Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.81% lower at 16,157.50, signalling that Dalal Street was headed for a negative start on Tuesday.

Asian shares were mixed as investors were cautious after iphone maker Apple announced its plans to slow hiring due to aggressive monetary tightening that would lead to an economic downturn. Japan’s Nikkei 225 index rose 0.71% and Topix gained 0.49%. China’s Hang Seng fell 1.17% and CSI 300 lost 0.61%.

Indian rupee fell 9 paise to 79.97 against the US dollar on Monday.

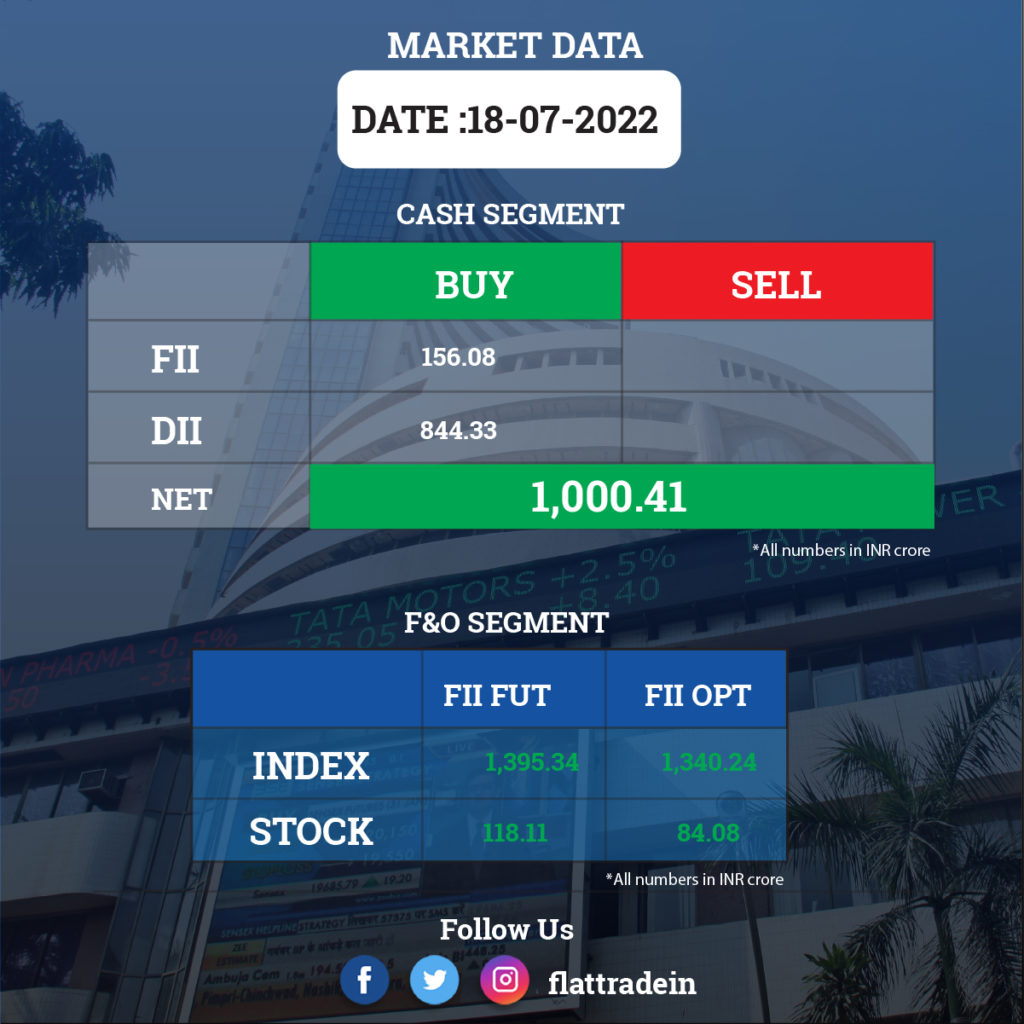

FII/DII Trading Data

Upcoming Results

Hindustan Unilever, HDFC Life Insurance Company, ICICI Lombard General Insurance Company, Ambuja Cements, L&T Finance Holdings, Network18 Media & Investments, TV18 Broadcast, Polycab India, AU Small Finance Bank, DCM Shriram, Garware Synthetics, Hatsun Agro Product, Kirloskar Pneumatic, Ponni Sugars (Erode), Rallis India, Shemaroo Entertainment, and Steel Strips Wheels are expected report quarterly earnings on July 19.

Stocks in News Today

Telcom companies: Reliance Jio has made a Rs 14,000-crore earnest money deposit (EMD), while rival Adani group has made a modest Rs 100 crore as EMD. As per the DoT’s website, Sunil Mittal-led Bharti Airtel has put in Rs 5,500 crore as EMD, while for Vodafone Idea the amount stands at Rs 2,200 crore. Earnest money deposit is reflective of the quantity of airwaves a company can bid for in the auction.

Coal India Ltd (CIL) and Adani Enterprises: The state-owned company has cancelled its maiden tender for short-term import of coal in which Adani Enterprises had emerged as the lowest bidder. Coal India decided to cancel the short-term tender of 2.416 million tonnes and PT Bara Daya Energy was asked to supply the indented quantity against the medium-term tender, the sources said.

Delhivery: The company faced institutional shareholders’ ire as majority of them rejected the company’s employee stock ownership plan (ESOP), according to Business Standard news report. According to market regulator, no company will make any fresh grant, which involves allotment or transfer of shares to its employees unless the pre-IPO ESOP scheme is ratified by shareholders after the IPO.

Vedanta: The group’s chairman Anil Agarwal said that India’s exploration and production policy should be liberalised for a wide range of metals and minerals. He noted that the country continues to pay hefty import bills year after year even as the nation is gifted with significant reserves of metals and minerals.

Mahindra & Mahindra (M&M): The company said it has hiked its stake in its Finland-based arm Sampo Rosenlew Oy to 100 per cent with the acquisition of residual shares for over Rs 35 crore. M&M has acquire acquire 1,317 equity shares of Sampo Rosenlew Oy at a price of euro 3,333 per share aggregating euro 43,89,561 (Rs 35.57 crore).

Jet Airways: The carrier is expected near a deal to buy 50 A220 jets from Airbus, Reuters reported citing two people familiar with the matter. are in an advanced stage of discussions The company’s spokesperson said that they are in an advanced stage of discussions with lessors and OEMs (manufacturers) for the aircraft.

Bank of Maharashtra: The lender’s net profit jumped 117.24% YoY to Rs 451.9 crore in Q1FY23 on the back of improvement in its net interest margins (NIMs). The lender had posted a net profit of Rs 208.01 crore during the same period last year. Its net interest income (NII) rose by 19.9% in Q1FY23 to Rs 1,685.7 crore from Rs 1,405.9 crore in Q1FY22. Its NIM improved to 3.28% in Q1FY23 from 3.05% a year ago. Its gross non-performing assets (GNPAs) stood at 3.74% till June 2022.

IndusInd Bank: The private sector lender says the board has approved the raising of funds up to Rs 20,000 crore through debt securities on a private placement basis. The fundraising is subject to the approval of the members of the bank.

Tube Investments of India: The company through its subsidiary TI Clean Mobility (TICMPL) acquired a 65.2% stake in IPLTech Electric (IPLT), through a combination of purchase of equity shares from the founders and other existing shareholders of IPLT. The acquisition cost was Rs 246 crore.

Nelco: The company posted a 7.8% year-on-year growth in consolidated profit at Rs 4.72 crore for the quarter ended June 2022 supported by a robust sales. Revenue grew by 48% YoY to Rs 81.68 crore during the quarter .

Alok Industries: The textile company posted a consolidated loss of Rs 141.58 crore for the quarter ended June 2022, up from a loss of Rs 97.65 crore in the same period last year, due to higher raw material, power and fuel costs. Revenue jumped by 56% YoY to Rs 1,971.52 crore in Q1FY23.