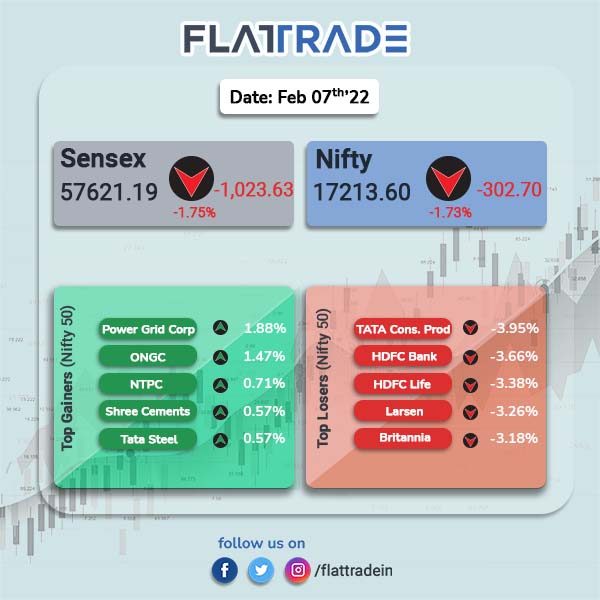

Dalal Street closed lower on Monday due to FII selling, concerns over higher crude prices and monetary policy tightening. The benchmark indices fell more than midcap and small cap stocks indices. The Sensex lost 1.75% to 57621.19 and the Nifty plunged 1.73% to 17213.60.

Nifty Midcap 100 was down 1.03% and BSE Smallcap fell 0.75%.

Top laggards were Nifty Financial Service [-2.57%], Private Bank [-2.34%], Bank [-2.05%], FMCG [-1.98%] and Pharma [-1.46%]. Top gainers were Nifty PSU Bank [0.92%] and Energy [0.51%].

Indian rupee was flat at 74.69 against the US dollar on Monday.

Stock in News Today

Reliance Industries Ltd (RIL): The energy conglomerate is seeking a minimum of $14 for selling natural gas being produced from coal seams in a block in Madhya Pradesh as it looks to cash in on the recent spike in energy prices globally.

Union Bank of India (UBI): The lender’s net profit rose 49.76% to Rs 1077.40 crore in the quarter ended December 2021 as against Rs 719.40 crore during the same a year ago. Total Operating Income remained nearly flat at Rs 17072.28 crore in the reported quarter as against Rs 17220.38 crore in the year-ago period.

Larsen & Toubro (L&T): The construction and engineering giant and Microsoft India inked a pact to develop a regulated sector-focused cloud offering to empower customers with the best-of-breed cloud computing and infrastructure services. The two companies will set up a joint governance group to define future platform designs, investments, and commercial/business models to service the regulated sectors’ emerging technology requirements.

Bharti Airtel: The telecom operator has plans to spend about Rs 1.17 lakh crore through business transactions with its subsidiaries like Indus Towers, Nxtra and Bharti Hexacom, according to a regulatory filing. The company will hold an extraordinary general meeting of the members of the company on February 26 to also seek their approval for issuing shares to Google for its about Rs 7,500 crore investment in the company to buy 1.28 per cent stake.

Maruti Suzuki India: The country’s largest carmaker commenced the bookings for its much-awaited, technologically advanced premium hatchback the New Age Baleno. The company said it has focused on developing a holistic solution that maximises safety and convenience, enhanced ‘tech quotient’.

Ashok Leyland: Commercial vehicle maker said that it will supply 200 trucks to the Bangladesh government as part of a $2-billion line of credit announced by Prime Minister Narendra Modi. As part of the order, 135 built trucks have already been delivered to Bangladesh, the company said.

Minda Industries: The company’s net profit rose 7.64% to Rs 65.76 crore in the quarter ended December 2021 as against Rs 61.09 crore during the year-ago period. Sales rose 11.78% to Rs 1333.70 crore in the quarter ended December 2021 as against Rs 1193.17 crore during the corresponding quarter a year-ago.

Meanwhile, the board of the company has approved acquisition of stake in Samaira Engineering and S. M. Auto Industries.

Clean Science and Technology: The company reported an 18% jump in consolidated net profit to Rs 57.9 crore in Q3FY22 from Rs 49 crore posted in Q3FY21. Consolidated revenue from operations grew by 44% to Rs 180.8 crore in Q3FY22 as compared to Rs 125.42 posted in Q3FY21.

Brightcom Group: The company signed a Letter of Intent to acquire all the assets of a US-based digital audio firm that owns and operates multiple assets. The assets’ acquisition value, including its net cash, is estimated at $102.5 million consisting of $95 million in cash and $7.5 million of BCG stock.

K P R Mill: The company’s net profit rose 35.52% to Rs 211.77 crore in Q3FY22 as against Rs 156.26 crore during the year-ago quarter. Revenue rose 36.18% to Rs 1227.45 crore in Q3FY22 as against Rs 901.32 crore during the year-ago period.

Punjab & Sind Bank: The lender’s net profit stood at Rs 300.82 crore in Q3FY22 as against a net loss of Rs 2375.53 crore in the year-ago period. Total Operating Income rose 6.13% to Rs 1871.18 crore in the quarter ended December 2021 as against Rs 1763.10 crore during the corresponding quarter of previous fiscal.