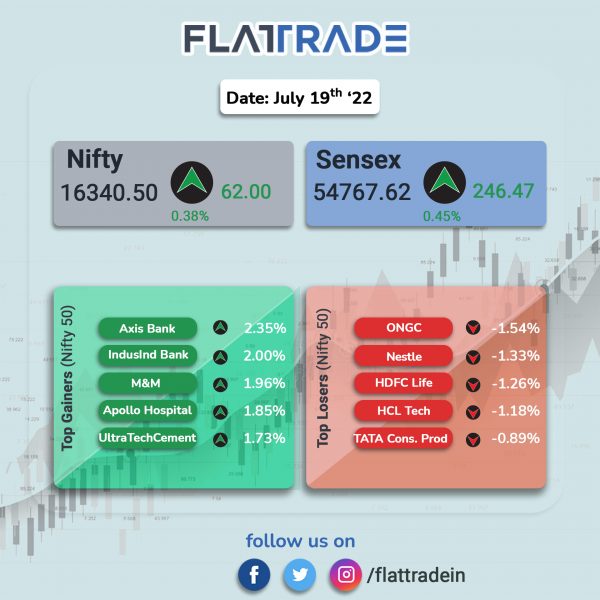

Benchmark stock indices ended higher in a volatile session, helped by gains in bank, auto and realty stocks. The Sensex rose 0.45% and the Nifty 50 index gained 0.38%.

Broader markets mirrored headline indices. The Nifty Midcap 100 index advanced 0.67% and the BSE Smallcap was up 0.88%.

Top gainers among Nifty sectors were Realty [2.55%], PSU Bank [2.29%], Pvt Bank [1.17%], Auto [1.05%] and Metal [0.81%]. Top losers were Media [-0.34%], Pharma [-0.25%] and Oil & Gas [-0.13%].

Indian rupee breached 80 against the US dollar to hit a low of 80.06 during the course of the day. However, it recouped some losses and ended 3 paise lower at 79.94 against the US dollar on Tuesday.

Stock in News Today

HDFC Life: The private insurer reported a profit after tax (PAT) of Rs 365 crore in the June quarter, up 21% from Rs 302 crore in the corresponding quarter last year. Its value of new business rose 25% to Rs 510 YoY crore in Q1FY23. The total assets under management rose 10% YoY to cross the Rs 2 lakh crore mark. The total annualized premium equivalent climbed 22% to Rs 1,904 crore.

Telcos: India has seen a net addition of 28.4 lakh wireless subscribers In May. Reliance Jio added 31,11,417 subscribers in May, while Bharti Airtel suscriber base grew by 10,37,881 in May 2022. Meanwhile, Vodafone Idea lost 7,59,258 subscribers in May and BSNL subscriber number fell by 5,31,502 in May.

Mindtree: The mid-tier IT services company has announced its partnership with US-based cloud data management and security firm Rubrik, according to its exchange filing. The two firms will jointly launch unified cyber-recovery platform named MINDTREE VAULT. The platform will combine Mindtree’s program management, cloud, data, cybersecurity capabilities and Rubrik’s data security and recovery solutions.

Arvind Ltd: The company said that its omnichannel technology business ‘Omuni’ has been bough by Shiprocket for Rs 200 crore in stock and cash deal. The combination of both entities will facilitate quick, efficient deliveries of shipments from the nearest store or warehouse, significantly reducing delivery timelines, the company said in an exchange filing.

DLF: The realty major’s chairman Rajiv Singh said that the company has initiated the development of new shopping malls and looks to double retail portfolio in next five years. Currently, DLF has a retail footprint of 42 lakh square feet including malls and shopping centres, mainly across Delhi-NCR.

Mastek: The company has signed a definitive agreement to acquire 100% of the US-based Metasoftech Solutions, for an upfront consideration of $76.6 million (approximately Rs 612.8 crore). The acquisition is expected to be completed by August 2022. Metasoftech Solutions is located in Arizona and is an independent salesforce consulting partner in the southwest region. For the 12-months ended June 30, the estimated turnover of the company was $29.4 million.

DCM Shriram: The company’s consolidated net profit soared 61.24% YoY to Rs 253.96 crore in Q1FY23. Its revenue from operations rose 46% on-year to Rs 2,851 crore in Q1FY23. The company said it is investing close to Rs 3,500 crore in various projects primarily in chemicals and sugar business which will be commissioned over the next 12 months and will be funded from internal accruals and debt.

Polycab India: The company’s net profit rose 197% to Rs 219.76 crore in the quarter ended June 2022 as against Rs 73.99 crore during the same quarter last year. Sales rose 47.51% to Rs 2736.56 crore in the quarter ended June 2022 as against Rs 1855.23 crore during the year-ago period.

Nucleus Software Exports: Shares of the company jumped after the IT company announced that it has entered a deal with Vietnam Public Joint-stock Commercial Bank to digitally transform its lending origination operations. Nucleus Software will use its lending platform FinnOne Neo for the said purpose.

Sterlite Technologies: The company has secured Rs 250 crore deal for building Indian telecom operator’s optical network. Under this deal, the company seeks to fulfil the telecom operator’s requirement for setting up a high-performance, modern communication network in India.