The profitability of domestic broking industry has moderated in the first quarter of fiscal 2023 with a decline of 10% quarter-on-quarter (QoQ) in net operating income (NOI) and 25% QoQ drop in net profit, according to ICRA rating agency.

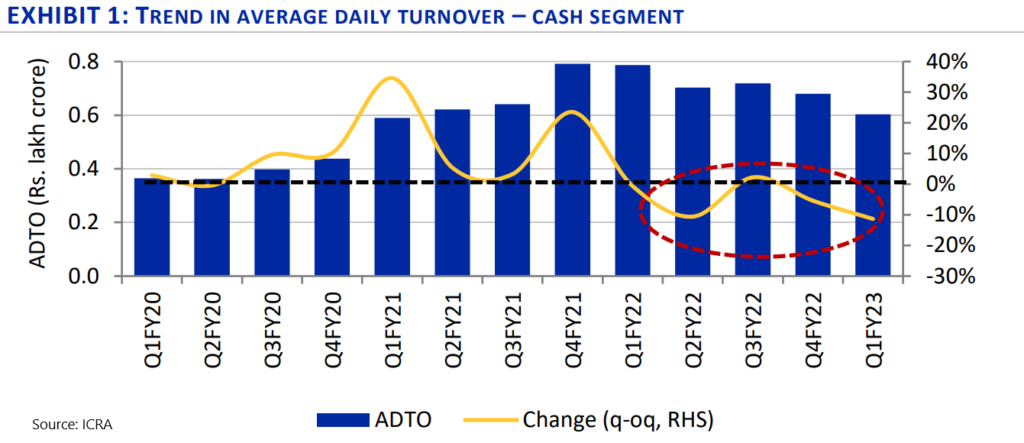

The report noted that geopolitical situation and adverse macroeconomic outlook have affected investors and traders sentiments, and have weighed on profit after tax of domestic broking firms. The profitability of the firms fell to 34% in Q1FY23 from 38% in Q4 FY22, along with a decline in the transaction volumes of high-yielding cash broking segment (exhibit 1).

The decline comes after two years of great performance for the broking industry, which witnessed healthy participation from retail investors, domestic institutions and a large number of initial public offerings. In the last two financial years, the average daily turnover (ADTO) more than quadrupled to about Rs. 72 lakh crore in FY2022 (exhibit 2). The net operating income (NOI) nearly doubled during this time and their profitability rose to 38% in FY2022 from 25% in FY2020, according to ICRA’s sample of broking companies.

Deep Inder Singh, Vice President, ICRA states, “As the incremental retail participation dampened in the current fiscal, the pace of new client additions slowed compared to the last fiscal. Also, the Foreign institutional investors (FII) remained net sellers in H1 CY2022, which also weakened investor sentiment.”

Rate of demat account opening slows down

The pace of demat opening have slowed in Q1FY23 to about 20 lakh accounts per month, according the rating agency’s report.

Nonetheless, in the last two years, the total number of demat accounts rose to 9.8 crore as of July 2022, up from 5.5 crore as of March 2021 and 4.1 crore in March 2020 with average monthly additions of about 30 lakhs in FY2022.

The rise was helped by higher retail participation in the last few years that led to increase in revenue growth for broking companies. Retail clients from tier-2 and tier-3 cities have increased and more younger traders/investors have risen in the last couple of years.

Changing dynamics of broking industry

According to the rating agency, smaller brokers are losing active client market share to larger firms due to industry consolidation. Stricter compliance, technology requirements, and pressure to offer discounted brokerage have hurt small brokerages.

Discount brokerage houses are estimated to have accounted for about 60% of NSE active clients as of June 2022, up from 2% in March 2016. Rapid growth in the last two years has been fuelled by the capital markets rally, the ease of the know your customer (KYC) process through online KYC, and the use of technology apps, according to ICRA.

Further, interest income remained flat in Q1FY23 after companies reported a significant increase in interest income from capital market exposures in FY2022 helped by equity market rally. As equity markets corrected, companies reported a 12% QoQ fall in broking linked income in Q1FY23.

Moreover, the leverage levels of brokerage groups have increased in recent years aided by capital market financing through loan against shares and margin trade funding. In addition, changes in regulations have also increased brokerage firms’ operating capital requirements, which has impacted the leverage levels. Recent rising interest rates amid volatile market conditions could reduce investors’ appetite for leverage and in-turn adversely impact the net interest income for brokers, ICRA noted.

Singh added, “Overall retail participation and transaction volumes are expected to remain healthy compared to the pre-COVID-19 pandemic levels. The outlook for the brokerage industry is stable, though its revenue trajectory and profitability are expected to moderate from the FY22 levels.”