Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.10 per cent higher at 17,873, signalling that Dalal Street was headed for a positive start on Wednesday.

Asian shares were trading higher, tracking strong gains in the US makets after robust earnings from the US retail giants. Japan’s Nikkei 225 index rose 0.81% and Topix index was higher by 0.78%. China’s Hang Seng advanced by 0.41% and CSI 300 index rose 0.32%.

The Indian rupee was flat at 79.66 against the US dollar on Tuesday.

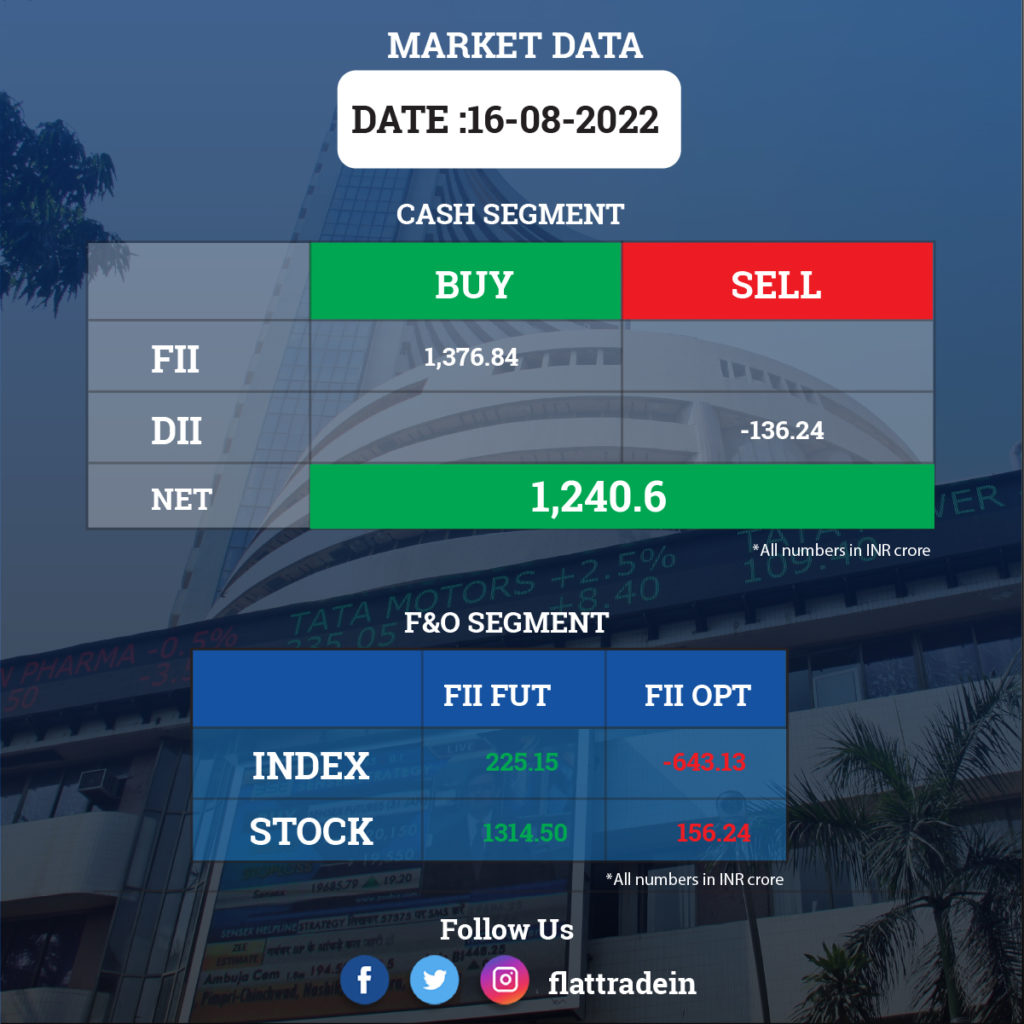

FII/DII Trading Data

Stocks in News Today

State Bank of India (SBI) and Bajaj Hindusthan Sugar: SBI has filed an insolvency petition in the National Company Law Tribunal (NCLT) against Bajaj Hindusthan Sugar. The petition has been filed at the Allahabad bench of the National Company Law Tribunal under the Insolvency and Bankruptcy Code. Bajaj Hindusthan Sugar owes nearly Rs 4,800 crore to banks like SBI, Punjab National Bank, Indian Bank and Central Bank of India.

Cipla: The company said it has appointed Ashish Adukia as global Chief financial officer. Dinesh Jain was relieved from additional responsibility as interim chief financial officer of the company. Jain will continue as senior vice president and head of corporate finance. The company also said that the US food and drug administration has begun inspection of the Goa plant.

Max Healthcare: Singapore state fund GIC, US-based financial services firm Capital Group, and a few other institutions picked up KKR’s 26.8 per cent stake in hospital chain Max Healthcare via block deals. Max Healthcare promoters, led by Abhay Soi, will now own 24 per cent in the company.

NTPC: The state-owned power giant floated a tender to raise Rs 5,000 crore term loan from financial institutions. The minimum amount of loan offered by banks or FIs should be Rs 500 crore or in multiple of Rs 500 crore. The proceeds of the loan will be used for capital expenditure, refinancing of loan and other corporate purposes. As per the document, the bids can be submitted till 1100 hours on August 31.

Hindustan Zinc: A PTI report said ICICI Securities, Axis Capital, Citigroup Global Markets, HDFC Bank and IIFL Securities are the five investment bankers selected to manage the sale of the government’s 29.53 percent residual stake in the company. The selected merchant bankers will assist the government on the timing of the divestment, get investor feedback, and hold investor road shows, besides seeking regulatory approvals.

Paytm: The company said it partnered with Samsung stores across India to facilitate smart payments as well as its loan service Paytm Postpaid through deployment of point of sale devices. The partnership will enable consumers purchasing Samsung devices from any authorised store in the country to pay through Paytm payment instruments, including UPI, wallet, buy now pay later scheme, debit cards and credit cards.

Bajaj Electricals: The consumer durables company elevated its Executive Director Anuj Poddar to Managing Director and Chief Executive Officer (CEO). The company has separated the post of Chairman & Managing Director and its patron Shekhar Bajaj will continue as Executive Chairman of the company.

Mahanagar Gas: The company cut the prices of kitchen fuel Piped Natural Gas (PNG) and automobile fuel Compressed Natural Gas (CNG), following an increase in allocation of domestically produced natural gas from the government. The price of PNG has been reduced by Rs 4 per standard cubic metre to Rs 48.50 per SCM, while that of CNG by Rs 6 a kilogram to Rs 80 per kg, as per an official statement.

Future Consumer: The company has defaulted on the payment of Rs 51.85 crore towards principal and interest due on non-convertible debentures, a regulatory filing said. The default happened on August 15, and it includes an interest amount of Rs 10.73 crore and a principal Amount of Rs 41.12 crore.

Future Lifestyle Fashions: The company Tuesday reported a widening of its consolidated net loss to Rs 1,879.91 crore in the fourth quarter ended March 2022 due to closure of stores and higher expenses. The company had posted a consolidated net loss of Rs 149 crore in the January-March quarter a year ago. Its revenue from operations during the quarter under review was down 27.04 per cent to Rs 607.42 crore as against Rs 831.62 crore in the March quarter of FY21.

Techno Electric & Engineering: The firm informed exchanges that it has secured orders for flue gas desulphurisation (FGD) aggregating to Rs 1455 crore. It got orders worth Rs 666 crore from Rajasthan Rajya Vidyut Utpadan Nigam Limited Kota and Rs 789 crore orders from Rajasthan Rajya Vidyut Utpadan Nigam Limited Jhalawar.