Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.34% lower at 17,783.50 signalling that Dalal Street was headed for a negative start on Tuesday.

Japanese stocks opened higher on Tuesday, extending US rallies, as investors focused on corporate earnings season. Nikkei 225 index rose 0.83% and the Topix gained 0.87%. Chinese shares were trading lower with the Hang Senf falling 0.91% and CSI 300 index dropping 0.77%.

The Indian rupee stood at 82.68 against the US dollar.

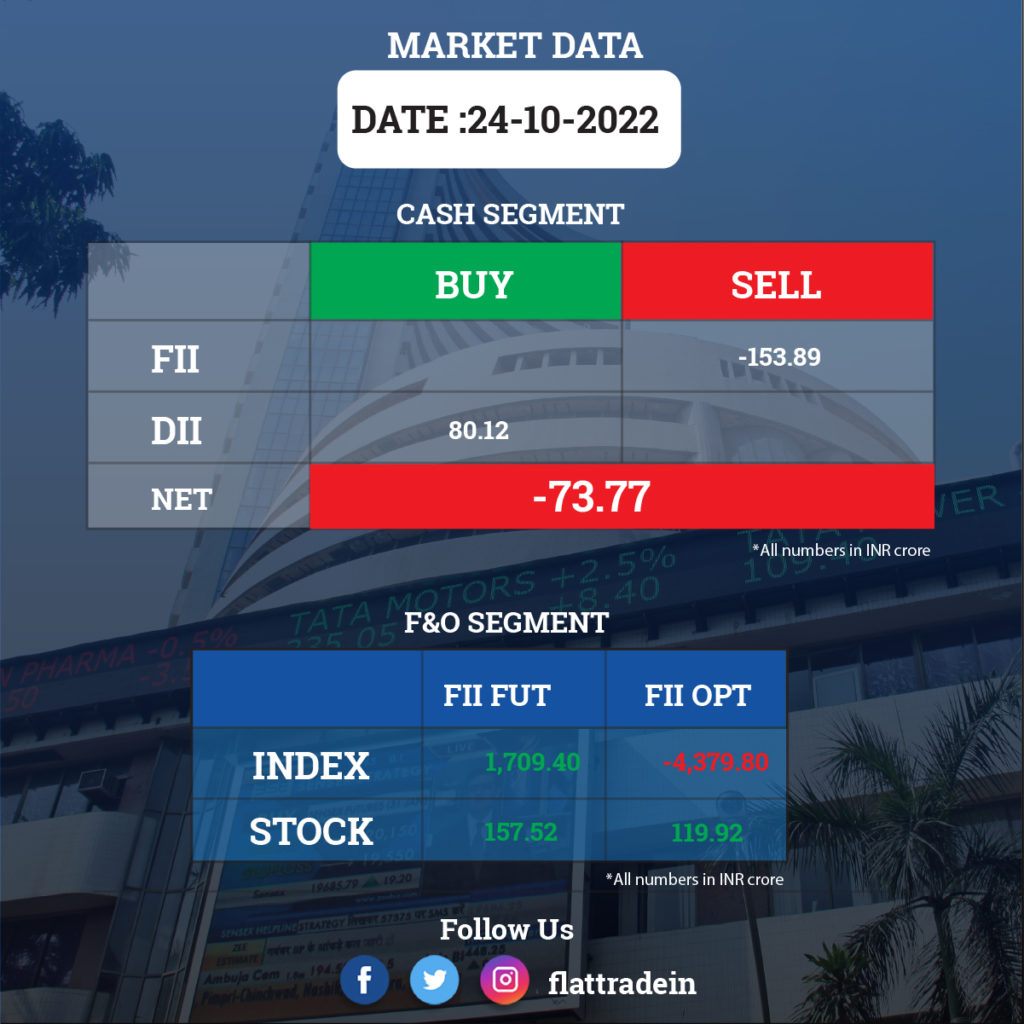

FII/DII Trading Data

Upcoming Results

Chennai Petroleum Corporation, Moschip Technologies, Nandani Creation and Nutricircle are expected to report results today.

Stocks in News Today

Reliance Industries Ltd (RIL): The company said that net profit remained almost flat at Rs 13,656 crore during Q2FY23 from the year-ago quarter. The conglomerate’s revenue from operations rose 32% to Rs 232,863 crore from Rs 191,532 crore year-on-year (YoY). RIL’s outstanding debt as on September 30, 2022 was Rs 294,859 crore, while cash and cash equivalents stood at Rs 201,606 crore, the company said in a statement. Meanwhile, RIL said that it will demerge its financial services business and list it separately on the stock exchanges under Jio Financial Services Ltd.

Hindustan Unilever: The FMCG company’s profit grew by 19.6% year-on-year to Rs 2,616 crore in quarter ended September 2022. The company’s revenue increased 15.9% YoY to Rs 14,751 crore during the quarter under review, with domestic volume growing at 4% during the quarter. EBITDA rose by 7.8% YoY to Rs 3,377 crore, but margin fell by 170 bps YoY to 22.9% in Q2FY23. The company’s board declared an interim dividend of Rs 17 per share for FY23.

ICICI Bank: The private sector lender reported a 37 per cent year-on-year (YoY) jump in net profit to Rs 7,558 crore in Q2FY23, aided by lower provisions and higher net interest income (NII). The lender had reported a net profit of Rs 5,511 crore in the year-ago period. The NII rose 26 per cent YoY to Rs 14,787 crore in Q2FY23 from Rs 11,690 crore in the year-ago period. Net interest margin stood at 4.31 per cent in the period under review compared to 4.01 per cent in the previous quarter. The bank’s gross NPA ratio fell by 22 basis points sequentially to 3.19 per cent in Q2FY23 and net NPA improved to 0.61 per cent.

Kotak Mahindra Bank: The private sector lender reported a 20.7 per cent jump in its consolidated net profit to Rs 3,608.18 crore in Q2FY23, compared to Rs 2,988.74 crore in the year-ago period. Net Interest Income grew 26.8 per cent YoY to Rs 5,099 crore during this period and net interest margin stood at 5.17 per cent. The bank reported a NIM of 4.45 per cent in the year-ago period. Net NPAs declined 51 bps on a YoY basis and 7 bps sequentially to 0.55 per cent.

IDBI Bank: The lender reported a 46 per cent rise in its net profit to Rs 828 crore in Q2FY23. The bank had posted a net profit of Rs 567.12 crore in the year-ago period. The total income in the quarter under review rose to Rs 6,065.51 crore from Rs 5,129.92 crore in the same period a year ago. Its net NPAs too came down to 1.15 per cent from 1.71 per cent.

IDFC First Bank: The private sector lender reported a 266 per cent jump in its net profit at Rs 556 crore for the quarter ended September 2022 on the back of strong growth in core operating income. The bank had posted a net profit of Rs 152 crore in the same quarter a year ago. Net interest income climbed 32 per cent at Rs 3,002 crore, while total income in the three months to September rose to Rs 6,531.03 crore from Rs 4880.29 crore in the same period of FY22. Net NPAs were also down at 1.09 per cent as against 2.19 per cent.

YES Bank: The private lender’s net profit declined by 32.2 per cent year-on-year (YoY) to Rs 153 crore in Q2FY23 from a net profit of Rs 225 crore in the Q2FY22. Net interest income (NII) was up 31.7 per cent YoY in Q2FY23 to Rs 1,991 crore. Its NIM improved to 2.6 per cent in July-September period, up by 40 basis points from level in Q2FY22. The bank’s net NPAs dipped to 3.6 per cent in the quarter under review from 5.5 per cent in the year-ago period.

JSW Steel: The company reported a consolidated quarterly net loss compared to a year-ago profit. Its consolidated net loss came in at Rs 848 crore for the three months ended September 2022 compared to a profit of Rs 7170 crore in the year-ago period. Total revenue from operations rose to Rs 41,778 crore in the reported quarter from Rs 32,503 crore a year earlier. The company’s performance was impacted due to a fall in steel prices and a lag effect of the benefits of lower raw material costs flowing through the company’s P&L, JSW Steel said in a statement.

Crisil: The rating agency reported a 31% annualised growth in net income at Rs 147.9 crore for the quarter ended September 2022. Its revenue from operations rose 19.6% YoY to Rs 683 crore in the quarter under review. Sharp foreign exchange movement in the dollar versus the rupee and the British pound supported profitability in both Q3 2022 and YTD 2022, compared with the corresponding periods of the previous year.

Amish Mehta, Managing Director & CEO, CRISIL, said that there was momentum for bank loan ratings in India, but corporate bond issuances were muted. He added that there was traction for its global businesses. Further, the board of directors has declared an interim dividend of Rs 10 per share ( of Re 1 face value) for 03 2022, compared with Rs 9 per share for the same quarter last year.

United Spirits: The company said its profit rose by 106% YoY to Rs 563 crore in the quarter ended September 2022 due to one-time gain of Rs 381 crore from the slump sale of business undertaking associated with 32 brands in ‘Popular’ segment. Revenue stood at Rs 2,879.7 crore, up by 17.6% compared to year-ago period on higher consumer demand. EBITDA was at Rs 446 crore, an increase of 4.8% YoY for the reported quarter and margin stood at 15.5%, down by 190 bps YoY.

SpiceJet: The Directorate General of Civil Aviation (DGCA) lifted the 50 per cent cap restrictions on SpiceJet. From the winter schedule, October 30- March 25, the airline can operate with full capacity, the regulator said. The DGCA had on July 27 ordered SpiceJet to operate a maximum of 50 per cent of its flights owing to a series of incidents involving its flights.

HDFC Life Insurance Company : The company reported a 19% increase in second-quarter profit from increased policy sales. Standalone profit-after-tax was Rs 3.26 billion Indian for the quarter ended September 2022 compared with Rs 2.74 billion in the year-ago period. Its net premium income rose 14.6% on-year to Rs 131.11 billion.

DLF Ltd: The real estate major reported a net profit of Rs 487 crore, a 28 per cent year-on-year (YoY) increase. The company’s revenue stood at Rs 1,360 crore and net debt at Rs 2,142 crore in the reported quarter. The company’s Ebitda stood at Rs 495 in Q2. DLF’s residential business also saw an yearly growth of 36 per cent and clocked new sales bookings of Rs 2,052 crore.

Motilal Oswal Financial Services: The company reported a 11 per cent growth in Profit After Tax (PAT) at Rs 509 crore for the quarter ended September 2022 driven by robust growth across the segments. This was the highest quarterly profit posted by the company. In comparison, the company had a PAT of Rs 458 crore in the same quarter of the preceding fiscal. The company’s revenues grew by 13 per cent to Rs 1,098 crore in the quarter under review from Rs 971 crore in the year-ago period.

RBL Bank: The net profit rose to Rs 202 crore for the September quarter as compared to Rs 31 crore in a year ago period on the back of lower provisioning for bad loans. The net interest income (NII) grew 16 percent year-on-year to Rs 1,064 crore during the July-September quarter. Total income of the bank during the quarter rose to Rs 2,758.98 crore as against Rs 2,567.65 crore in the corresponding period. Net NPAs also came down to 1.26 per cent from 2.14 per cent.

Karur Vysya Bank: The Tamil Nadu-based lender on Thursday reported a 52 per cent rise in net profit of Rs 250 crore for the second quarter of this financial year, compared to Rs 165 crore in the same period in FY22. Its net interest income for the quarter was up by 21 per cent to Rs 821 crore for the current quarter as against Rs 680 crore for Q2FY22. Its net NPA ratio stood at 1.36 per cent (Rs 819 crore) as against 2.99 per cent a year ago (Rs 1,538 crore).

Bombay Dyeing & Manufacturing Company: The company said that it will move to the Securities Appellate Tribunal against the Sebi’s ruling that barred the company, its promoters from the securities markets for up to two years. Sebi, in its order, barred 10 entities, including Bombay Dyeing and its promoters — Nusli N Wadia, Ness Wadia and Jehangir Wadia — from the securities markets for up to two years and levied a fine totalling Rs 15.75 crore on them for involving in fraudulent scheme of misrepresenting the company’s financial statements.

Vodafone Idea: The loss-making telecom operator said it has received the board’s nod to settle Rs 1,600 crore dues to equipment vendor ATC Telecom Infrastructure Ltd by converting the due amount into equity if unpaid in 18 months. It will raise the amount through equity convertible debt bonds that carry a coupon rate of 11.2 per cent per annum.

Jaiprakash Power Ventures (JPVL): The company posted a consolidated net profit of Rs 75.42 crore in Q2FY23. The company had reported a consolidated net loss of Rs 1.42 crore in the quarter ended on September 2021. Total income of the company rose to Rs 1,501.33 crore in the quarter from Rs 948.48 crore in the same period a year ago.

Route Mobile: The company posted a 74.5 per cent rise in consolidated profit after tax at Rs 73.6 crore for the second quarter ended September 2022. The company had posted a profit after tax (PAT) of Rs 42.17 crore in the same period a year ago. The revenue from operations jumped by 94 per cent to Rs 845.84 crore from Rs 435.67 crore in the September 2021 quarter.

Kirloskar Industries (KIL): The Board of Directors of the company has sought an Extraordinary General Meeting (EGM) of the shareholders of Kirloskar Brothers, a listed entity, to conduct a forensic audit on the latter. Kirloskar Industries is led by Atul and Rahul Kirloskar, while Kirloskar Brothers (KBL) is a company managed by Sanjay Kirloskar. The EGM was requisitioned following statements made by KBL that it spent Rs 274 crores on legal, professional fees and consultancy charges.

Tejas Networks: The company reported a 70.7% year-on-year growth in consolidated profit at Rs 1.07 crore for September ended quarter impacted by weak margin performance and higher tax cost. Revenue was at Rs 219.9 crore, an increase of 27.3% and EBITDA was at Rs 21.5 crore, a rise of 17.4% compared to year-ago period, but margin fell 80 bps to 9.8% YoY.

Zydus Lifesciences: The pharma company has received approval from the USFDA to market Ketorolac tromethamine tablets. The drug is used for relieving pain, usually after surgery. The drug will be manufactured at company’s formulation manufacturing facility at Ahmedabad SEZ.

Multi Commodity Exchange of India (MCX): The company clocked a healthy 94% year-on-year growth in profit at Rs 63.3 crore for the quarter ended FY23, with revenue from operations growing 53% to Rs 127.4 crore. The compny’s EBITDA increased 94% to Rs 65.5 crore for the quarter. Margin expanded by nearly 11 percentage points to 51.4% compared to year-ago period.

Dodla Dairy: The company has recorded a 34% year-on-year growth in profit at Rs 39.4 crore for the quarter ended FY23, driven by decline in finance cost, higher other income with fall in tax rates. Revenue grew by 22.8% YoY to Rs 695.3 crore, but EBITDA fell 3.9% to Rs 58.9 crore and margin declined by 230 bps YoY to 8.5% for the quarter.

KEC International: The company has received new orders worth Rs 2,042 crore across its businesses including transmission & distribution, civil and railways. With this, its order inflows for the current year stand at Rs 10,500 crore, a robust growth of 40% over last year.

Chalet Hotels: The company posted a profit of Rs 15.7 crore for the quarter ended September FY23, as against a loss of Rs 13.8 crore in year-ago period, supported by robust sales and operating performance. Total income for the quarter stood at Rs 250.5 crore, a growth of 82% and EBITDA stood at Rs 87.7 crore, a two-fold jump compared to year-ago period.

Torrent Pharmaceuticals: The company recorded a 1.3% year-on-year decline in consolidated profit at Rs 312 crore for the quarter ended September FY23, with 50 bps YoY contraction in EBITDA margin. Consolidated revenue at Rs 2,291 crore grew by 7.2% and EBITDA at Rs 679 crore increased by 2.9% compared to year-ago period.

VIP Industries: The company has recorded 135% year-on-year growth in consolidated profit at Rs 43.4 crore for the quarter ended September FY23, on a low base in a year-ago period. The earnings in Q2FY22 were impacted by second Covid wave. Revenue grew by 56% to Rs 514.7 crore and EBITDA increased 71.2% to Rs 71.6 crore, with margin rising 120 bps to 13.9% compared to year-ago period.

Sasken Technologies: The company has recorded a 136% sequential growth in consolidated profit at Rs 35.9 crore for the quarter ended September FY23, driven by other income (against loss in previous quarter). Revenue grew by 18.5% to Rs 120 crore compared to previous quarter. The company has declared an interim dividend of Rs 12 per share.

Indraprastha Gas: The city gas distributor reported a 4 per cent rise in its September quarter net profit as rise in input natural gas prices hurt margins. The net profit stood at Rs 416.15 crore in July-September compared with Rs 400.54 crore in the same period a year back.

Birlasoft: The IT firm posted an 11.6 per cent increase in consolidated net profit to Rs 115 crore in the second quarter ended September 30, 2022. The company had registered a net profit of Rs 103 crore in the same period a year ago.

Puravankara: The realty firm said its sales bookings have risen 43 per cent to a record Rs 1,306 crore during April-September period of this fiscal year on better housing demand. Its sales bookings stood at Rs 910 crore in the year-ago period.

Best Agrolife: The agro chemicals firm has clocked an over five-fold jump in its consolidated net profit at Rs 129.81 crore for the quarter ended September on higher sales. Its net profit stood at Rs 25.18 crore in the year-ago period.