Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.13% lower at 15,954, signalling that Dalal Street was headed for a negative start on Thursday.

Asian stocks recovered after opening lower amid higher US inflation data. Japan’s Nikkei 225 index rose 0.7% and Topix was up 0.16%. China’s Hang Seng inched up 0.08% and CSI 300 rose marginally by 0.03%.

Indian rupee fell 3 paise to 79.63 against the US dollar on Wednesday.

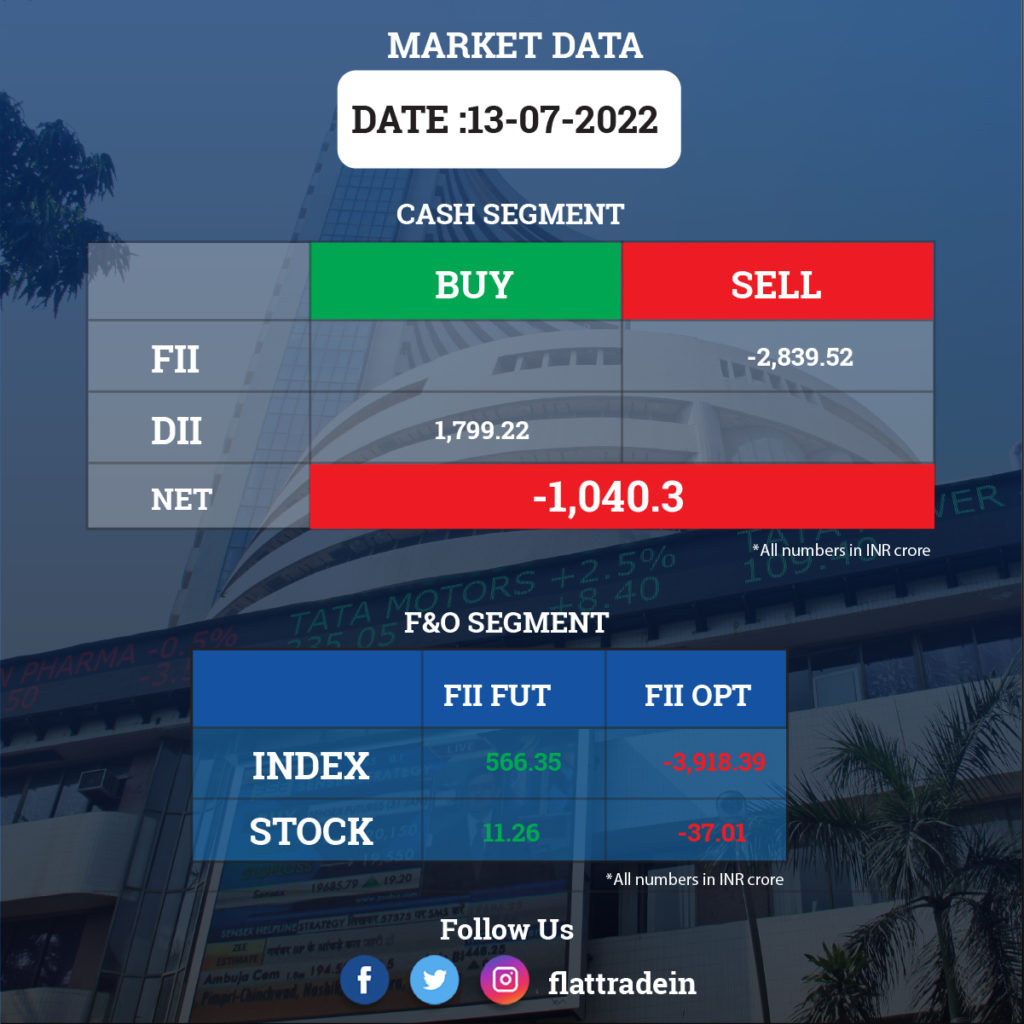

FII/DII Trading Data

Stocks in News Today

Infosys: The company said that it will acquire Denmark-based BASE life science for about 110 million euros (Rs 875 crore) in an all-cash deal. The acquisition will deepen Infosys’ expertise in life sciences domain as well as strengthen its footprint across Europe. The deal is expected to close during the second quarter of current fiscal.

HDFC Ltd: The company will issue bonds on a private placement basis to raise up to Rs 5,000 crore, the company said. The secured redeemable non-convertible debentures (NCDs) will bear interest rate at 7.77%, payable annually and has a tenor of 4 years 11 months and 10 days, HDFC said in a regulatory filing.

Mindtree: The mid-tier IT services company reported a net profit of Rs 472 crore, up 37% year-on-year, in the Q1FY23. Revenue for the quarter grew 36.2% YoY at Rs 3,121 crore. The company signed a total contract value of $570 million during the quarter.

Tata Metaliks: The company reported a sharp fall in net profit to Rs 1.22 crore during Q1FY23, mainly on account of higher expenses. It had reported a net profit of Rs 94.72 crore in the year-ago period. Its total income stood at Rs 669.35 crore compared to Rs 606.45 crore in the year-ago period.

Tata Power: The Tata Group firm’s arm TP Saurya said it has bagged a 600-MW wind solar hybrid power project in Karnataka from state-owned Solar Energy Corporation of India. The letter was awarded through a tariff-based competitive bidding process. The project will be commissioned within 24 months from the PPA execution date.

JSW Energy: The company said that its subsidiary JSW Neo Energy has bagged a 300 MW wind energy project from Solar Energy Corporation of India (SECI). With this, the company’s total power generation portfolio increases to 7.3 GW, with renewable energy share amounting to 57%.

Dabur India: The company through its subsidiaries has acquired the entire stake in Bangladesh-based Asian Consumer Care from its joint venture partner Advanced Chemical Industries for about Rs 51 crore. Dabur held 76% stake in the firm before acquisition through its subsidiary Dabur International, while the remaining 24 per cent was held by Advanced Chemical Industries, the company said in a regulatory filing.

Hindustan Zinc: The metal miner said the board has approved an interim dividend of Rs 21 per equity share for the financial year 2022-23 amounting to Rs 8,873.17 crore. The record date for payment of interim dividend is July 21.

NHPC: The government has accorded an investment approval for pre-investment activities, implemented by NHPC, for Sawalkot HE project (1856 MW) in Union Territory of Jammu & Kashmir for an amount of Rs 973 crore at November 2021 price level.

Sanofi India: The pharma company said the board of directors on July 26 will consider declaration of one-time special interim dividend for the year ending December 31, 2022. The record date for interim dividend has been fixed as August 8.

Jubilant Pharmaova: The company’s Jubilant Pharma Holdings said it has signed an agreement with Standard Chartered Bank for a five-year loan of $400 million, about Rs 3,186 crore. Majority of the amount will be used for repayment of existing term loan and debt bonds, the company said in a regulatory filing.

Raymond: The company said that it has appointed Coca-Cola veteran Atul Singh to lead the group. Singh has worked at Coca-Cola for about two decades at several senior leadership positions and concluded his journey there as chairman, Asia Pacific and spearheaded its businesses across 25 countries. Prior to joining Coca-Cola, Singh worked at Colgate-Palmolive for 10 years where he held several key positions globally.

Somany Ceramics: the company is aiming at a 27% sales growth to Rs 2,700 crore during the current fiscal even though the industry is passing through a “bad phase” due to rise in natural gas prices, a company official said. It had registered a revenue of Rs 2,120 crore last year.