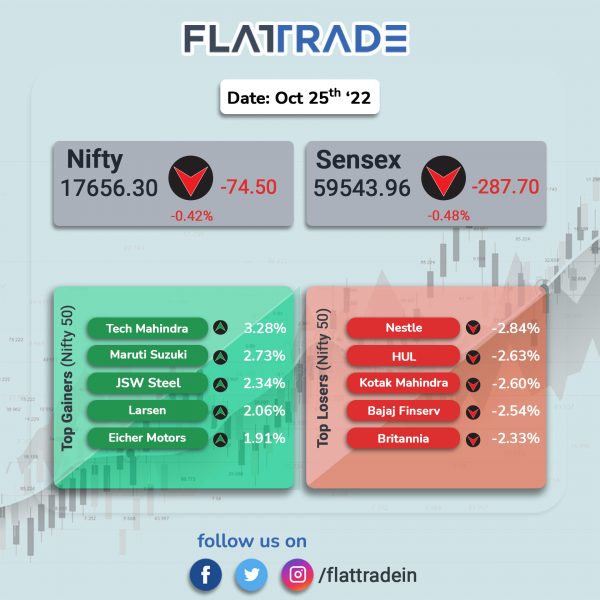

Benchmark equity indices ended lower as investors sold FMCG and private bank stocks. The Sensex fell 0.48% and the Nifty dropped 0.42%.

Broader markets were mixed. The Nifty Midcap 100 index rose 0.45% and the BSE Smallcap slipped 0.35%.

Top gainers among Nifty sectoral indices were PSU Bank [3.5%], Auto [1.24%], IT [0.66%], Metal [0.4%] and Pharma [0.39%]. Top losers were FMCG [-1.03%], energy [-1.01%], Private bank [-0.84%], Financial Services [-0.78%] and Realty [-0.62%].

The Indian rupee fell 4 paise to 82.73 against the US dollar on Tuesday.

India’s foreign exchange reserves continued the downward trajectory, dropping $4.5 billion to $528.37 billion for the week ended October 14, according to data released by the RBI.

Stock in News Today

Adani Ports and SEZ (APSEZ): The company has incorporated a wholly-owned subsidiary in the name of Tajpur Sagar Port. The new company will be involved in the development of deep-sea port on design, build, finance, operate and transfer basis at Tajpur, West Bengal.

Infosys: The IT major will extend its Living Labs ecosystem to help Australian start-ups to advance their market. The launch event was hosted in the Infosys Living Lab in Melbourne in collaboration with its partner Telstra Ventures, a venture capital firm with over A$1.3 billion in assets under management that invests in market leading, high growth technology companies globally.

FSN E-Commerce Ventures (Nykaa): The company shares fell 2.85% to Rs 1111.30, slipping below its initial public offer (IPO) price of Rs 1125 apiece. The development comes as the lock-in period for pre-IPO shareholders ends next month on November 10.

Central Depository Services Ltd (CDSL): The company’s consolidated total income stood at Rs 170 crore in Q2FY23, up 3% YoY and 16% QoQ. Net profit stood at Rs 80 crore in the reported quares, a fall of 7% YoY and a rise of 40% QoQ. CDSL became the first depository to register 7 crore demat accounts in August 2022. During Q2FY23, 48 lakh demat accounts were opened.

V.I.P. Industries: The company reported more than two-fold jump jump in consolidated net profit to Rs 43 crore in Q2FY23 from Rs 19 crore in Q2FY22. Revenue from operations increased by 56% YoY to Rs 515 crore during the quarter. EBIDTA surged by 57% to Rs 77 crore in the quarter under review from Rs 49 crore in Q2FY22. EBIDTA margin was 14.8% in Q2FY23 as against 14.4% in Q2FY22.

Alembic Pharma: The drug maker announced that its Bioequivalence facility located at Vadodara has completed the United States Food and Drug Administration (USFDA) inspection without any observations. The USFDA had conducted the inspection between October 17 and October 21 at the facility in Vadodara.

BSE Ltd: The company has launched Electronic Gold Receipt (EGR) on its platform on October 24. It has introduced two new products of 995 and 999 purity during the Muhurat trading on Diwali. Trading will be in multiples of 1 gram and deliveries in multiples of 10 gram and 100 gram. The EGR market will remain open from 9:00 a.m. to 9.30 pm. It will have T+1 settlement.

Indraprastha Gas (IGL): The company’s shares rose more than 7% in intraday trade after the company reported 4% rise in standalone net profit to Rs 416.15 crore on a 94% YoY jump in net revenue from operations to Rs 3,922.02 crore in Q2FY23. Total gross sales value nearly doubled to Rs 3,908.48 crore in the three months ended September 2022 from Rs 2,005.07 crore in the year-ago period. Overall sales volume in the September quarter grew 12%. The company has appointment Sukhmal Kumar Jain as an Additional Director and Chairman with effect from October 23. Jain will replace Arun Kumar Singh as Chairman and Director.

Commercial Syn Bags: The company’s board approved the issuance of bonus share in the proportion of two new equity bonus share for every one existing fully paid equity share of face value of Rs 10 apiece.

Bajaj Holdings & Investment’s (BHIL): The company’s consolidated net profit rose 9.8% to Rs 1,242.79 crore on a 27.6% jump in total revenue from operations to Rs 187.60 crore in Q2FY23.

SJVN: The state-run company said that it will commission a 75 MW solar project at Kalpi in Uttar Pradesh by month-end. The project will generate 168.34 million units (MUs) in the first year and the project’s cumulative energy generation over a period of 25 years would be about 3,919 MUs. The Power Purchase Agreement (PPA) for the same has been signed with Uttar Pradesh Power Corporation Limited for 25 years.

Moschip Technologies: The company’s net profit declined 22.50% to Rs 1.24 crore in the quarter ended September 2022 as against Rs 1.60 crore during the quarter ended September 2021. Sales rose 29.27% to Rs 49.15 crore in the quarter ended September 2022 as against Rs 38.02 crore during the quarter a year ago.