Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.77% lower at 17,081, signalling that Dalal Street was headed for a negative start on Monday.

Asian shares fell following another decline in the US markets amid persistent high inflation. Nikkei 225 index fell 1.43% and Topix dropped 1.12%. Hang Seng slumped 1.66% and CSI 300 index lost 0.61%.

The Indian rupee was unchanged at 82.35 against the US dollar on Friday.

Electronics Mart India will make its debut on the stock exchange today. The offer price has been fixed at Rs 59 per share.

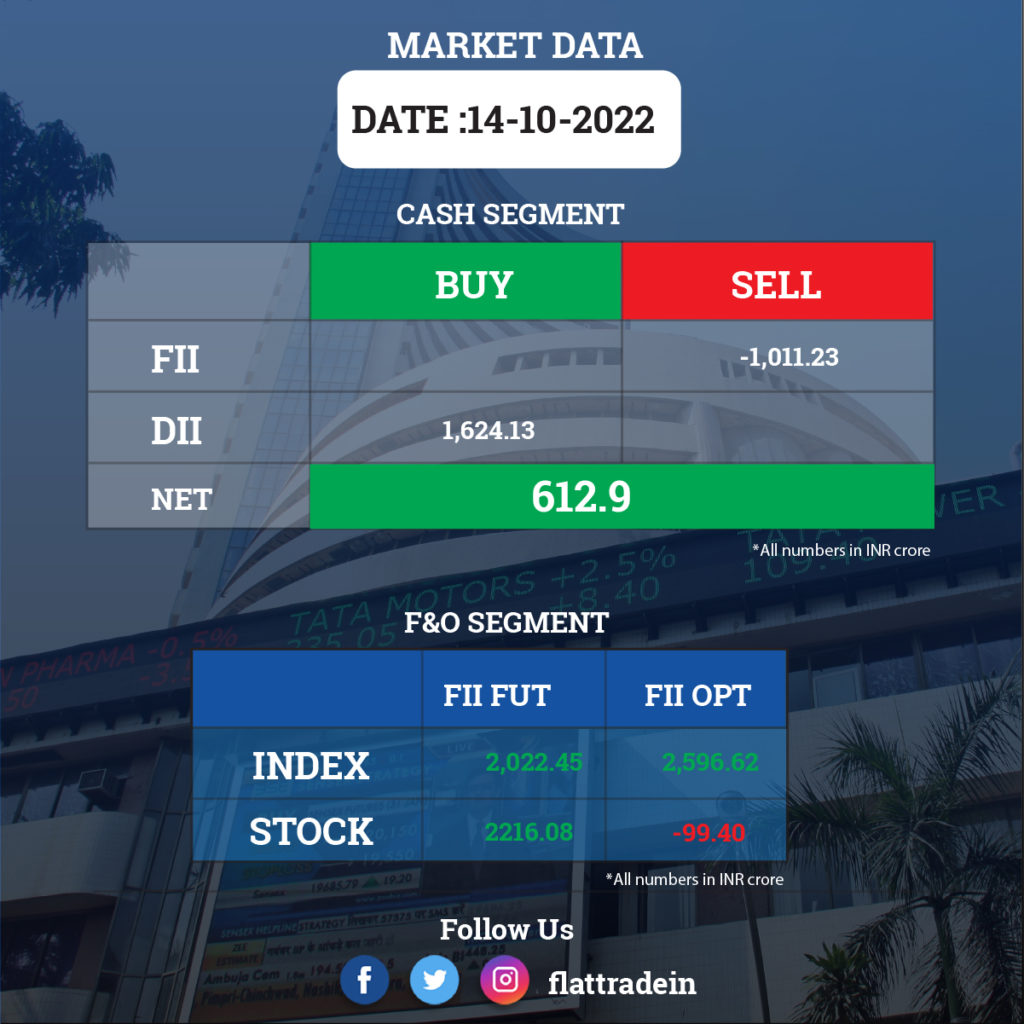

FII/DII Trading Data

Upcoming Results

ACC, Bank of Maharashtra, Can Fin Homes, Craftsman Automation, Heidelbergcement India, PVR, Tata Coffee, Tata Metaliks, RPG Life Sciences, Spandana Sphoorty Financial, Indowind Energy, Star Housing Finance, and Thangamayil Jewellery will report earnings today.

Stocks in News Today

HDFC Bank: The private sector lender has reported a 20% YoY growth in standalone profit at Rs 10,605.8 crore for the quarter ended September FY23. Net interest income grew by 18.9% YoY to Rs 21,021.2 crore with loan book growing 19% compared to year-ago period. HDFC Bank’s total deposits were at Rs 16.73 trillion, registering a growth of 19 per cent over the same time a year ago. Gross non-performing assets as a percentage of gross advances fell 5 bps quarter-on-quarter to 1.23% and net NPA fell 2 bps to 0.33% in Q2FY23.

Avenue Supermarts (D-Mart): The retail chain operator clocked a 64.13% year-on-year growth in profit at Rs 685.71 crore for the quarter ended September 2022, with revenue rising 36.6% to Rs 10,638.33 crore. Total expenses stood at Rs 9,925.95 crore, up 36.93% in Q2FY23, as against Rs 7,248.74 crore of the corresponding quarter last fiscal.

L&T Infotech: The IT firm posted 23.22% increase in its consolidated net profit at Rs 679.8 crore for the quarter ended September 2022, as against a net profit of Rs 551.7 crore in the same period a year ago. Its consolidated revenue from operations grew by 28.39% to Rs 4,836.7 crore during the reported quarter from Rs 3,767 crore in the year-ago period.

Shree Cement: The cement company has reported a 67.2% year-on-year decline in standalone net profit at Rs 189.6 crore for the quarter ended September 2022, due to high cost of fuel and weak operating performance. Revenue from operations grew by 17.9% YoY to Rs 3,780.9 crore in Q2FY23. At the operating level, EBITDA plunged 41.7% to Rs 523.3 crore hit by higher power & fuel cost, and freight & forwarding expenses.

Bajaj Auto: The company has reported a 15.7% year-on-year decline in consolidated profit at Rs 1,719.4 crore for the quarter ended September 2022 as the profit in Q2FY22 was boosted by exceptional income. Revenue grew by 16.4% to Rs 10,202.7 crore, while EBITDA jumped 25% to Rs 1,749.6 crore and margin expanded by 120 bps YoY to 17.2% in Q2FY23.

Adani Enterprises: The company will acquire SIBIA Analytics and Consulting Services, a Kolkata-based advanced analytics and machine learning company, for an undisclosed amount.

Tata Power: The company suffered a cyberattack on its IT infrastructure, impacting some of its systems. The company has taken steps to retrieve and restore the systems and all critical operational systems are functioning.

Tata Steel: The company said it is actively engaged with the U.K. government for financial support for its business there, amid reports of that the company is looking to divest their steel business in the country, PTI reported.

Adani Ports and SEZ: The company’ susbsidiary, Adani Agri Logistics, has received a Letter of Award from the Food Corporation of India (FCI), to build silo complexes at various locations across the country. Adani Agri Logistics will develop and operate silo complexes at Kanpur, Gonda and Sandila in Uttar Pradesh and Katihar in Bihar.

Tata Elxsi: The company has recorded a 39.3% year-on-year growth in profit at Rs 174.2 crore for the quarter ended September FY23, supported by topline. Revenue grew by 28.2% YoY to Rs 763.2 crore in Q2FY23.

ZEE Entertainment Enterprises: Equity shareholders of the company have given a approval to the proposed merger of ZEE and BangIa Entertainment with and into Culver Max Entertainment, formerly Sony Pictures Networks India. ZEE already had received an approval from the Competition Commission of India (CCI) for the merger on October 4, and also received approvals from the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE) in July 2022.

Oberoi Realty: The real estate company recorded a 19.5% year-on-year growth in consolidated profit at Rs 318.62 crore for the quarter ended September FY23, led by increase in income from joint ventures against significantly low income in year-ago period. Revenue declined 8.7% YoY to Rs 688.6 crore in the quarter ended September FY23.

Reliance Industrial Infrastructure Ltd (RIIL): The company reported an 11.4% drop in the second quarter net profit on flat revenue. Net profit of Rs 2.26 crore in July-September was 11.4% lower than Rs 2.55 crore net profit in the same period last year, the company said in a statement. The profit was however 61% higher than Rs 1.40 crore net profit in the preceding April-June quarter. Revenue was nearly unchanged at Rs 21.2 crore.

Dilip Buildcon: The road construction company has received project worth Rs 702 crore from Gujarat Metro Rail Corporation. The completion period for the said project is 26 months.

Birla Corporation: The company has been declared as the successful bidder for Marki Barka coal mines in Madhya Pradesh, by the Government of India.

Olectra Greentech: The company and Gujrat State Road Transport Corporation (GSRTC) have mutually decided to cancel the additional 50 buses order. Olectra had initially secured an order for supply of 50 electric buses from GSRTC which has been already supplied as on date, and later GSRTC issued a Letter of Award to Olectra for additional 50 buses.

Narayana Hrudayalaya: The company’s subsidiary, Health City Cayman Islands (HCCI), at Cayman Islands has entered into share purchase agreement to acquire the entire outstanding 50,000 ordinary shares of ENT in Cayman (EICL), a Cayman Islands resident company. EICL provides complete diagnosis and treatment of ear, nose, and throat conditions.

Ujjivan Small Finance Bank: The bank said the board has approved the scheme of amalgamation of Ujjivan Financial Services into and with the bank. The proposed Scheme is subject to approval of the Reserve Bank of India, and regulatory authorities.

Ahluwalia Contracts (India): The company has secured order from Government of Assam office for additional construction work of new medical college & hospital, Bongaigaon (Assam) worth Rs 110.67 crore. The order inflow during the FY23 stands at Rs 3,011.76 crore, till date.