Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.55% higher at 17,858, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian stocks were trading higher as technology stocks gained and investors awaited commentary from Federal Reserve Chair Jerome Powell later Tuesday. The Nikkei 225 index rose 0.22% and Topix gained 0.45%. The Hang Seng jumped 1.1% and CSI 300 index rose 0.24%.

Indian rupee fell 90 paise to 82.72 against the US dollar on Monday.

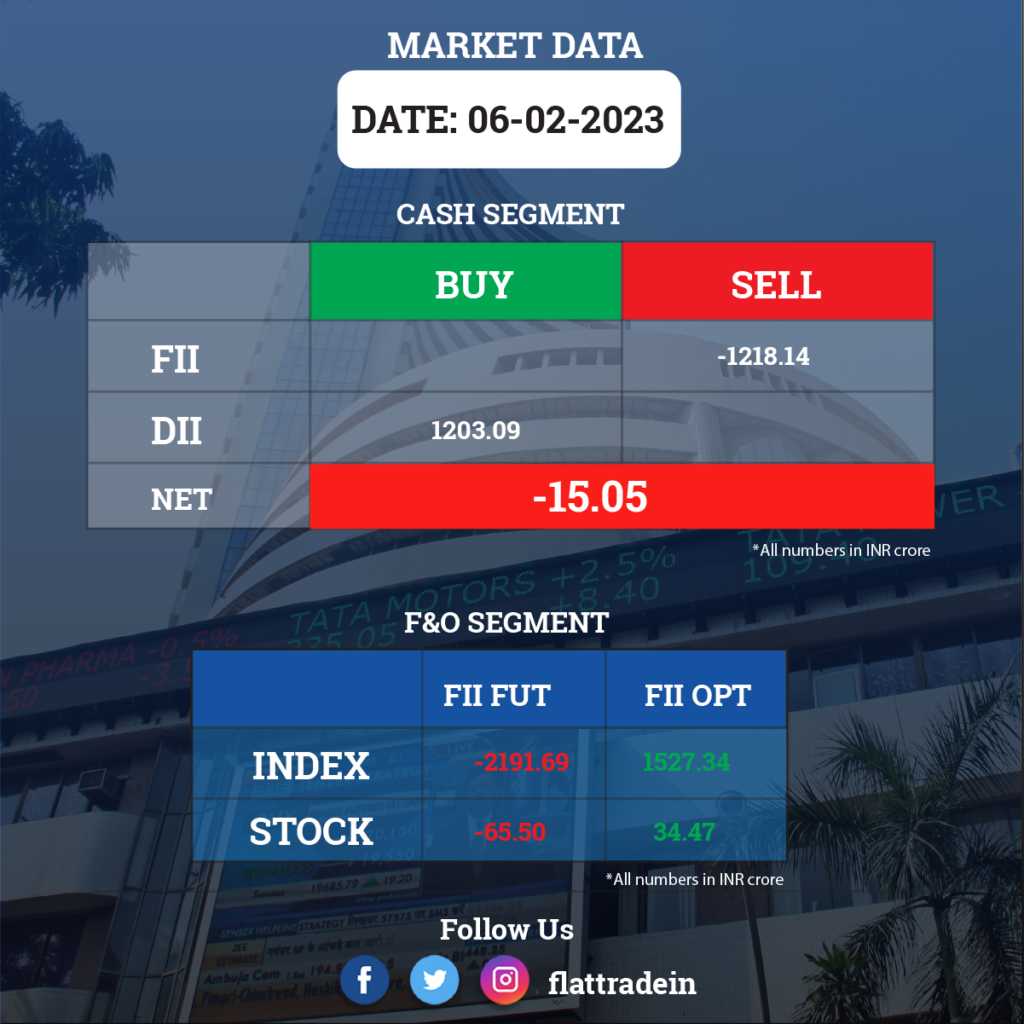

FII/DII Trading Data

Upcoming Results

Bharti Airtel, Hero MotoCorp, Ambuja Cements, Adani Ports and Special Economic Zone, Adani Green Energy, NDTV, Aditya Birla Fashion and Retail, Astral, Barbeque-Nation Hospitality, Bharat Dynamics, Computer Age Management Services, Deepak Nitrite, Gujarat Fluorochemicals, GSK Pharma, Kalyan Jewellers India, Motherson Sumi Wiring India, Navin Fluorine International, NHPC, Phoenix Mills, Ramco Cements, Rashtriya Chemicals & Fertilizers, Sobha, Thermax, and Wonderla Holidays will report their quarterly earnings today.

Stocks in News Today

Tata Steel: The company posted a consolidated loss of Rs 2,502 crore for the quarter ended December FY23, against a profit of Rs 9,598 crore in the year-ago period, impacted by a sharp drop in realisations and margin in Europe. Revenue for the quarter fell 6.1% YoY to Rs 57,083.6 crore. On the operating front, EBITDA plunged 74.5% YoY to Rs 4,048 crore and the margin dropped 1,906 bps to 7.09% for the quarter.

LIC Housing Finance: The housing finance company has recorded a profit of Rs 480 crore for the quarter ended December FY23, down by 37.4 percent compared to the year-ago period, impacted by impairment on financial instruments. Net interest income grew by 10.4 percent YoY to Rs 1,605.9 crore for the quarter.

SJVN: The state-owned power producer posted a 22% rise in consolidated net profit at Rs 287.42 crore in the December quarter, mainly due to higher revenues. The consolidated net profit of the company was at Rs 235.46 crore in the quarter ended on December 31, 2021. Total income of the company rose to Rs 711.24 crore in the third quarter of the current fiscal from Rs 610.45 crore in the same period a year ago. SJVN’s board has approved an interim dividend of Rs 1.15 per equity share for 2022-23. The record date for the same is fixed on February 17.

Tejas Networks: The networking equipment maker has managed to narrow its consolidated loss to Rs 10.9 crore for quarter ended December FY23, against loss of Rs 24.3 crore led by healthy topline and profit at operating level. Revenue for the quarter at Rs 274.55 crore grew by 156% YoY. Company reported EBITDA profit of Rs 8 crore for the quarter against EBITDA loss of Rs 28.3 crore in year-ago period.

Muthoot Finance: The gold loan financing company has registered a 12.4% YoY decline in standalone profit at Rs 902 crore for the three-month period ended December FY23 despite a fall in impairment on financial instruments, as net interest income fell nearly 10 percent to Rs 1,704 crore compared to the year-ago period.

JK Paper: The paper manufacturer has recorded a 119% YoY increase in consolidated profit at Rs 329.3 crore for the three-month period ended December FY23, as revenue grew by 60.5% YoY to Rs 1,643 crore for the quarter. On the operating front, EBITDA surged 125% YoY to Rs 565.5 crore and the margin expanded by 985 bps to 34.4% in Q3FY23.

UltraTech Cement: The cement major has announced the commissioning of a 1.5 mpta brownfield cement grinding unit at Jharsuguda in Odisha, taking the total cement capacity in Odisha to 4.1mtpa. With this commissioning, the company’s total cement manufacturing capacity in India now stands at 122.85 mtpa.

Grasim Industries: The board members of the company have given their approval for the appointment of Ananyashree Birla and Aryaman Vikram Birla as additional directors (non-executive directors). Yazdi Piroj Dandiwala is also appointed as an additional director (independent director).

Nuvoco Vistas Corporation: The cement manufacturer has narrowed its loss to Rs 75.3 crore for December FY23 quarter, from loss of Rs 85.5 crore in same period last year. Higher input cost, power & fuel expenses, and freight & forwarding cost impacted bottomline. Revenue for the quarter at Rs 2,605 crore grew by 20.3% over a year-ago period with increase in sales volume by 6% and better prices. At the operating level, EBITDA increased by 18.2% YoY to Rs 268.3 crore but margin fell by 18 bps to 10.3% for the quarter.

BLS International Services: The company has reported robust earnings for the quarter ended December FY23 with profit growing 62% YoY to 45.85 crore on strong operating performance. Revenue for the quarter grew by 93% YoY to Rs 438 crore led by a sharp recovery in visa and consular business, and an increase in revenue from ZMPL. On the operating front, EBITDA at Rs 66.3 crore increased by 160% YoY in Q3FY23 with the margin rising 390 bps to 15.1% on improvement in operational efficiencies.

Hindustan Zinc: The government is planning to oppose proposal to buy global zinc assets of Vedanta Ltd. for $2.98 billion, Bloomberg repoted citing people familiar with the matter said. The government, which has nearly 30% stake in Hindustan Zinc, is likely to vote against the plan on concerns ranging from high valuations to it being a related party transaction, the sources said.

Procter & Gamble Hygiene and Health Care: The company said its net profit declined 2% to Rs 207 crore for the October-December quarter on account of commodity cost inflation. The company, which follows the July-June financial year, had posted a net profit of Rs 212 crore in the same period of last fiscal. Revenue from operations rose to Rs 1,137 crore in the period under review as against Rs 1,092 crore in the year-ago period, Procter & Gamble said in a statement. The board of the company on Monday declared an interim dividend of Rs 80 on every share of Rs 10.

Indian Energy Exchange (IEX): The company achieved 8639 MU total volume in January, including Green Power trade of 347 MU, and 3.95 lakh RECs (equivalent to 395 MU). The total electricity volume on the Exchange in January at 8245 MU, saw an increase of 9% YoY and 4% MoM.

Kohinoor Foods: The company reported a net profit of Rs 14 crore for the three months ended December as against just Rs 40 lakhs in the same period last year. Meanwhile, revenue was down 26% to Rs 17 crore.

Mold-Tek Packaging: The company posted a revenue of Rs 155 crore in the third quarter of the fiscal, compared with Rs 160 crore in year-ago period. The profit after tax declined 2% to Rs 16.31 crore in Q3FY23 over the same period last year.

Indo Count Industries: The company’s net profit fell 47% YoY to Rs 38 crore in the three months ended December 2022. Revenue fell 16% YoY during the quarter under review.

V-Mart: The company reported a revenue of Rs 777 crore, up 12% YoY in the third quarter of FY23. EBITDA and PAT stood at Rs 104 crore and Rs 20 crore, respectively for the quarter.

Balaji Amines: The specialty chemicals company has registered a 30% YoY decline in consolidated profit at Rs 62.6 crore for quarter ended December FY23, impacted by higher input cost. Revenue for the quarter at Rs 586 crore increased by 3.7% over a year-ago period. On the operating front, EBITDA fell nearly 18% YoY to Rs 128 crore and margin weakened by 567 bps to 21.8% for the quarter YoY.

Monte Carlo Fashions: The retail clothing chain has reported consolidated profit at Rs 86.3 crore for three months period ended December FY23, growing 11.4% over a year-ago period, partly hit by higher input cost. Revenue for the quarter at Rs 519.54 crore increased by 12.5% YoY. On the operating front, EBITDA grew by 14.5% YoY to Rs 130.12 crore and margin rose by 43 bps to 25.04% for the quarter.

Indo Count Industries: The home textile bed linen manufacturer has recorded a 47% YoY decline in consolidated profit at Rs 37.71 crore for quarter ended December FY23, impacted by weak topline and operating performance. Revenue for the quarter at Rs 657.3 crore fell by 13% compared to year-ago period. At the operating level, EBITDA dropped 36.67% YoY to Rs 73.35 crore and margin fell 410 bps to 11.2% for the quarter.

Action Construction Equipment: The construction equipment manufacturer has recorded a 70% YoY growth in consolidated profit at Rs 46.5 crore for December FY23 quarter, driven by healthy topline and operating performance. Revenue at Rs 556.33 crore for the quarter grew by 27.4% YoY. At the operating level, EBITDA jumped 57% YoY to Rs 61.86 crore and margin improved by 208 bps to 11.1% for the quarter.

Kirloskar Ferrous Industries: The company has announced the commissioning of its second coke oven plant in Koppal, Karnataka. The plant has production capacity of 2 lakh metric tonnes per annum. After commencement of operations of said plant, total production capacity of coke increased to 4 lakh Metric Tonnes per annum. Coke will be used mainly for captive consumption.

BLS International Services: The company has reported robust earnings for quarter ended December FY23 with profit growing 62% YoY to 45.85 crore on strong operating performance. Revenue for the quarter grew by 93% YoY to Rs 438 crore led by sharp recovery in visa & consular business, and increase in revenue from ZMPL. On the operating front, EBITDA at Rs 66.3 crore increased by 160% YoY in Q3FY23 with margin rising 390 bps to 15.1% on improvement in operational efficiencies.

Dhampur Sugar Mills: The company has completed expansion of its distillery capacity by 130 KLPD (kilo litre per day) on ‘C’ heavy molasses at Dhampur unit in Uttar Pradesh. With this expansion, the distillery capacity of the company now stands at 350 KLPD.