Prudent Corporate Advisory Services Limited, a retail wealth management services, is planning to raise Rs 538.61 crore by going public. The subscription for its initial public offering will open on May 10 and end on May 12, 2022. The price band has been fixed at Rs 595-630 apiece.

The issue comprises of only Offer For Sale of about 85.49 lakh shares. The face value is Rs 5 per each equity share. Prudent’s employees will get a discount of Rs 59 per equity share to the final issue price.

Company Summary

Prudent Corporate Advisory Services Limited is a Gujarat-based independent retail wealth management services group in India and one of the top mutual fund distributors in terms of average assets under management (“AAUM”) and commission received.

The company offers technology enabled, comprehensive investment and financial services platform with end-to-end solutions critical for financial products distribution and presence across both online and offline channels.

The company’s wealth management services cater to 1,351,274 unique retail investors through 23,262 MFDs on their B2B2C platform and its branches are spread across 110 locations in 20 states in India as on December 2021.

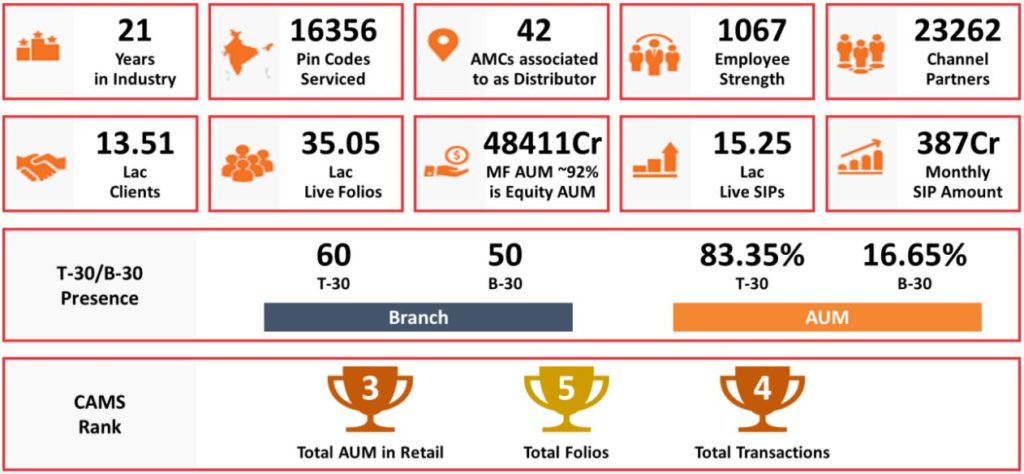

Some of the key metrics of their business as on December 31, 2021 are given below in the image,

Company Strengths

- Prudent offers a comprehensive multi-product investment platform with end-to-end solutions critical for financial products distribution.

- The company uses technology to improve investor and partner experience through their platforms such as FundzBazar, PrudentConnect, Policyworld, WiseBasket and CreditBasket.

- The company has a granular retail AUM with a mix skewed towards high-yield equity AUM

- It has a pan-India diversified distribution network with ability to expand into underpenetrated B-30 markets.

- Prudent has demonstrated a consistent track record of profitable growth on the back of highly scalable, asset-light and cash generative business model

- The company is backed by an experienced management team and a global investor.

Company Financials

Particulars | 9MFY22 | FY21 | FY20 | FY19 |

Commission and fee income from distribution of mutual fund products | 2,713.88 | 2,312.93 | 1,955.87 | 1,956.98 |

Total revenue from operations | 3,212.21 | 2,865.07 | 2,348.33 | 2,219.84 |

EBITDA | 814.96 | 619.1 | 466.71 | 382.05 |

EBITDA margin | 25.37% | 21.61% | 19.87% | 17.21% |

PAT | 576.28 | 452.97 | 278.53 | 210.19 |

PAT margin | 17.94% | 15.81% | 11.86% | 9.47% |

ROCE | 26.83% | 28.73% | 24.75% | 25.30% |

Cash flow from operations | 505.8 | 577.22 | 502.78 | 123.2 |

Cash flow from operations / EBITDA | 62.06% | 93.24% | 107.73% | 30.71% |

*All numbers are Rs in million except for percentage

Purpose of the IPO

- To carry out the company’s Offer for Sale.

- To achieve the benefits of listing the equity shares on stock exchanges.

- The company expects that the listing of equity shares will enhance their brand image and provide liquidity to its shareholders.

Company Promoters

Sanjay Shah is the promoter of the company.

IPO Details

IPO Opening Date | 10-May-22 |

IPO Closing Date | 12-May-22 |

Face Value | Rs 5 per equity share |

Issue Price (Price Band) | Rs 595 to Rs 630 per share |

Lot Size | 23 Shares |

Issue Size | 8,549,340 shares of Rs 5 each |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Minimum | 1 | 23 | Rs 14,490 |

Maximum | 13 | 299 | Rs 188,370 |