Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.38 per cent higher at 18,357, signalling that Dalal Street was headed for a positive start on Wednesday.

Asian share markets were trading higher, tracking a rally in the US markets overnight. Hang Seng gained 0.50% and the CSI 300 index advanced 0.37%. Japanese market was closed on account of a public holiday.

Indian rupee rose 17 paise to 81.67 against the US dollar on Tuesday.

Inox Green Energy Services will make its stock market debut today. The company raised Rs 740 crore by selling its shares in the range of Rs 61-65 apeice.

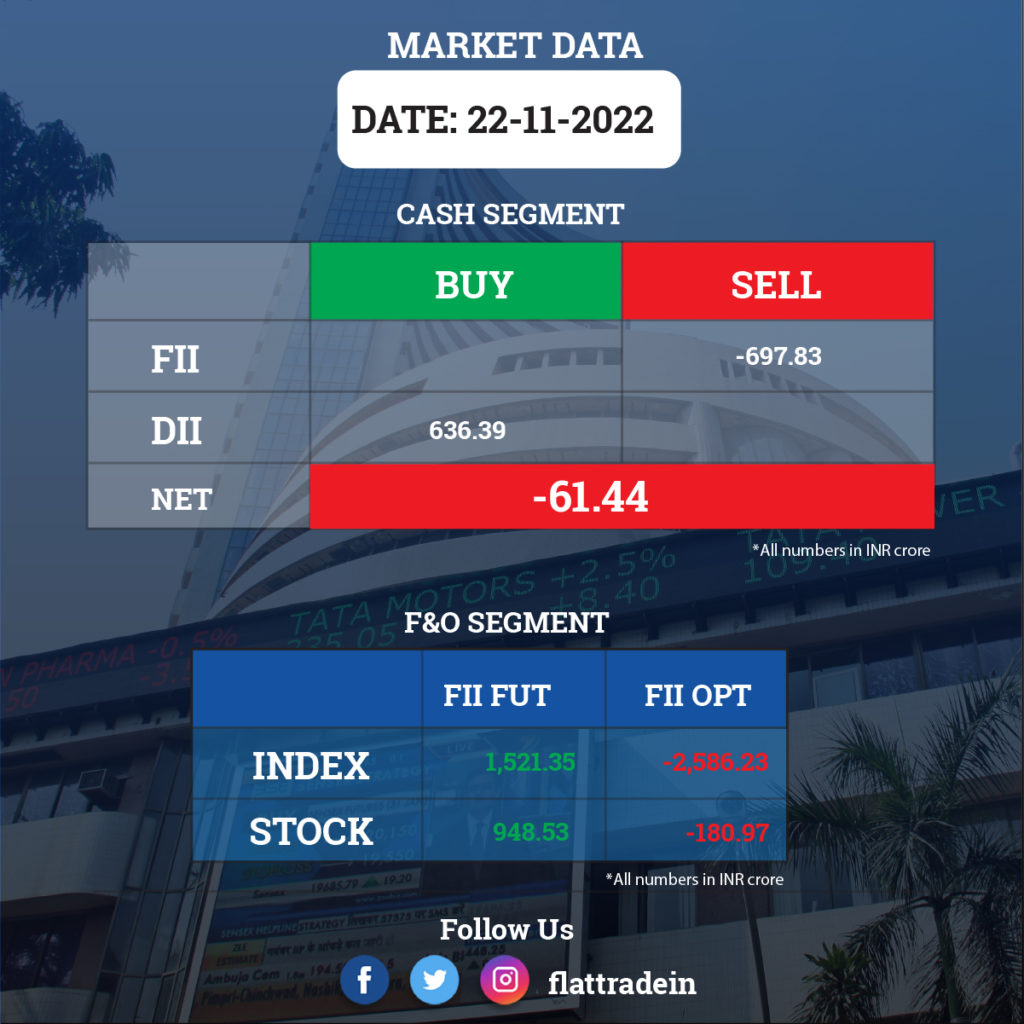

FII/DII Trading Data

Stocks in News Today

Vedanta: The mining giant announced the third interim dividend of Rs 17.50 per equity share for the current fiscal amounting to Rs 6,505 crore. The record date for payment of the dividend has been fixed as November 30. The company’s gross debt stood at Rs 58,597 crore as on September 30.

Meanwhile, Hindustan Zinc, a subsidiary of Vedanta, will trade ex-dividend on November 23. The company recommended an interim dividend of Rs 15.5 per share.

FSN E-Commerce Ventures (Nykaa): Arvind Agarwal resigned as Chief Financial Officer of Nykaa with effect from the close of business hours on November 25. The company said that it is in the process of appointing a new CFO.

Bharti Airtel: The telco’s subsidiary, Nxtra Data, started the construction of its new hyper-scale data centre in Kolkata. The company will invest Rs 600 crore in the data center that will serve the underserved markets of east and north-east regions along with the SAARC countries.

Wipro: BNP Paribas Arbitrage sold 48 lakh shares of IT company in two tranches at an average price of Rs 387 apiece totalling Rs 185.76 crore through the open market transactions, according to the block deal data available with the BSE. France-based Societe Generale acquired the company’s shares at the said price.

Vodafone Idea: Shareholders of debt-ridden telecom company have approved issuing shares worth Rs 1,600 crore to ATC Telecom Infrastructure on a preferential basis. The company’s board has given its nod to settle Rs 1,600 crore dues to equipment vendor ATC Telecom by converting the due amount into equity, if the amount remained unpaid in 18 months.

Mindtree: The ex-date for the IT company merger is November 23 and the record date is November 24. Mindtree will be delisted from exchanges, and L&T Infotech will be renamed LTI-Mindtree.

Future Retail: Reliance Retail, Adani Group’s JV April Moon Retail and 11 other companies have made it to the final list of prospective bidders for acquiring debt-ridden Future Retail. These companies have been included in the final list of prospective resolution applicants after receiving no objections from stakeholders concerned to the provisional list.

Tech Mahindra: Life Insurance Corporation bought additional 1.95 crore shares or 2.01% stake in the IT services company via open market transactions. With this, LIC’s shareholding increased to 6.87%, from 4.86% earlier.

Siemens: The engineering company recorded registered 20.7% YoY growth in consolidated profit at Rs 381.7 crore for the quarter ended September FY22 and revenue from operations rose 11.6% to Rs 4,657.1 crore compared to the year-ago period. For FY22, consolidated profit jumped 22.5% to Rs 1,262 crore and revenue increased 22.3% to Rs 16,137.8 crore compared to Rs 13,198.5 crore in the preceding year. The company recommended a dividend of Rs 10 per share for FY22.

Minda Corporation: The company firm said that it has signed a technology license agreement with LocoNav for white-labelling of telematics software. Under the agreement, LocoNav will be the technology partner for telematic systems to Spark Minda and will provide with a white-labelled software.

Welspun India: The textile company expects sales to cross Rs 15,000 crore by FY26, a growth of about 60 per cent in the next three years. The firm is looking at ‘multiple drivers for growth’ in the domestic market as well as export market.

JSW Energy: The energy company has sought shareholders’ approval to appoint Jindal as a director on the company’s board. Parth Jindal is the son of the company’s Chairman an Managing Director Sajjan Jindal.

MBL Infrastructure: The civil construction company has received arbitration award for its residential project in Delhi. The Learned Arbitral Tribunal passed an award in favour of the company against Public Works Department, Delhi, for a residential complex project in Delhi for Rs 9.29 crore from November 22, 2022, if not paid within 90 days.

Hindustan Motors: The company has entered into an MOU to extend the electric vehicle domain across the border to enhance the production of eco-friendly electric vehicle.