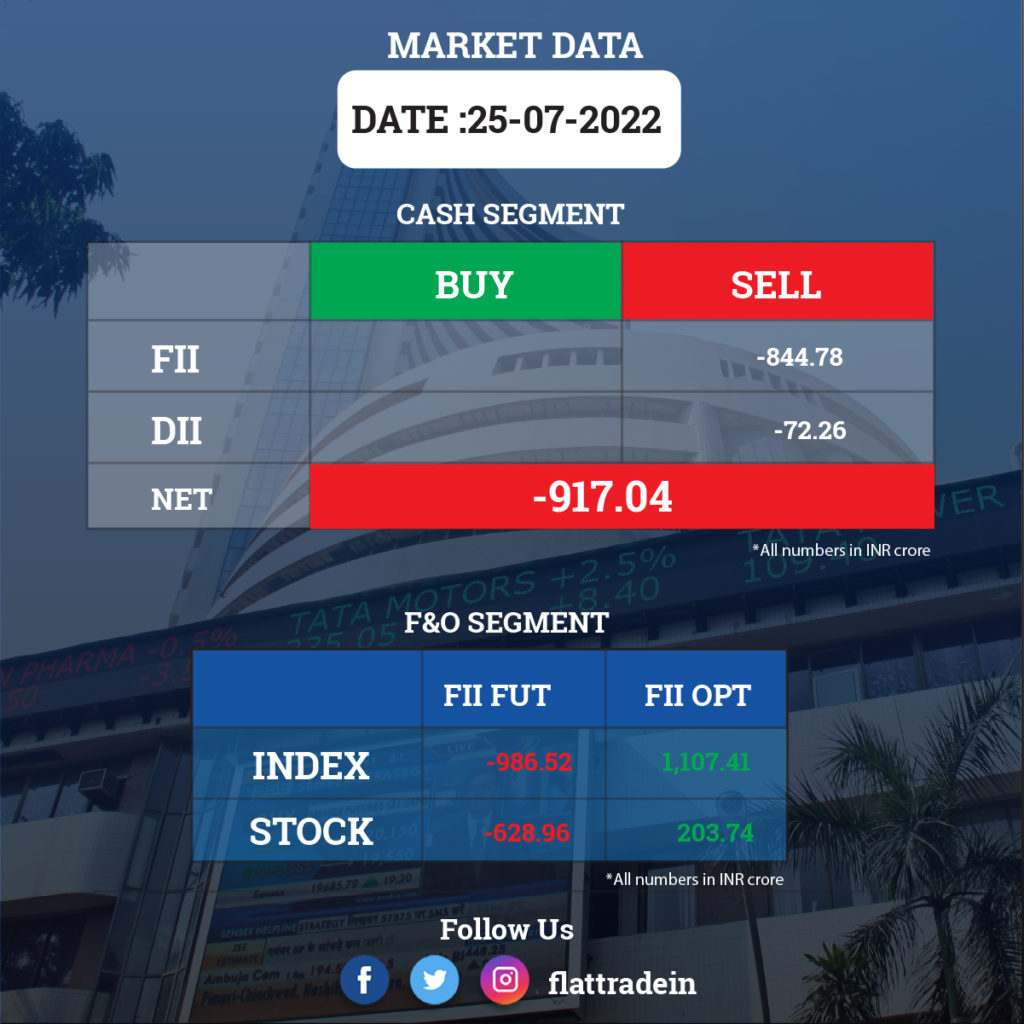

FII/DII Trading Data

Upcoming Results

Larsen & Toubro, Bajaj Finserv, Asian Paints, Bajaj Auto, Tata Power Company, Union Bank of India, Aditya Birla Sun Life AMC, United Spirits, Ujjivan Small Finance Bank, UTI Asset Management Company, Greenlam Industries, Ramco Systems, Symphony, Sanofi India, Shoppers Stop, Apollo Pipes, EIH Associated Hotels, EPL, Ethos, KEI Industries, Mahindra EPC Irrigation, PNB Gilts, SIS, South Indian Bank, and TTK Healthcare will report their June quarter earnings on July 26.

Stocks in News Today

Axis Bank: the private sector lender reported a 91 per cent year-on-year (YoY) growth in standalone net profit to Rs 4,125.26 crore in Q1FY23. The growth was attributed to higher net interest income (NII) and improved margins. During the quarter under review, NII rose 21 per cent YoY to Rs 9,384 crore. The bank’s net interest margin (NIM) stood at 3.6 per cent in the quarter under review , up from 3.46 per cent a year-ago period. The bank reported gross NPA of 2.76% for the quarter as against 3.85% in the same period a year ago.

Tata Steel: The Tata Group company posted a 21 per cent fall in its consolidated net profit to Rs 7,714 crore for the April-June quarter of FY23 due to higher expenses. It had reported a net profit of Rs 9,768 crore in the same period lat fiscal. Total income stood at Rs 63,698.15 crore in the quarter under review as against Rs 53,627.66 crore in the corresponding quarter last year. Its expenses including the cost of materials consumed and the finance cost, increased to Rs 51,912.17 crore in the reported quarter from Rs 41,490.85 crore in the same period last year.

Tech Mahindra: The IT services company reported a 16.4 per cent decline in its consolidated net profit at Rs 1,132 crore in Q1FY23, compared to a net profit of Rs 1,353 crore in the year-ago period. Its revenue grew 24.6 per cent to Rs 12,708 crore in the reported quarter from Rs 10,198 crore in the year-ago period.

Jindal Stainless Limited (JSL): The company on Monday reported about 8 per cent increase in its consolidated net profit to Rs 329.37 crore in the April-June quarter of FY23 on higher income. The company had a net profit of Rs 305.84 crore in the same period of FY22. Its total income rose to Rs 5,490.91 crore, about 36 per cent increase compared to Rs 4,042.32 crore in the year-ago period.

Macrotech Developers: The realty firm reported a 68 per cent increase in its consolidated net profit to Rs 270.80 crore in Q1FY23, compared to a net profit of Rs 160.91 crore in the year-ago period. Total income rose to Rs 2,675.78 crore in the first quarter of this fiscal from Rs 1,749.97 crore in the corresponding period of the previous fiscal. In the first quarter of the current fiscal, the company witnessed pre-sales from India business of Rs 2,814 crore.

Indian Energy Exchange (IEX): The company posted over 11 per cent rise in its consolidated net profit to Rs 69.12 crore in Q1FY23, compared with a consolidated net profit of Rs 62.10 crore in the year-ago quarter. Total income of the company increased to Rs 113.39 crore in Q1FY23 from Rs 102.87 crore in Q1FY22.

GlaxoSmithKline Pharmaceuticals: The company said its consolidated net profit increased by 8 per cent to Rs 116 crore in the first quarter of FY23. It had reported a net profit of Rs 107 crore in the same period of the previous year. Revenue from operations rose to Rs 745 crore in the quarter under review as against Rs 718 crore in the year-ago period.

Century Textiles and Industries: The company reported a 78 per cent jump in net income at Rs 63 crore driven by strong revenue growth in Q1FY23. The company said its revenue grew to Rs 1,170 crore, a growth of 41 per cent compared to the year-ago period. The company’s Managing Director J C Laddha said that the strong numbers were due to high operational efficiency and improved market demand.

Karur Vysya Bank: The private sector lender has posted a 110 per cent rise in net profit during Q1FY23 to Rs 229 crore, from Rs 109 crore during the April-June period of FY22. Its net interest income was up 17 per cent to Rs 746 crore from Rs 638 crore a year ago. The bank’s gross NPA declined to 5.21 per cent from 7.97 per cent a year ago. Its net NPA stood at 1.91 per cent in Q1FY23 as against 3.69 per cent in Q1FY22.