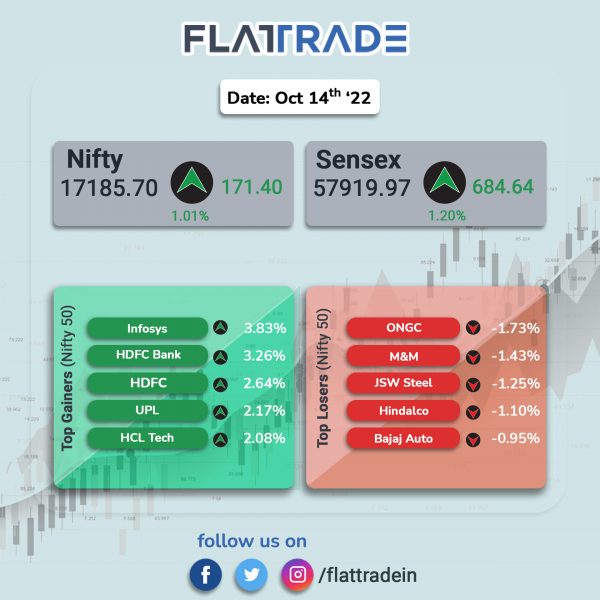

Benchmark indices closed higher, aided by gains in banking and information technology stocks. The Sensex closed 1.2% higher and the Nifty gained 1.01%.

In broader markets, the Nifty Midcap 100 index slipped 0.07% and the BSE Smallcap [0.01%] was flat.

Top gainers among Nifty sectoral indices were Financial Services [1.82%], Bank [1.76%], Private Bank [1.7%], IT [1.63%] and Pharma [0.65%]. Top losers were Oil & Gas [-1.09%], Energy [-1%], Realty [-0.8%], Media [-0.79%] and Auto [-0.67%].

The Indian rupee was unchanged at 82.35 against the US dollar on Friday.

India’s annual wholesale price inflation rate fell to 10.7% in September 2022 from 12.41% in the prior month. Food inflation based on WPI Food Index decreased to 8.08% in September 2022 from 9.93% in August 2022. Food Index decreases from 176.0 in August, 2022 to 175.2 in September, 2022.

Stock in News Today

Larsen & Toubro (L&T): The infrastructure company announced that its construction arm has secured ‘significant’ order for its water & effluent treatment business. The value of the significant project is Rs 1,000 crore to Rs 2,500 crore, according to L&T. The repeat order is from the Narmada Water Resources, Water Supply & Kalpsar Department, Government of Gujarat, to execute pumping system and pipeline works from Tappar Dam to Nirona Dam (Northern Link).

Bharti Airtel: The telcom firm announced the launch of the ‘Always On IoT’ connectivity solution in India at the Indian Mobile Congress. The solution comprises of dual profile M2M eSim which allows an IOT device to always stay connected to a mobile network from different Mobile Network Operators (MNOs) in the eSIM. The Airtel ‘Always On’ solution complies with the Automotive Research Association of India (ARAI)’s AIS140 standard implemented by the Ministry of Road Transport and Highways (MoRTH).

Federal Bank: The private lender posted a 52.89% rise in standalone net profit to Rs 703.71 crore in Q2FY23 compared with Rs 460.26 crore in Q2FY22. The bank’s total income grew 19.62% to Rs 4,630.30 crore in Q2FY23 compared with Rs 3,870.90 crore in Q2 FY22. Net interest income stood at Rs 1,762 crore in Q2FY23, up 19.1% from Rs 1,479 crore in the same quarter last year. Net interest margin improved marginally to 3.30% in Q2FY23 from 3.20% in Q2FY22. Gross NPA as a percentage to gross advances stood at 2.46% and Net NPA was at 0.78% at the end of the second quarter.

Cyient: Shares of the company fell over 3% in intraday trade after it posted poor quarterly results. The company said its net profit declined 34.79% to Rs 79.10 crore in the quarter ended September 2022 as against Rs 121.30 crore during the same quarter last fiscal. Revenue from operations rose 25.60% to Rs 1,396.20 crore in the quarter ended September 2022 as against Rs 1,111.60 crore in the corresponding quarter last year. The board of directors has announced an interim dividend of Rs 10 per share on a share of Rs 5 each for FY23 and the dividend will be paid by November 9.

Adani Enterprises: The company clarified that it is not evaluating any proposal to buy Jaypee cement business. The company added that it is not in a position to comment on the veracity of said media report.

Ashoka Buildcon: The company announced that Ashoka Baswantpur Singnodi Road, a wholly-owned subsidiary of the company has submitted duly executed financing documents to National Highways Authority of India for a Hybrid Annuity Mode (HAM) project. The project is for development of six-lane greenfield highway from Baswantpur to Singondi section of NH 150 C under Bharatmala Pariyojana project. The bid cost for the project is Rs 1079 crore.

NMDC: The company has fixed October 28 as the record date for the purpose of identification of shareholders of NMDC (demerged company) to whom the shares of NMDC Steel (resulting company) would be required to be issued and allotted by NMDC Steel pursuant to the scheme of arrangement.

Unichem Laboratories: The company said that it has received abbreviated new drug application (ANDA) approval for its Extended Phenytoin Sodium capsules from the United States Food and Drug Administration (USFDA). The drug is a generic version of Dilantin (Phenytoin Sodium) capsules of Viatris Specialty. The drug is for the treatment of tonic-clonic (grand mal) and psychomotor (temporal lobe) seizures.

KPI Green Energy: The company has received the commissioning certificate from Gujarat Energy Development Agency (GEDA) for capacity of 6 MWdc solar power project under its under Captive Power Producer segment. The power from the said solar project would be supplied to Parag Syntex (1.40 MW), Murlidhar Texprints (0.60 MW) and Shabnam Petrofils (4 MW).

EaseMyTrip: The travel company has launched its new product line called Save Now Buy Later (SNBL) as an investment scheme for its customers to help them manage their finances better while they travel. The scheme will benefit customers in planning their holiday and hotel stay well in advance by starting with a Systematic Investment Plan (SIP) and getting a return of up to 20% on the total invested amount exclusively from the company.

For domestic travellers, upon successful completion of 3 months, the collected amount can be redeemed to book a holiday package or a hotel stay of choice any time post the 90 days period from EaseMyTrip. Meanwhile, for international travellers, the company allows investing beyond 90 days period to enable its customer to plan their international trip way ahead. The maximum duration of the investment can be done for two years or 5 lakhs whichever is achieved first for both domestic and international travel.

Ramkrishna Forgings: The company has fixed November 2 as the record date for the purpose of payment of interim dividend. The board will meet on October 21 to consider and approve the earnings for the quarter ended September 2022 and second interim dividend, the company said in a regulatory filing.

Spandana Sphoorty: The company’s board has approved the issuance of secured, rated, listed, non-convertible debentures up to Rs 60 crore on private placement basis, according to its exchange filing.

Birlasoft: The company has fixed November 2 as the record date for the purpose of payment of interim dividend. The company’s board will meet on October 21 to decide on paying interim dividend to eligible shareholders, company said in an exchange filing.

PNC Infratech: The company has received communication from the National Highways Authority of India confirming the financial closure of two projects, worth Rs 2,926 crore. The two projects- Kanpur Lucknow Expressway packages I and ll, under special purpose vehicles Kanpur Lucknow Expressway and Awadh Expressway, are on hybrid annuity mode. The bid cost for the project handled by Kanpur Lucknow Expressway is Rs 1,413 crore and the one handled by Awadh Expressway is Rs 1,513 crore.