Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.30% lower at 17,053, signalling that Dalal Street was headed for a negative start on Thursday.

Asian shares were trading lower as cautious investors awaited inflation data later Thursday. Nikkei 225 index was down 0.52% and Topix was 0.68% lower. Hang Seng dropped 1.12% and CSI 300 index fell 0.66%.

Indian rupee was unchanged 82.32 against the US dollar on Wednesday.

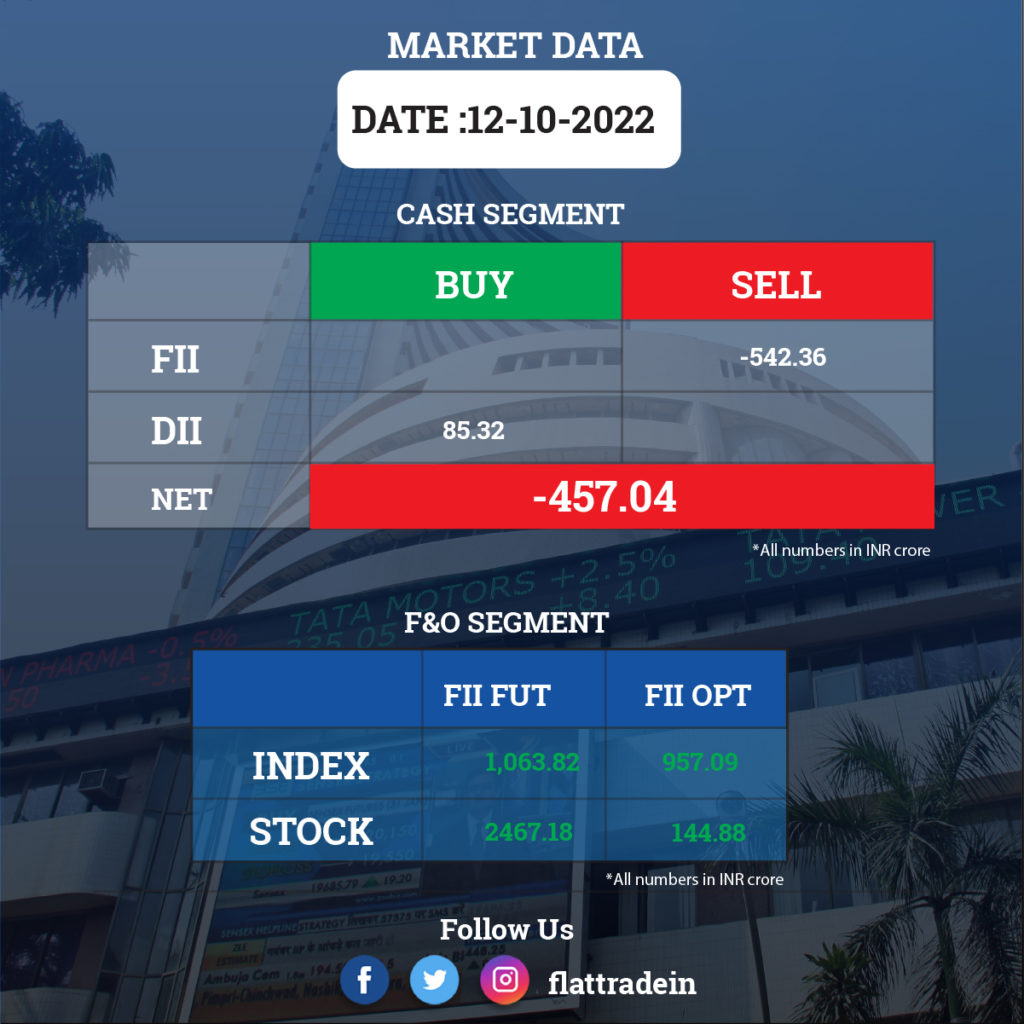

FII/DII Trading Data

Upcoming Results

Infosys, Mindtree, Angel One, Cyient, Aditya Birla Money, Anand Rathi Wealth and Den Networks will announce their results today.

Stocks in News Today

HCLTech: The IT services company posted a 6.3% sequential growth in consolidated profit at Rs 3,489 crore and revenue increased by Rs 5.2% QoQ to Rs 24,686 crore. The constant currency revenue growth stood at 3.8% QoQ and the top line in dollar terms rose 1.9% QoQ to $3,082 million. Total contract value bookings (new deal wins) was up 16% QoQ at $2,384 million. HCL Tech expects revenue to grow 13.5–14.5% YoY in constant currency and EBIT margin guidance revised to 18-19% in FY23.

Wipro: The IT firm reported a 14.6% YoY jump in its Q2 revenue at Rs 22,540 crore, while its net income decreased 9.27% to Rs 2,659 crore. Wipro’s operating margin for the quarter stood at 15.1% in the reported quarter, an increase of 16 bps QoQ. The company expects revenue from the IT services business to be in the range of $2,811-$2,853 million. In constant currency terms, the IT services segment revenue increased by 4.1% QoQ and 12.9% YoY.

Reliance Retail: Reliance Industries’ retail arm announced a multiyear collaboration to launch an extensive range of NBA merchandise in India. Under the partnership, Reliance Retail introduced a wide selection of NBA team and league-branded products to fans in India, including a comprehensive range of adult and youth apparel, accessories, back-to-school supplies, toys, collectibles and more.

Vedanta: Shareholders of the company approved the proposal to transfer money out of its reserves of Rs 12,857 crore to retained earnings. The move essentially frees up cash reserves and allows companies to reward shareholders through dividends. In a regulatory filing, Vedanta noted that 100% of Promoter and Promoter Group shareholders as well as public institutions voted in favour of the proposal.

Tata Power: The company is going to develop Tata Motors’ seven MW solar project at its Pantnagar manufacturing facility in Uttarakhand. This installation is expected to generate 215 million units of electricity, potentially mitigating over 1.7 lakh tonnes of carbon emissions.

LIC: The company has sold over 2% of its holding in state-owned company, Power Grid, over the past five months for Rs 3,079.43 crore, the insurer said. LIC’s shareholding in Power Grid has declined from 5.303% to 3.3% of the paid-up capital. The shares were sold at an average price of Rs 220.40 per share during the period through an open market sale in an ordinary course of transaction, LIC said.

Adani Ports and SEZ: In a stock exchange filing, the company said that it has received Letter of Award from West Bengal Industrial Development Corporation for development of deep-sea port at Tajpur, West Bengal on Design, Build, Finance, Operate and Transfer basis. According to a statement from the state government, the port would entail an investment of Rs 15,000 crore.

Adani Wilmar: The company expects its revenue for September FY23 quarter to grow at low single-digit compared to the year-ago period, whereas the first half of FY23 revenues and volumes are expected to register a low double-digit growth. The food and FMCG basket continued its growth trajectory similar to previous quarters registering growth of over 40 percent. Its industry essential business also grew close to 20% during the quarter and H1 both.

Dish TV India: The direct-to-Home operator and four others have settled with markets regulator Sebi a case pertaining to alleged non-disclosure of voting results of the company’s Annual General Meeting (AGM) held on December 30, 2021. These five entities have settled the case after collectively paying Rs 65.34 lakh towards settlement amount, the Securities and Exchange Board of India (Sebi) said in an order. The development comes after the entities proposed Sebi to settle the alleged violations of regulatory norms through a settlement order, “without admitting or denying the findings”.

PVR and Inox Leisure: The multiplex operator PVR said it has received the nod from its shareholders for the scheme of merger with rival Inox Leisure. The proposal was passed by over 99% of the number of valid votes cast, said the scrutiniser’s report of the meeting shared by PVR.

SAIL: The government scrapped the privatisation of SAIL’s Bhadravathi steel plant due to insufficient bidder interest. The Department of Investment and Public Asset Management said the strategic sale had received multiple expression of interest (EoIs) and bidders also conducted due diligence.

BHEL: The state-owned company said it has signed agreements with Coal India and NLC India to set up coal gasification based plants. Under the Memorandum of Understanding with Coal India, BHEL said it will jointly set up a coal to ammonium nitrate project based on gasification of high ash domestic coal.

Sterling and Wilson Renewable Energy: The company has won an order from NTPC Renewable Energy (NTPC REL) for its proposed 1,255 MWac and 1,568 MWdc solar PV project at Khavda RE power park, Gujarat. The total value of the project is Rs 2,212 crore. In addition, the company posted a consolidated loss of Rs 298.71 crore for the quarter ended September FY23, widening from a loss of Rs 284.35 crore in the same period last year, whereas revenue for the said quarter stood at Rs 312.69 crore against Rs 1,438.42 crore YoY.

Elgi Equipments: The company’s subsidiary, Elgi North America, said its air compressor EG 200V-125 has been selected by US-based North Pacific Industrial Coatings to support its blasting and painting operations. The new compressor would be a reliable source of compressed air and enable North Pacific Industrial Coatings to save about one lakh kW units a year.

Panacea Biotec: Investor Serum Institute of India offloaded 2.2% equity stake in the company via open market transactions on October 11. With this, its shareholding in the company reduced to 7.63%, down from 9.83% earlier.

Suven Life Sciences: The company said the board of directors has approved a rights issue of 7,26,91,239 shares for Rs 399.80 crore. The issue price is Rs 55 per equity share. The rights entitlement ratio is (1:2) one rights equity share for every two shares held by the eligible equity shareholders of the company.

Aether Industries: The speciality chemicals manufacturer announced the opening of its Rs 33-crore research and development centre in Surat, Gujarat. The centre will house seven synthetic labs with 55 German-made fume hoods that will allow the company to conduct 110 reactions daily.

Future Enterprises: The debt-ridden and cash strapped firm said it has defaulted on payment of interest on non-convertible debentures totalling Rs 9.16 crore. The due date for payment was October 11, 2022.

CESC: The utility services provider said the board of directors will consider a proposal for issue of secured unlisted non-convertible debentures up to Rs 300 crore on October 15.