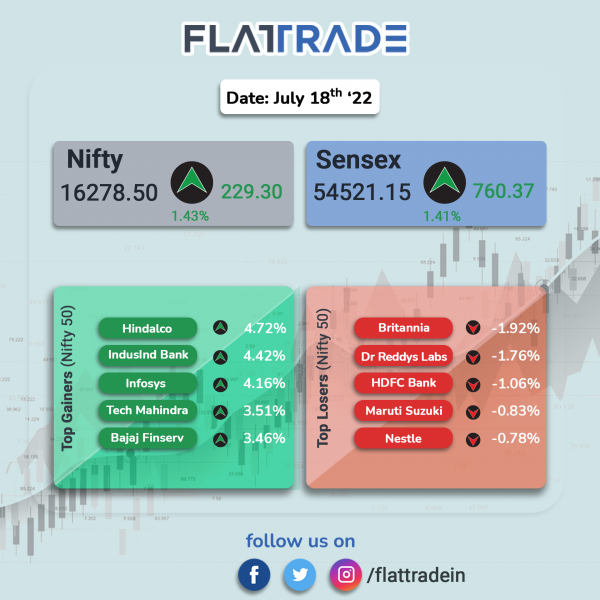

Benchmark stock indices ended higher on broad-based buying and gains in technology, metal and banking stocks. The Sensex jumped 1.41% and the Nifty 50 index rose 1.43%.

In broader markets, Nifty Midcap 100 index and the BSE Smallcap rose 1.4%, each.

Top gainers among Nifty sectors were IT [3.16%], PSU Bank [2.77%], Metal [2.49%], Private Bank [2.29%] and Bank [1.95%]. Top losers were Pharma [-0.15%] and FMCG [-0.09%].

Indian rupee fell 9 paise to 79.97 against the US dollar on Monday.

Stock in News Today

HCL Technologies : The IT servieces company has signed a multi-year deal with Dutch chemicals firm DSM. HCL will modernise DSM’s core IT business systems and use Fenix 2.0 digital execution framework to help DSM transition to product-based operating model.

Larsen & Toubro (L&T): Shares of the company rose 2.54% after the company announced that its realty arm has signed three projects worth $1 billion in the Mumbai Metropolitan Region (MMR).

The company has entered into a binding agreement to jointly develop projects in South Mumbai, Western Suburbs and Thane worth Rs 8,000 crore ($1 billion), with development potential of 4.4 million square feet.

State Bank of India (SBI): The public sector lender, which currently holds 26% stake in the YES Bank, will not take a decision to sell its stake this year. SBI is allowed to reduce the stake at the end of Financial Year 2022-23 (FY23) but it may not decide about that this financial year due to volatile market conditions, the Times of India reported.

Jindal Stainless: The company will supply 3,500 tonnes stainless steel for the Indian Railway’s Udhampur-Srinagar-Baramulla Railway Link (USBRL) tunnel project coming up in Jammu and Kashmir. The company said the project is a 272 km-long railway link between Jammu and Kashmir.

Tata Consultancy Services (TCS): The IT company said that it has been ranked number one by revenue among the top 30 suppliers of software and IT services (SITS) to the UK market by industry analyst firm, ‘TechMarketView’. The report is compiled through a detailed analysis of UK revenues of over 200 publicly quoted and privately held companies, a TCS statement said. TCS has retained its position as the UK’s largest SITS provider.

Adani Wilmar: The company has reduced MRP of soyabean oil, sunflower oil, mustard oil, bran oil, groundnut oil, vanaspati and palmole oil amid a steep fall in global prices. The maximum price reduction of Rs 30 per litre has been done in soyabean oil segment.

YES Bank: The private sector lender will invest up to Rs 350 crore for a potential 20 per cent stake in asset reconstruction company JC Flowers, which has emerged as the base bidder for the lender’s bad loans worth Rs 48,000 crore.

The lender is also planning to raise up to $1 billion in FY23 to bolster its core capital base once the NPA challenge is over, its managing director and chief executive Prashant Kumar told reporters here on Monday. He also added that the bank has come out of the reconstruction scheme successfully.

Prestige Estates Projects: The realty firm reported over four-fold jump in its sales bookings at Rs 3,012 crore during the first quarter of this fiscal year on better demand and lower base effect. The sales bookings stood at Rs 733.9 crore in the year-ago period.

Gujarat State Fertilizers & Chemicals (GSFC): The company informed the exchanges that its Urea-II plant has been shut down immediately after noticing leakage in bottom thermo well of Urea reaction on Saturday. The estimated time to prepare standby Urea reactor will be at least 12 days, according to company. It expects 13 days of production loss and about 10,400 million tonnes of neem urea loss due to the shutdown.

JSW Steel: The company said it has partnered with US-based Boston Consulting Group (BCG) to meet its decarbonization goals. The company has an ambitious target of reducing its carbon emission by 42 per cent by 2029-30 versus base year 2005.

Quick Heal Technologies: Shares of the company surged 20 per cent after the company said that its board will consider buyback proposal in the upcoming meeting on July 21. The board will also consider and approve the un-audited financial results of the company for Q1FY23.