Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.96% higher at 16,194, signalling that Dalal Street was headed for a positive start on Monday.

Asian shares rose amid easing expectations of aggressive rate hikes and as Chinese authorities pledged to boost the country’s economy. Japan’s Nikkei 225 index rose 0.54% and Topix slipped 0.03%. China’s Hang Seng jumped 1.28% and CSI 300 index increased 0.46%.

Indian rupee rose 4 paise to 79.84 against the US dollar on Friday.

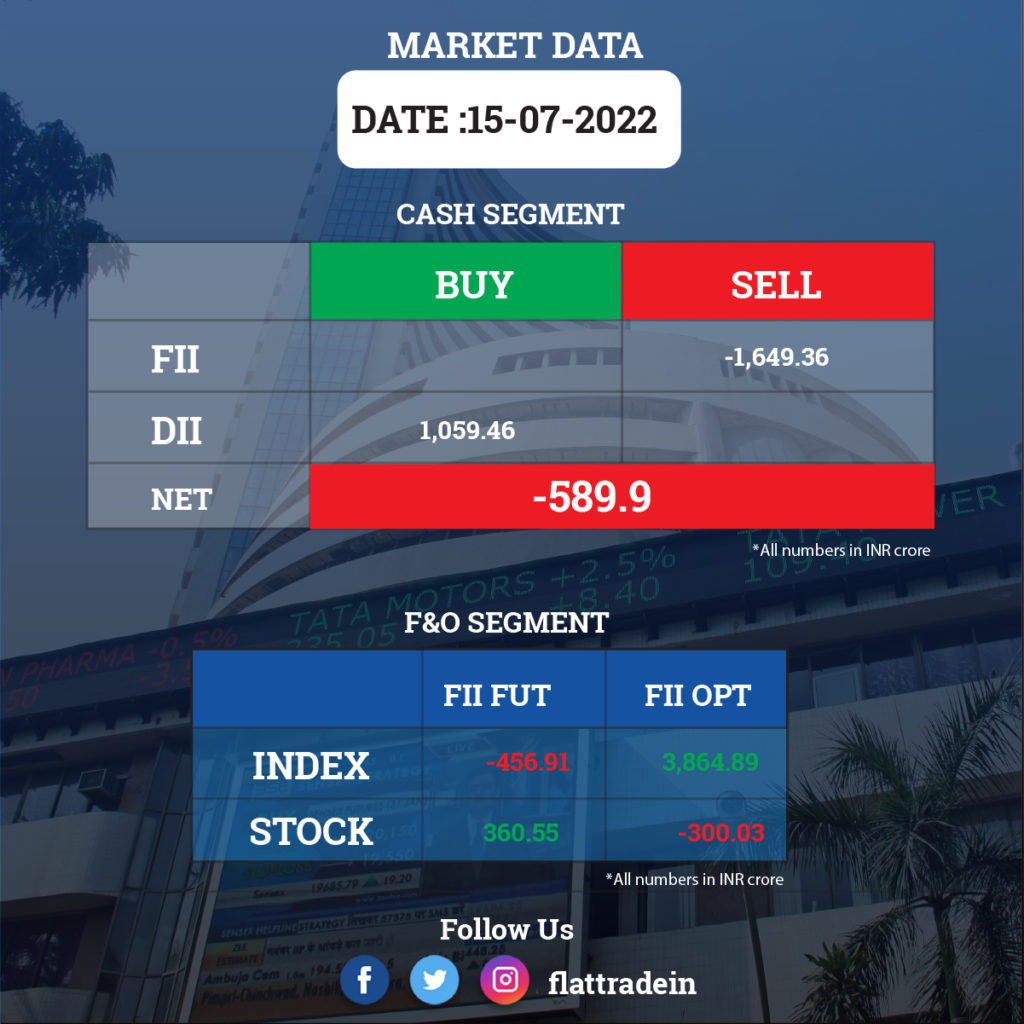

FII/DII Trading Data

Upcoming Results

HeidelbergCement India, Nelco, Bank of Maharashtra, Bhansali Engineering Polymers, Alok Industries, Ganesh Housing Corporation, Onward Technologies, Sudal Industries, Tanfac Industries will report their quarterly earnings on July 18.

Stocks in News Today

HDFC Bank: The lender reported a 19% year-on-year increase in its standalone net profit at Rs 9,196 crore in Q1FY23, after providing Rs 2,984.1 crore for taxation. During the same period last year, the net profit stood at Rs 7,729.64 crore. The bank’s net interest income, the difference between the interest earned and the interest expended, rose 14.5% to Rs 19,481.4 crore. Gross non-performing assets (NPA) were at 1.28% of gross advances as on June 30, 2022.

Jindal Steel and Power Limited (JSPL): The company reported a consolidated net profit of Rs 2,770.88 crore for the quarter ended June 2022, on account of higher income. During the quarter under review, its total income rose to Rs 13,069.17 crore from Rs 10,643.17 crore in the year-ago period. Expenses were also higher at Rs 10,566.64 crore as against Rs 7,233.55 crore in the year-ago period.

ICICI Prudential Life Insurance: The company reported a net profit of Rs 156 crore in Q1FY23, compared to a loss of Rs 186 crore in the year-ago period, helped by lower claims and provisions. The value of new business (VNB) increased 32% to Rs 471 crore in Q1FY23, compared to Rs 358 crore in the year-ago period. Its new business premium – the value acquired from new policies for a particular year – of the insurer grew 24.4% to Rs 3,184 crore in the same period.

L&T Technology Services (LTTS): The company reported net profit of Rs 274 crore in Q1FY23, up 27% year-on-year. Sequentially, the profit was up 4.7%. Revenue for the company, which focuses on engineering services, grew at 23% YoY at Rs 1,873 crore. The company also reaffirmed the FY23 revenue growth guidance of 13.5-15.5%.

Tata Steel: The company plans a capital expenditure of Rs 12,000 crore on its India and Europe operations during the current financial year, the company’s Chief Executive Officer T V Narendran said. The domestic steel major plans to invest Rs 8,500 crore in India and Rs 3,500 crore on the company’s operations in Europe.

Bharti Airtel: The telco has tested its first 5G private network at the Bosch Automotive Electronics India facility in Bengaluru. Airtel implemented Industrial-grade use cases for quality improvement and operational efficiency at Bosch’s unit, utilising the trial spectrum allotted by the government.

Bharat Electronics: The state-owned defence company has clocked 1,401% year-on-year growth in consolidated profit at Rs 366.33 crore for the quarter ended June 2022, driven by strong operating income. Revenue in Q1FY23 grew 90.5% to Rs 3,140.6 crore from the corresponding period last fiscal.

Lupin: The drug maker said it has inked a licensing pact with Alvion Pharmaceuticals to commercialise medicines for cardiometabolic diseases in Southeast Asia. The Mumbai-based company said it is committed to providing affordable treatment options to healthcare providers and patients.

Vodafone Idea: The debt-ridden telecom operator’s shareholders have approved equity allocation worth Rs 436.21 crore to its promoter entity. As per voting results submitted to the stock exchanges, 99.94% of Vodafone Idea (VIL) shareholders approved allocation of the equity to Vodafone Group firm Euro Pacific Securities.

Vedanta: The company expects to bring into operation two coal blocks in Odisha in this fiscal and is working out a plan to fast-track the operationalisation of another coal mine in the eastern state. The mining major is focusing on the long-term security of coal especially when thermal power plants and the non-regulated sector have witnessed supply shortages in the current and the last year.

Hindustan Zinc: The company is looking at expanding its footprint in the production of zinc alloys and has received approval to set up a 30 kilo tonnes per annum plant (KTPA), company’s CEO Arun Misra said. The move will make way for the production of value-added zinc alloy products and enable the company to deliver international quality products in the domestic market.

Indian Oil Corporation (IOC): The state-owned oil marketing company has launched a unique Bikers Cafe to cater to the needs of biker expeditions to the Himalayas as it looks to retain its market leadership with differentiated offerings tailored for various consumer sets. Its officials said the first such offering has been started near Shimla and more such facilities will be set up along the Chandigarh-Manali route as well as the Chandigarh-Kaza sector.

InterGlobe Aviation: The company said its board has approved the appointment of former SEBI Chairman M Damodaran as non-independent non-executive director.

Karnataka Bank: The city-headquartered lender has signed a Memorandum of Understanding (MoU) with JCB India Limited, a manufacturer of earthmoving and construction equipment in India. The tie-up arrangement with JCB India is expected to boost the lending avenues under the bank’s MSME portfolio.

Happiest Minds Technologies: The IT company has purchased a fully built-up ready-to-use commercial property spread over 2.4 lakh square feet in Bengaluru for Rs 101 crore, the company said. The facility with a seating capacity of 1,600 seats is in the technology hub of Electronics City.

KNR Constructions: The company has bagged road construction project in Telangana. The company has received a Letter of Acceptance for construction of a four lane road from IDA Pashamailaram Industrial Park to ORR in Sangareddy district, Telangana. The order is worth Rs 34.26 crore and the construction project is for 18 months.

Oberoi Realty: The real estate company has reported a five-fold year-on-year increase in Q1FY23 profit at Rs 403.48 crore. Revenue trebled to Rs 934.81 crore and EBITDA surged nearly four-fold to Rs 513.87 crore.

Just Dial: The company posted Q1FY23 loss of Rs 48.3 crore due to mark-to-market losses. Operating revenue came in at Rs 185.6 crore, up 12.2% YoY in Q1FY23.

SeQuent Scientific: The company said its board of directors has appointed P V Raghavendra Rao as the chief financial officer (designated as key managerial personnel) with effect from July 25. Rao, a chartered accountant and having close to 22 years of work experience, comes from Macleods Pharmaceuticals, where he was chief financial officer.

Coromandel International: The company’s arm has invested in climate-smart deeptech startup Ecozen. The startup, Ecozen Solutions, has raised Rs 54 crore of additional funding as the first tranche of a planned Rs 200 crore Series C round. The new funding round was led by Dare Ventures, the venture capital arm of Coromandel International, with participation from existing investors Caspian and Hivos-Triodos Fonds (managed by Triodos Investment Management) through equity. Northern Arc, UC Inclusive Credit, Maanaveeya, and Samunnati also participated with debt funding.

Maharashtra Seamless: Maharashtra Seamless receives subsea sour service seamless pipes order. The company has received its first order of subsea sour service seamless pipes from a customer with basic value of Rs 130 crore. Subsea sour service seamless pipes are high value addition pipes and are used for subsea transportation of crude oil and gas in high pressure environments.

Den Networks: The digital cable TV service provider has reported a 69% year-on-year decline in consolidated profit at Rs 12.71 crore in the quarter ended June, dented by lower revenue and weak operating performance. Revenue fell 6.5 percent YoY to Rs 283.36 crore in Q1FY23.

Medplus Health Services: The company said it will enter the insurance broking business in life, general insurance. The company has incorporated a wholly-owned subsidiary, namely, MedPlus Insurance Brokers. The subsidiary will carry on the business of direct insurance broking business in life and general insurance, and all kinds of guarantee and indemnity business.