Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.01% higher at 17,571, indicating that Dalal Street was headed for a flat-to-positive start on Friday.

Asian shares were trading lower ahead of key US jobs report amid concerns over more aggressive interest rate hikes from the Federal Reserve. Japan’s Nikkei 225 index fell 0.2% and Topix was down 0.48%. Hang Seng dropped 0.785 and CSI 300 index lost 0.255.

The Indian rupee fell 11 paise to 79.56 against the US dollar on Thursday.

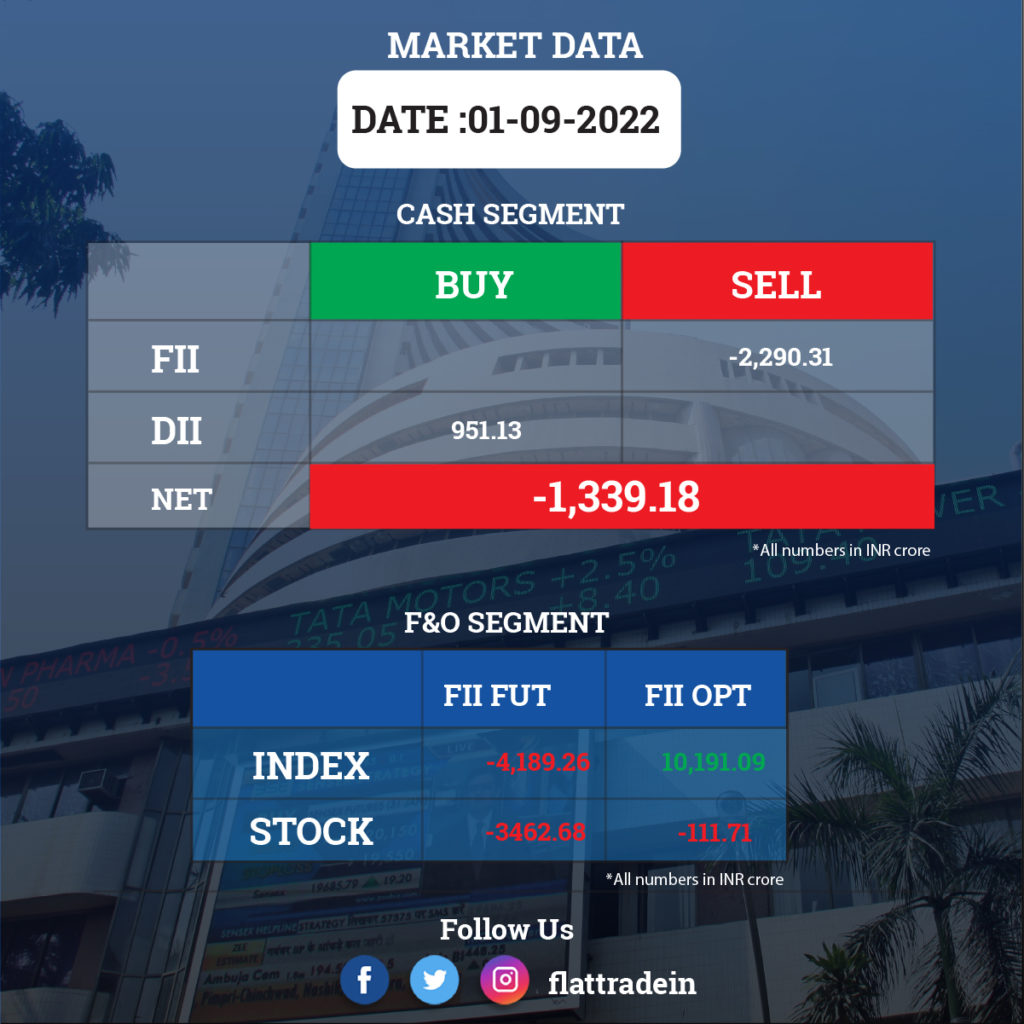

FII/DII Trading Data

Stocks in News Today

Adani Enterprises: The company rejected RRPR Holding’s contention that it would need the Income Tax department’s nod to convert warrants into equity shares to Vishvapradhan Commercial (VCPL), its indirect subsidiary. RRPR is a promoter group entity of New Delhi Television (NDTV), which is at the centre of an acquisition by the Adani group. Adani Enterprises said that the RRPR disclosure lacked bonafides and had no merit or basis either in law or in fact and was misconceived.

Aurobindo Pharma: The company’s wholly-owned arm, CuraTeQ Biologics, plans to invest around Rs 300 crore on capacity expansion of biologics manufacturing facilities. The board of directors of CuraTeQ Biologics approved the expansion of its operations by establishing another mammalian cell culture manufacturing facility of higher capacity to cater to the future requirements, Aurobindo Pharma said in a regulatory filing.

Hero MotoCorp: The two-wheeler maker reported a 1.92% increase in total sales at 4,62,608 units in August 2022. The company had sold 4,53,879 units in the year-ago period. Domestic sales were at 4,50,740 units as compared to 4,31,137 units in August 2021, a growth of 4.55%. Exports declined to 11,868 units from 22,742 units in the corresponding period of last year.

Infosys: The IT services company has completed the acquisition of Europe-based life sciences consulting and technology firm BASE life science. With this acquisition, Infosys will expand its footprint in the Nordics region and will bring domain experts with commercial, medical, digital marketing, clinical, regulatory, and quality knowhow.

LIC: The insurer intends to raise its market share in non-participating insurance products as well as diversify the channel mix, LIC chairman M R Kumar said. Non-participating life insurance products do not offer any bonuses or add-ons such as dividends to the policyholders. A pure term life insurance policy is non-participating product offering a fixed cover against payment of the policy premium.

UPL Corp: The company said Mike Frank has been elevated as the chief executive officer (CEO) of UPL Ltd. Frank will also be a member of the UPL Crop Protection Board of Directors, the company said in a statement.

NTPC: The company has received interest from a dozen companies, majorly global asset managers and financiers for stake in its green energy arm. The thermal power behemoth is looking to sell minority stake to raise up to Rs 2,000 crore. Some of the institutions that have shown interest are Canada Pension Plan Investment Board (CPPIB), Brookfield, Abu Dhabi’s TAQA and National Investment and Infrastructure Fund (NIIF), Malaysian oil and gas company Petronas and global steel major ArcelorMittal.

Ashok Leyland: The commercial vehicle maker’s total vehicle sales, including exports, grew 51% on an annual basis to 14,121 units in August. The company had sold a total of 9,360 vehicles in August 2021.The domestic vehicle sales increased 58% to 13,301 units in the month under review, from 8,400 units in the year-ago period, the company said.

TVS Motor: The two- and three-wheeler maker has reported a 15% rise in its sales by selling 3,33,787 units in August. The company had registered sales of 2,90,694 units in the same month of last year. Domestic two-wheeler sales grew by 33 per cent to 2,39,325 units in August 2022 from 1,79,999 units in August 2021. The company said that total exports registered sales of 93,111 units in August 2022 as against 1,09,927 units exported in August 2021.

Olectra Greentech: The electric vehicle maker plans to raise up to Rs 800 crore through issuance of securities. The company is looking to raise the amount through issuance of equity shares and /or through sale of securities convertible including warrants into equity shares, subject to regulatory approval.

RattanIndia Power: The company said the board of directors appointed Rajiv Rattan as an Executive Chairman of the company for a period of five years with effect from October 1, 2022. Rajiv, a part of the promoter group, is currently a non-executive Chairman.

Ramco Systems: The company’s US subsidiary Ramco Systems Defense and Security Incorporated (RSDSI) has bagged a contract from General Atomics Aeronautical Systems, Inc. (GA-ASI). Ramco will implement its Aviation M&E MRO Suite V5.9 for GA-ASI’s SkyGuardian Global Support Solutions (SGSS) program.

SIS: The company’s subsidiary, SIS Australia Group Pty Limited, has signed Share Purchase Agreement for acquisition of 85% shareholding in Safety Direct Solutions Pty Ltd which provides critical risk management, medical and training services. The company will complete transaction by September 30 and the transaction cost is about AUD 5 million.