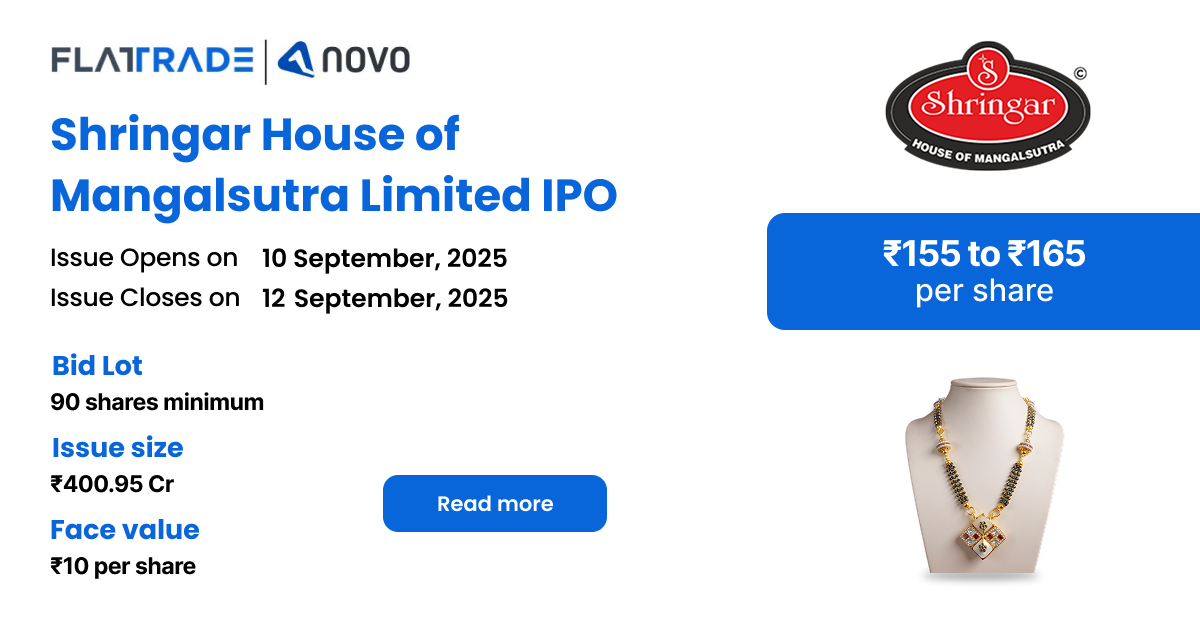

Shringar House of Mangalsutra IPO is a bookbuilt issue of Rs 400.95 crore. This issue is entirely a fresh issue of 2.43 crore shares with no offer for sale.

The IPO opens for subscription on September 10, 2025, and closes on September 12, 2025. The allotment is expected to be finalized on Monday, September 15, 2025. The price band for the IPO is set at ₹155 to ₹165 per share, and the minimum lot size for an application is 90 shares.

Company Summary

Incorporated in January 2009, Shringar House of Mangalsutra Limited manufactures and designs Mangalsutra in India.

The company designs, manufactures, and markets a diverse collection of Mangalsutras featuring various stones like American diamonds, cubic zirconia, pearls, and semi-precious stones, using 18k and 22k gold for its business-to-business (B2B) clients.

The company sells its products to corporate clients, wholesale jewellers, and retailers nationwide.

The company serve a diverse client base, including corporate clients, wholesale jewellers, and retailers across India, with a presence in 24 states and 4 union territories. In addition, the company expanded internationally to the UK, New Zealand, UAE, USA, and Fiji during Fiscals 2023 to 2025.

The company’s domestic and international corporate clients include Malabar Gold Limited, Titan Company Limited, GRT Jewellers, Reliance Retail, Joyalukkas India, and Damas Jewellery (UAE), among others

As of March 31, 2025, the company has served 34 corporate clients,1,089 wholesalers, and 81 retailers.

Shringar House of Mangalsutra Limited also manufacture and supplies Mangalsutras on a job-work basis to our Corporate Clients. For the Fiscals 2025, 2024, and 2023, the company processed a total of 1,320.72 kgs, 1,221.19 kgs and 870.26 kgs of bullion into Mangalsutras, generating revenue of ₹264.83 million, ₹193.24 million and ₹156.47 million, respectively.

As of June 30, 2025, the company has 237 employees.

Company Strengths

- Established client base and long-standing relationships with the clients.

- Design innovation and diversified product portfolio.

- Integrated Manufacturing Facility.

- Quality assurance and quality control of Mangalsutras.

- Continuously improving financial performance.

- Experienced Promoters and a professional management team.

Company Financials

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 375.75 | 265 | 211.55 |

| Total Income | 1,430.12 | 1,102.71 | 951.29 |

| Profit After Tax | 61.11 | 31.11 | 23.36 |

| EBITDA | 92.61 | 50.76 | 38.89 |

| Net Worth | 200.85 | 136.85 | 105.72 |

| Reserves and Surplus | 123.72 | 125.72 | 94.62 |

| Total Borrowing | 123.11 | 110.09 | 93.19 |

| Amount in ₹ Crore | |||

Objectives of IPO

- Funding capital expenditure requirements for civil construction work and towards the purchase of equipment, plant, and machinery for setting up a new manufacturing line of SteriPort at Hariyala, Kheda, Gujarat

- Funding capital expenditure requirements towards civil construction work, purchase of equipment, plant, and machinery for setting up a new manufacturing line for SVP at Hariyala, Kheda, Gujarat

- General corporate purposes

Promoters of the company

The promoters of the Company are Bhavesh Patel, Vishal Patel, Jayshreeben Patel, Jitendra Kumar Patel, and Milcent Appliances Private Limited.

IPO Details

| IPO Date | September 10, 2025 to September 12, 2025 |

| Listing Date | September 17, 2025 |

| Face Value | ₹10 per share |

| Price Band | ₹155 to ₹165 per share |

| Lot size | 90 shares |

| Total Issue size | 2,43,00,000 shares (aggregating upto ₹400.95 Cr ) |

| Issue type | Bookbuilding IPO |

| Listing at | NSE, BSE |

| Share Holding Pre Issue | 7,21,32,080 shares |

| Share Holding Post Issue | 9,64,32,080 shares |

Category Reservation

| Application Category | Maximum Bidding Limits | Bidding at Cut-off Price Allowed |

| Only RII | Upto Rs 2 Lakhs | Yes |

| Only sNII | Rs 2 Lakhs to Rs 10 Lakhs | No |

| Only bNII | Rs 10 Lakhs to NII Reservation Portion | No |

| Only employee | Upto Rs 5 lakhs | Yes |

| Employee + RII/NII | 1. Employee limit: Upto Rs 5 lakhs (In certain cases, employees are given a discount if the bidding amount is upto Rs 2 Lakhs) 2. If applying as RII: Upto Rs 2 Lakhs 3. If applying as NII: sNII > Rs 2 Lakhs and upto Rs 10 Lakhs, and bNII > Rs 10 lakhs | Yes for Employee and RII/NII |

Lot Allocation Details

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 90 | ₹14,850.00 |

| Retail (Max) | 13 | 1,170 | ₹1,93,050.00 |

| S-HNI (Min) | 14 | 1,260 | ₹2,07,900.00 |

| S-HNI (Max) | 67 | 6,030 | ₹9,94,950.00 |

| B-HNI (Min) | 68 | 6,120 | ₹10,09,800.00 |

Allotment Schedule

| Basis of Allotment | Mon, 15 Sep, 2025 |

| Initiation of Refunds | Tue, 16 Sep, 2025 |

| Credit of Shares to Demat | Tue, 16 Sep, 2025 |

| Tentative Listing Date | Wed, 17 Sep, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on September 12, 2025 |

IPO Reservation

| Investor Category | Shares Offered |

| QIB Shares Offered | Not more than 50% of the Net Issue |

| Retail Shares Offered | Not less than 35% of the Net Issue |

| NII Shares Offered | Not less than 15% of the Net Issue |

To check allotment, click here