Indian central bank concluded its three-day monetary policy committee meeting on August 6 and unanimously decided to keep the policy repo rate unchanged at 4%. On a 5to 1 majority, RBI also decided to continue its accommodative stance to support and sustain the growth of the economy.

The Reserve Bank of India said the Indian economy is in much better position than at the time of the MPC’s meeting in June 2021 as the coronavirus cases declined and vaccination steadily rose. The RBI prioritized growth over inflation and aimed at keeping the financial system stable.

Economic Growth

Domestic economic activity started to pick up as the second wave weakened and different states in India reopened their economy. Various metrics indicated that consumption by private and public sector, investments and demand were gaining momentum.

RBI opined that as restrictions eased and vaccination programme was expanded across the country, private spending on goods and services including travel, tourism and recreational activities will get a boost and help in a broader recovery.

The central bank also had a positive outlook for the agriculture sector and expected that higher demand from rural India will support private consumption.

Demand from urban places will improve the prospects for manufacturing and services as there has been an uptick in automobiles registration, electricity consumption, imports excluding oil and gold, consumer durable sales and hiring of urban workers.

In addition, improving capacity utilisation, increasing consumption of steel products, higher imports of capital goods, stable financial conditions and various economic packages announced by the Central Government are expected to restart the Indian economy, the central bank noted.

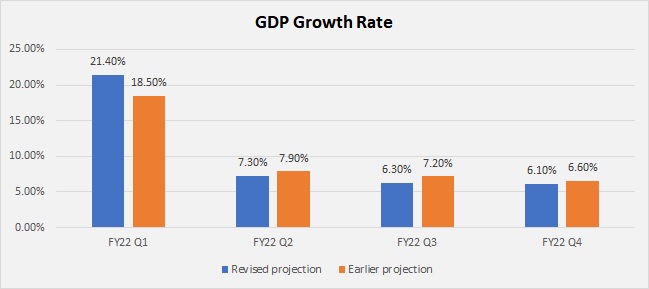

The central bank was also caution about external factors and downside risk to the economy such as rising global commodity prices, episodes of volatility in financial markets and possible increase of new infections across the country. Considering all these positive and negative factors, the RBI kept the GDP growth at 9.5% for FY22. The below graph shows RBI’s estimates on a quarterly basis.

Inflation

Headline consumer price inflation stood at 6.3% in May and June due to supply side shocks, demand-supply discrepancy in specific sectors and rise in global commodity prices.

Indicators for assessing food price inflation showed some moderation in prices of edible oils and pulses in July helped by supply side interventions by the government. Besides, with the arrival of south-west monsoon, increase in kharif crop sowing and adequate food stock buffer are expected to keep a lid on price rise of cereals in the coming months.

Moreover, subdued demand conditions are keeping inflation in core services such as house rentals below historical averages. In addition to it, elevated prices of industrial raw materials, high retail prices of petrol and diesel and logistics costs continue to have an adverse impact on manufacturing and services sector.

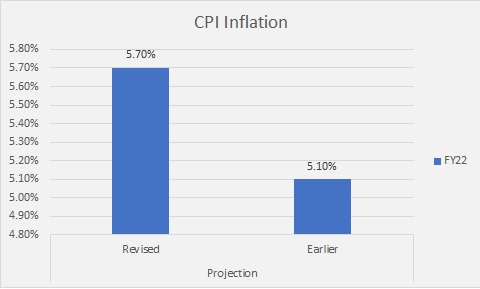

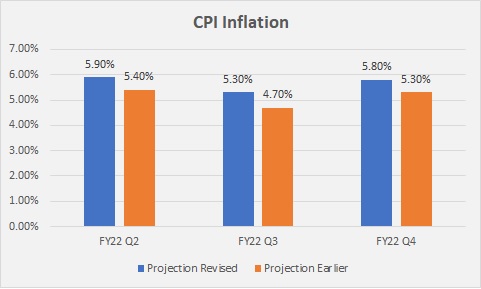

All these factors led the MPC to project CPI inflation to be 5.7% for FY22. Below are the CPI inflation projections on a quarterly basis

As of now, the RBI is ready to use all lever such as monetary, prudential and regulatory policies to support the economy to rebound and help in its sustainable growth. The RBI will release the minutes of the August 20, which will throw more light on different views of the six-member MPC committee.