Signatureglobal plans to go public to raise up to Rs 730 crore. The subscription for the initial public offering will be open from September 20 to September 22, 2023. The price band is fixed at Rs 366 – Rs 385 per share.

The IPO consists of fresh issue of shares aggregating up to Rs 603 crore and offer for sale of shares worth up to Rs 127 crore. The face value of each share is Re 1 and the size of one lot is 38 shares.

Company Summary

Signatureglobal is a prominent real estate development company in the National Capital Region of Delhi (Delhi NCR) in the affordable and lower mid segment housing in terms of units supplied (in the below Rs 80 lakh price category) between 2020 and the quarter ended March 31, 2023, with a market share of 19%.

The company had started its operations in 2014 and it has grown over the years and in less than a decade it has sold 27,965 residential and commercial units within the Delhi NCR region, with an aggregate saleable area of 18.90 million square feet. The company’s sales (net of cancellation) have grown at a compounded annual growth rate (CAGR) of 42.46%, from Rs 1690.27 crore in fiscal 2021 to Rs 3430.58 crore in fiscal 2023. As of March 31, 2023, the company has sold 25,089 residential units with an average selling price of Rs 36 lakh per unit.

The company has strategically focused on the Affordable Housing (“AH”) segment and the Middle Income Housing (“MH”) segment through Government of India and state government policies. Moreover, all of their projects have been, and are being, undertaken under the affordable housing project (AHP) or Deen Dayal Jan Awas Yojana affordable housing project AHP.

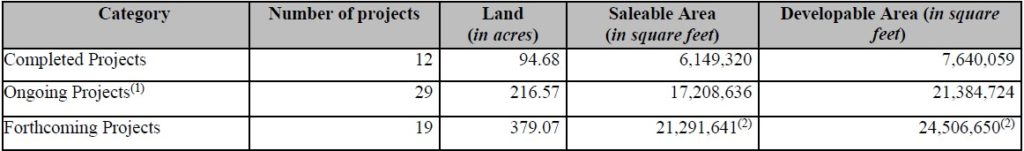

In terms of sales in Gurugram, the company has a market share of 31% in the affordable and lower mid segment, and a market share of 24% in all budget categories, in the period from 2020 to March 2023. The company in its red herring prospectus stated that most of its completed projects, ongoing projects and forthcoming projects are located in Gurugram and Sohna in Haryana and the details are given below in the table:

Company Strengths

- Largest affordable and mid segment real estate developer in Delhi National Capital Region.

- Strong brand recognition and distribution network.

- Ability to scale up rapidly and robust digital marketing capabilities translating into faster sales.

- Properties at affordable prices located at strategic locations.

- Quick turnaround time and end-to-end in-house project execution expertise.

- Positive operating cash flows with low levels of debt.

- Strong focus on sustainable development.

- Experienced promoters and professional senior management team with marquee investors.

Company Financials

Period Ended | FY23 | FY22 | FY21 |

Total Assets (Rs in crore) | 5,999.13 | 4,430.85 | 3,762.37 |

Total Revenue (Rs in crore) | 1,585.88 | 939.6 | 154.72 |

Revenue from operations (Rs in crore) | 1,553.57 | 901.3 | 82.06 |

EBITDA (Rs in crore) | 38.36 | -46.57 | -14.77 |

Profit After Tax (Rs in crore) | -63.72 | -115.5 | -86.28 |

Total Net Worth (Rs in crore) | 47.54 | -352.22 | -206.87 |

Total Borrowing (Rs in crore) | 1,709.75 | 1,157.53 | 1,176.38 |

Purpose of the IPO

- The company plans to use the net proceeds from fresh issue of shares for re-payment or pre-payment, in full or in part, of certain borrowings availed by the company aggregating up to Rs 264 crore; infusion of funds in certain of their subsidiaries, for re-payment or pre-payment, in full or in part, of certain borrowings availed by their subsidiaries totalling Rs 168 crore; and inorganic growth through land acquisitions and general corporate purposes.

- The company will not receive any proceeds from offer for sale and the selling shareholder will be entitled to the proceeds of the offer for sale after deducting the offer related expenses and applicable taxes.

Company Promoters

Pradeep Kumar Aggarwal, Lalit Kumar Aggarwal, Ravi Aggarwal, Devender Aggarwal, Pradeep Kumar Aggarwal HUF, Lalit Kumar Aggarwal HUF, Ravi Aggarwal HUF, Devender Aggarwal HUF, and Sarvpriya Securities Private Limited.

IPO Details

IPO subscription Date | September 20 to September 22, 2023 |

Face Value | Re 1 per share |

Price Band | Rs 366 to Rs 385 per share |

Lot Size | 38 Shares |

Total Issue Size | 1,89,61,039 shares aggregating up to Rs 730 crore |

Fresh Issue | 1,56,62,338 shares aggregating up to Rs 603 crore |

Offer for Sale | 32,98,701 shares aggregating up to Rs 127 crore |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 38 | Rs 14,630 |

Retail (Maximum) | 13 | 494 | Rs 1,90,190 |

Small HNI (Minimum) | 14 | 532 | Rs 2,04,820 |

Small HNI (Maximum) | 68 | 2,584 | Rs 9,94,840 |

Large HNI (Minimum) | 69 | 2,622 | Rs 10,09,470 |

Allotment Details

Event | Date |

Allotment of Shares | September 27, 2023 |

Initiation of Refunds | September 29, 2023 |

Credit of Shares to Demat Account | October 3, 2023 |

Listing Date | October 4, 2023 |

To check allotment, click here