Dalal Street closed marginally higher in a volatile week as the RBI kept its key interest rate unchanged. On Monday, the benchmark indices opened gap-up after HDFC and HDFC Bank merger news. But, the indices gave up all the gains in the next three days. However, on Friday, the indices rose on the surprise policy decision by India’s central bank.

For the week, the Nifty rose 0.64% to 17,784.35 and the Sensex gained 0.29% to 59,447.18.

Top Nifty sector gainers were Realty [5.66%], PSU Bank [4.83%], FMCG [4.39%], Metal [4.3%], Auto [2.04%]. Nifty IT [-2.61%] and Media [-0.33%] were the only sectors that fell on a weekly basis.

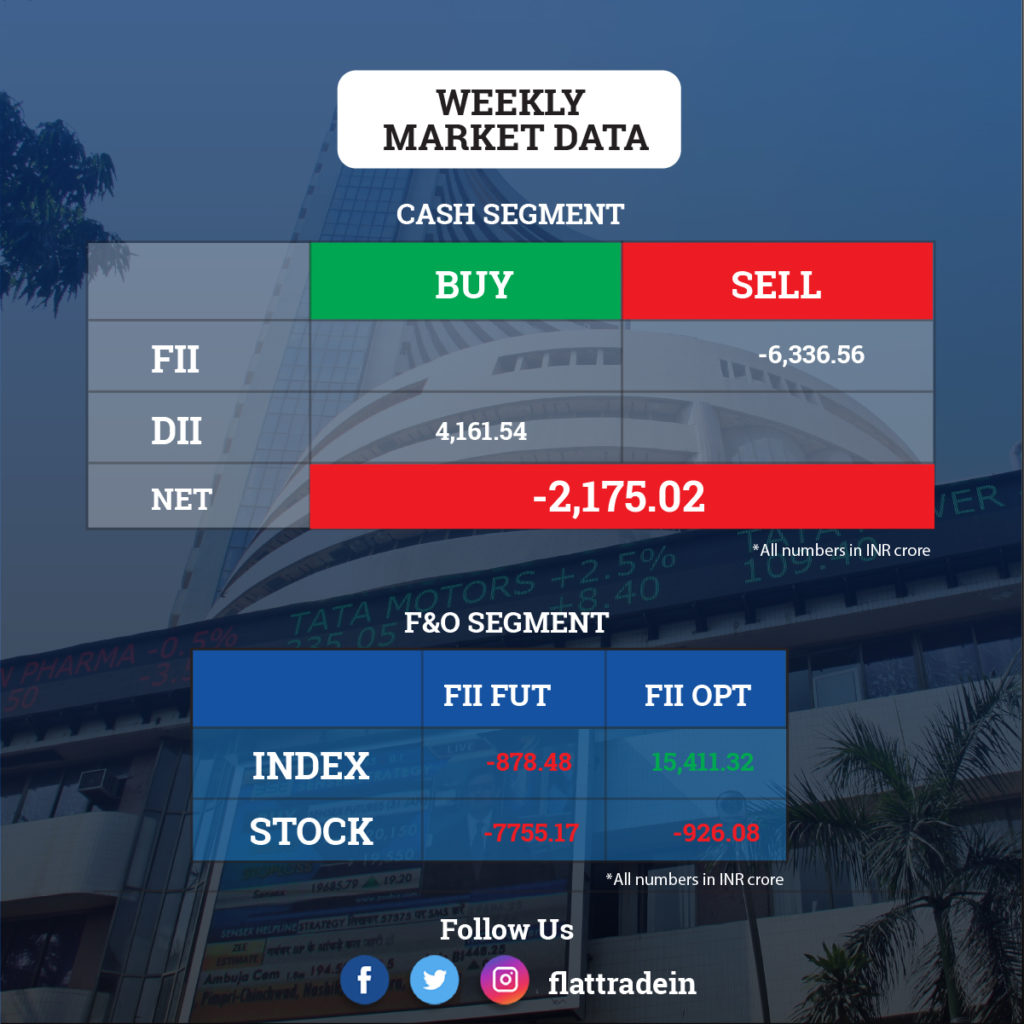

FIIs were net sellers and DIIs were net buyers. FIIs sold for Rs 6337.56 crore in the cash segment on a weekly basis, while DIIs bought Rs 4,161.54 crore.

Company News

HDFC Bank and HDFC: India’s largest private sector lender HDFC Bank will merge with housing finance firm HDFC Ltd, the companies said. Shareholders of HDFC Ltd will receive 42 shares of the bank for 25 shares held. Existing shareholders of HDFC Ltd will own 41 per cent of HDFC Bank.

Meanwhile, HDFC Bank is planning to raise funds of Rs 50,000 crore via bonds through private placements.

Adani Group: Abu Dhabi-based International Holding Company (IHC) will invest $2 billion in three companies of Adani Group that would help the companies with its expansion plans. IHC will acquire 1.26% in Adani Green at Rs 1,923.2 per share, 1.41% stake in Adani Transmission at Rs 2,454.95 per share and 3.53% stake in Adani Enterprises for Rs 1,915.85 apiece.

State Bank of India, Axis Bank and IDBI Bank: India’s antitrust body is investigating the trustee units of the three banks for suspected collusion on fees, triggering a lawsuit by a group representing them, Reuters reported. The antitrust case was triggered by a complaint from Muthoot Finance. When Muthoot wanted to raise debt in August last year, the gold loan company received a costing proposal which was 300% higher than previous rates.

Meanwhile, CNBC-TV18 reported that the Indian government plans to invite expression-of-interest for stake sale in IDBI Bank in May. The government plans to complete the transaction by FY2023, according to sources.

Defence companies: Shares of the companies closed higher after the government announced plans to expand procurement of locally manufactured products. Defence Minister Rajnath Singh on Thursday released the third positive indigenisation list of 101 equipment and platforms, which the Services can procure only from the domestic industry. Top gainers were Bharat Dynamics [15.35%], Bharat Electronics [2.24%], Mishra Dhatu Nigam [8.9%], Hindustan Aeronautics [2.7%], Cochin Shipyard [1.85%] and Bharat Forge [2.35%].

Reliance Industries Ltd (RIL): The company has set up electric vehicle (EV) charging infrastructure at its Mumbai campus to allow employees to charge their EVs free of cost. The Jio-bp pulse zone at Reliance Corporate Park presently includes six chargers of different configurations to cater to both electric two-wheelers and four-wheelers.

Meanwhile, TVS Motor and Jio-bp announced that they have agreed to explore the creation of a robust public EV charging infrastructure for electric two-wheelers and three-wheelers in the country, building on Jio-bp’s growing network in this space. The customers of TVS electric vehicles are expected to get access to the widespread charging network of Jio-bp, which is also open to other vehicles.

Indian Oil Corporation (IOC) and Larsen & Toubro (L&T): The state-run oil refinery IOC, engineering major L&T and green energy player ReNew Power said that they will form a joint venture (JV) to develop the green hydrogen sector in India. The JV will focus on developing Green Hydrogen projects in a time-bound manner to supply Green Hydrogen at an industrial scale.

Vodafone Idea Limited (VIL): British telecom major Vodafone has raised its stake in debt-ridden Vodafone Idea to 47.61 per cent through its subsidiary Prime Metals, a regulatory filing said. The company earlier held 44.39 per cent stake in Vodafone Idea Limited (VIL).

Mahindra & Mahindra (M&M): The car manufacturer said that it has terminated a deal to sell its bankrupt unit, SsangYong Motor Co, to South Korean electric carmaker Edison Motors Co. The caompany in an excahnge filing cited Edison’s inability to deposit the bid amount for the termination of the deal.

SpiceJet: The Delhi High Court granted interim protection from arrest to the company’s promoter Ajay Singh in a case of an alleged fraud related to the transfer of shares of the airline to certain individuals. “No coercive action till the next date of hearing,” said Justice Anoop Kumar Mendiratta who listed Singh’s anticipatory bail application in the case for further consideration on May 24. Meanwhile, the court directed Singh to join the investigation and keep the disputed shares frozen.

Future Group: India’s apex court said that parties will approach the tribunal led by the Singapore International Arbitration Centre (SIAC) to resume arbitration proceedings in connection with the merger deal of FRL with Reliance Retail. The Bench also said that Future Retail’s plea for termination of proceedings before SIAC will also be heard on priority.

Titan Company: The consumer durable retailer said that its jewellery business in Q4FY22 declined by 4 per cent YoY, despite the addition of 16 stores in the quarter. However, watches and wearables business registered 12 per cent growth YoY with addition of 34 stores. Its eyecare segment reported 5 per cent growth.

Coffee Day Enterprises Ltd: The company said it has defaulted a total of Rs 479.68 crore on repayment of loans and unlisted debt securities in the quarter ended March 31, 2022. It has defaulted Rs 224.88 crore on repayment of loans or revolving facilities like cash credit from banks and financial institutions. Also, there has been a default of Rs 200 crore on payments of unlisted debt securities.

Zee Entertainment Enterprises: Investment firm Invesco said three funds managed by its developing markets investment team, including Invesco Developing Markets Fund, will sell up to 7.8 per cent of the share capital of the media major to align exposures to the firm with other funds managed by the team.

Ruchi Soya: Shares of the company rose nearly 13% after shares under the recently concluded follow-on public offering (FPO) started trading on Friday. About 66.15 million new shares issued in the Rs 4,300-crore FPO began trading.

Uma Exports: Shares of the company has a strong debut on the bourses on Thursday, listing at Rs 80 apiece on the BSE, a 17.6 per cent premium against its issue price of Rs 68 apiece. The company closed at Rs 84 per equity share.

Economy News

The Reserve Bank of India (RBI) in its Monetary Policy Committee (MPC) meeting on Friday kept key policy rate unchanged while maintaining its accommodative stance. RBI kept repo rate unchanged at 4%. Reverse repo rate stands at 3.35%. The Marginal Standing Facility rate is at 4.25%.

The RBI has lowered India’s GDP growth estimates to 7.2% for FY23. GDP growth projections as follows: 16.2% in Q1FY23; 6.2% in Q2; 4.1% in Q3; 4% in Q4.

The RBI has also revised India’s inflation forecast to 5.7% in FY23. Inflation estimates are as follows: 6.3% in Q1FY23; 5% in Q2; 5.4% in Q3; 5.1% in Q4. Both the growth projections assume crude oil at $100/barrel in FY23, according to RBI.

The seasonally adjusted S&P Global India Services PMI Business Activity Index rose to 53.6 in March 2022 from 51.8 in February 2022. A reading above 50 indicates expansion of the sector and below 50 denotes contraction of activity in the sector. To read more, click here

The seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) stood at 54 in March, falling from 54.9 in February. To read more, click here

India’s merchandise exports rose to $418 billion in fiscal 2021-22 on higher shipments of petroleum products, engineering goods, gem and jewellery and chemicals, according to government data.

Global Markets

Wall Street indices fell for the week as the US Fed’s monetary policy and the situation in Ukraine continued to weigh on investors’ sentiments. Information technology and consumer discretionary were the biggest losers. For the week, For the week, the S&P 500 fell 1.26%, the Dow lost 0.27% and the Nasdaq plunged 3.86%.

The Fed released minutes from its mid-March policy meeting. The minutes revealed that policymakers were ready to shrink reduce the central bank’s balance sheet by $95 billion per month, more than the consensus expectation of around $80 billion. The minutes also showed that officials were likely to hike interest raise rates by 50 basis points at their upcoming May meeting.

Japan’s major stock indices fell over the week on week global cues and hawkish stance by the Fed. The International Monetary Fund (IMF) downgraded its growth estimates in 2022 to 2.4% year-on-year, from 3.3%. The Nikkei 225 index was plunged 2.46% and the broader Topix tanked 2.44%.

Chinese markets fell as fresh coronavirus lockdown, aggressive monetary tightening poilcy by the US central bank and week economic data. The Caixin Services Purchasing Managers’ Index, which measures activity among smaller businesses, fell drastically to 42 in March from 50.2 in February. The Shanghai Composite index fell 0.94%, Hang Seng lost 0.76% and the CSI 300 dropped 1.06%.