Bonus issue are extra shares given to shareholders who are already holding a company’s shares. These bonus shares are given at free of cost to the existing shareholders. Bonus shares are given when the company is low on liquidity but has made good profit and it has good reserves.

In one of the cases, if a company pays dividend, then their cash reserves will decrease. To avoid this situation and use this cash to improve its business, they issue bonus shares. It is also given to improve the creditworthiness and make the company stock attractive to small investors who have less capital.

Benefits of Bonus Shares

Bonus issue is announced in various format like 1:1, 3:1, 2:3, etc. If a company announces bonus issue of 3:1, then the company will issue 3 extra shares for 1 share held by the shareholder, subject to eligibility. This also has ex-bonus date and record date. A shareholder or investor must hold a company share in their demat account for him or her to be eligible for that bonus shares. Therefore, after an investor receives the bonus shares, he or she will have 4 shares [ 3 shares +1 share ] in his/her demat account.

Investors having lower capital can buy those company shares in large quantity. Subsequently, when the company grows every year, the stock price will go up. The investors holding the company shares will profit when they sell the share at a higher price. It also sends a positive signal to the investor community about the financial strength of the firm.

As a shareholder, you need not pay anything to receive the bonus shares. There is also no taxes needed to be paid for receiving the bonus shares, unlike when you pay taxes on receiving dividend. When a company issues bonus shares, the face value remains the same. For example, if the face value of a share is Rs 5 before the bonus issue of shares, even after the bonus issue, the face value will be Rs 5. But, the share price decreases and the number of a shares an investor holds will increase.

How to Interpret Bonus Ratio

If a company says they will issue bonus shares in the ratio 1:10, then it means all eligible shareholder will get one share for every 10 shares held.

On the other hand, if a company says they will issue bonus shares in the ratio 5:1, then the company will issue 5 additional equity shares for one equity share held by the shareholder.

Important Dates

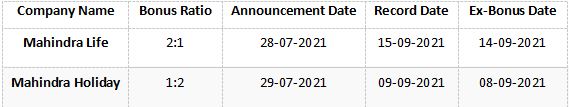

There are a few important dates while issuing bonus shares that you must know. This is something similar to important dates while a company issues dividends. Below table shows an example of a couple of companies.

Announcement date: This is the date on which the company will recommend the issue of bonus shares after a board meeting. This information is shared with the exchange and the corresponding pdf file can be found under corporate information on the NSE website. So, in the above table, the announcement date for Mahindra Life is July 28, 2021.

Ex-Bonus date: This is the date before which you must have bought the company’s share to receive the bonus share. Even if you buy the share on ex-bonus date, you will not be eligible for bonus shares. This is because India follows T+2 settlement cycle. So, if you buy on ex-bonus date, it will not reflect in your demat account.

Record date: The record date is one day after the ex-bonus date. Let us take the example of Mahindra Life to understand. If the ex-bonus date is September 14, 2021, then the record date is September 15, 2021, as seen in the table. This is the cut-off date and the date on which a company will check their records for eligible investors who can receive the bonus shares. The bonus shares will be credited to your demat account within 15 days from record date.