Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.07% higher at 17,800, signalling that Dalal Street was headed for flat start on Wednesday.

Asian markets were mixed ahead of the crucial US inflation data, which is likely to influence the Federal Reserve’s monetary policy path. The Nikkei 225 index rose 0.67% and the Topix advanced 0.78%. The Hang Seng fell 0.72% and the CSI 300 index slipped 0.04%.

Indian rupee fell 14 paise to 82.12 against the US dollar on Tuesday.

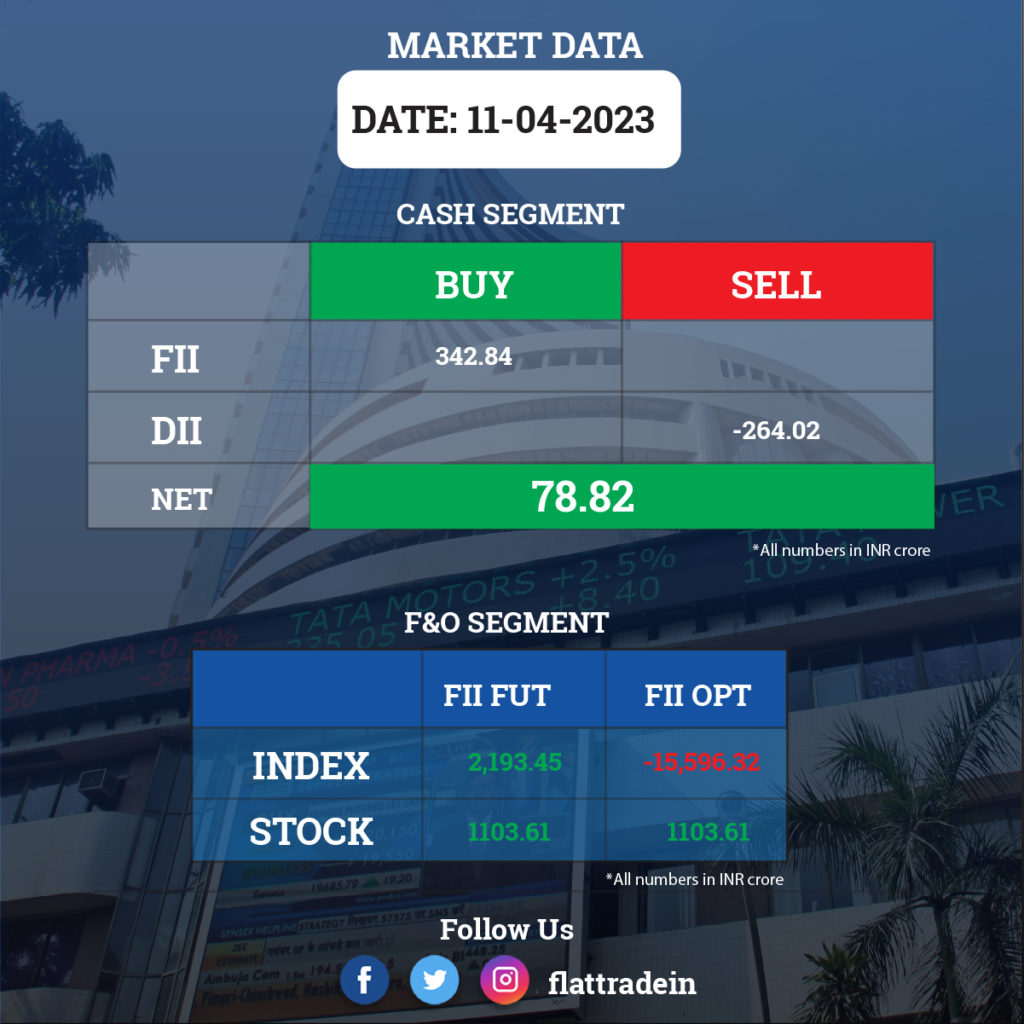

FII/DII Trading Data

Upcoming Results

Tata Consultancy Services (TCS), Anand Rathi Wealth, Goa Carbon, Dharani Sugars and Chemicals, National Standard (India) and Sanathnagar Enterprises will report their quarter Q4FY23 results today.

Stocks in News Today

HDFC Bank: The lender’s board will meet on April 15 to consider raising Rs 50,000 crore during the FY2024 through perpetual debt instruments (part of AT1 capital), Tier II capital bonds and long-term bonds on private placement basis.

Bharat Heavy Electricals (BHEL) and Titagarh Wagons: The BHEL-Titagarh Wagons consortium has received an order from Ministry of Railways for supply of 80 sleeper class Vande Bharat trainsets at Rs 120 crore per train, their comprehensive maintenance for 35 years, and upgradation of government manufacturing units and trainset depots.

Delta Corp: The casino gaming company reported its Q4FY23 results. Its consolidated revenue rose 4.05% YoY to Rs 227.16 crore and net profit was up 6.36% YoY at Rs 51.17 crore. Ebitda fell 12.78% YoY to Rs 60.18 crore and margin stood at 26.5% in the reported quarter as against 31.6% in the year-ago period.

Adani Enterprises: The company incorporated a wholly owned subsidiary Pelma Collieries which will develop, build and operate coal washery, including coal handling systems.

Sula Vineyards: The company witnessed a strong 15 percent growth YoY for its own brands in Q4FY23 at Rs 104.3 crore, and wine tourism grew by 18 percent YoY to Rs 12.4 crore, while own brands revenue in FY23 increased by 26 percent to Rs 482.5 crore and wine tourism business registered a 30 percent jump at Rs 45 crore in FY23 compared to FY22.

Paras Defence and Space Technologies: The company’s subsidiary — Paras Anti-drone Technologies — has entered into a Memorandum of Understanding (MoU) with Spacekawa Explorations (Kawa Space) for indigenous development and deployment of space intelligence, surveillance and reconnaissance (ISR) payloads. Paras Anti-drone and Kawa Space will develop and advance technologies for space applications.

Canara Bank: The state-owned bank has hiked its Marginal Cost of Funds Based Lending Rate (MCLR) effective April 12. The exchange filing said that the MCLR for six months has been increased from 8.4% to 8.45%, while the MCLR for one year has been increased to 8.65% from 8.6%. The overnight, one month, and three month MCLR have been kept the same.

Time Technoplast: The company received an order worth Rs 54 crore from Indraprastha Gas for supply of CNG cascades made from Type-lV composite cylinders.

Sanofi India: The price of company’s insulin glargine brand Lantus has been reduced 21% on a weighted average basis after National Pharmaceutical Pricing Authority fixed the ceiling price for the cost to buyers. While it will impact sales, there will be no impact on profitability, the company said.

Lumax Industries: The board approved Vineet Sahni’s resignation from the position of chief executive officer and senior executive director of the company with effect from close of business on April 14.

Spandana Sphoorty Financial: The board of the company will meet on April 14 to consider and approve raising funds via privately placed non-convertible debentures.

Delhivery: Tiger Global Management, on Tuesday, sold additional 1.18 crore shares of Delhivery for Rs 388 crore through bulk deal on BSE. It had offloaded 1.7 per cent stake in February, and another 0.75 per cent in March.

KP Energy: The company has commissioned 52.5 MW (Phase-I) ISTS connected Wind Power Project at Sidhpur site at Dwarka.