Yatharth Hospital and Trauma Care Services plans to raise up to Rs 687 crore through initial public offering. The subscription for the IPO will be open from July 26 to July 28, 2023. The price band is fixed at Rs 285-300 per share.

At the upper end of the price band, the issue is expected to fetch about Rs 687 crore and at the lower end of the price band, the issue will fetch about Rs 677 crore.

The IPO comprises of fresh issue of shares worth Rs 490 crore and offer for sale of 65,51,690 shares of face value of Rs 10 each.

Company Summary

Yatharth Hospital is one of the leading private hospitals in the National Capital Region of Delhi (“Delhi NCR”), in terms of number of beds in fiscal 2023. The company operates three super specialty hospitals in Delhi NCR. It has acquired a 305-bedded multi-speciality hospital in Orchha, Madhya Pradesh near Jhansi, Uttar Pradesh, which commenced commercial operations in from April 10, 2022. This is one of the largest hospital in Jhansi-Orchha-Gwalior region in terms of number of beds. With this acquisition, Yatharth Hospital’s total bed capacity has increased to 1,405 beds, according to its red herring prospectus.

The company’s Centres of Excellence (COE) represent top 10 revenue generating specialties. The COEs are led by a team of respective domain expert doctors who are ably assisted by other doctors. As of March 31, 2023, the company engages 609 doctors and offer healthcare services across several specialties and super specialties.

Yatharth Hospitals are accredited by National Accreditation Board for Hospitals & Healthcare Providers (NABH), and its hospitals at Greater Noida and Noida Extension are also accredited by National Accreditation Board for Testing and Calibration Laboratories.

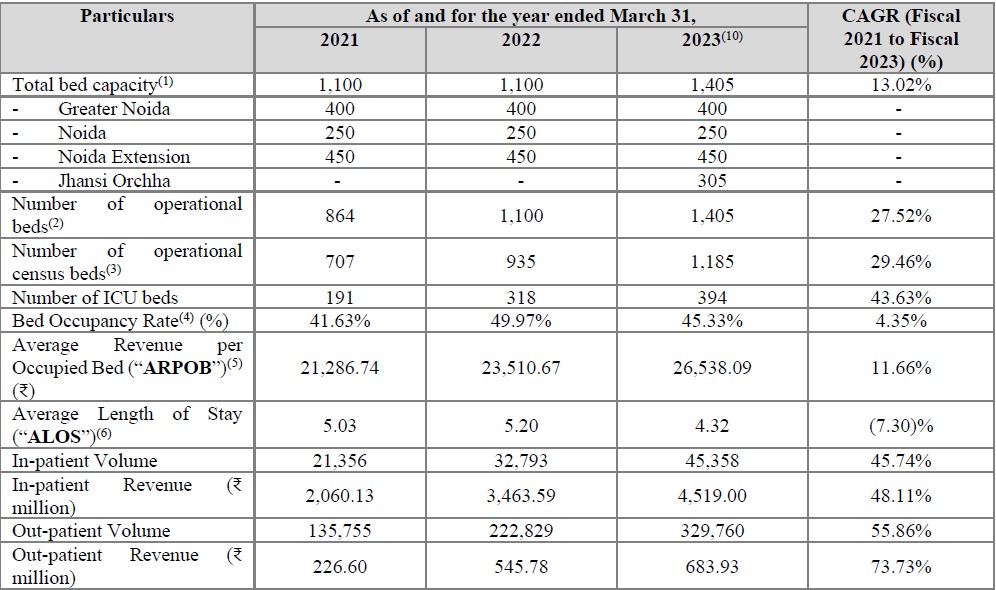

In fiscal 2023, the hospital’s Bed Occupancy Rate stood at 45.33%, its Average Revenue Per Occupied Bed (ARPOB) was Rs 26,538.09 and the Average Length Of Stay (ALOS) was 4.32 days.

Key Operational Metrics

Company Strengths

- Yatharth Hospital is a leading super-specialty hospital in Delhi NCR with diverse specialty and payer mix.

- The hospitals are equipped with advanced technology and high-end medical devices.

- The company has a team of highly qualified doctors, medical professionals and support staffs.

- Experienced and qualified professional management team with strong execution track record.

- Stable operating and financial performance as well as consistent growth over the past three fiscals.

Company Financials

Period Ended | FY23 | FY22 | FY21 |

Total Assets (Rs in crore) | 485.97 | 426.02 | 308.77 |

Total Revenue (Rs in crore) | 523.1 | 402.59 | 229.19 |

EBITDA (Rs in crore) | 133.76 | 110.81 | 67.01 |

EBITDA margin | 25.71% | 27.64% | 29.30% |

Profit After Tax (Rs in crore) | 65.77 | 44.16 | 19.59 |

PAT margin | 12.64% | 11.01% | 8.57% |

ROCE | 26.10% | 22.93% | 18.43% |

ROE | 35.95% | 37.78% | 25.06% |

Purpose of the IPO

The company proposes to utilise the net proceeds of the fresh issue of shares towards the following purposes:

- Repayment/ prepayment, in full or part, of certain borrowings availed by the company aggregating up to Rs 100 crore.

- Repayment/ prepayment, in full or part, of certain borrowings availed by its Subsidiaries, namely, AKS Medical & Research Centre Private Limited (“AKS”) and Ramraja Multispeciality Hospital & Trauma Centre Private Limited totalling Rs 145 crore.

- Funding capital expenditure expenses of the Company for two hospitals, namely, Noida Hospital and Greater Noida Hospital totalling up to Rs 25.64 crore.

- Funding capital expenditure expenses of its subsidiaries– AKS and Ramraja– for respective hospital operated by them totalling RS 106.97 crore.

- Funding inorganic growth initiatives through acquisitions and other strategic initiatives totalling up to Rs 65 crore and also other general corporate purposes.

Company Promoters

Ajay Kumar Tyagi and Kapil Kumar are the promoters of the company.

IPO Details

IPO Subscription Date | July 26 to Jul 28, 2023 |

Face Value | Rs 10 per share |

Price | Rs 285 to Rs 300 per share |

Lot Size | 50 Shares |

Fresh Issue | Shares aggregating up to Rs 490 crore |

Offer for Sale | 65,51,690 shares of Rs 10 |

Issue Type | Book Built Issue IPO |

Listing At | BSE, NSE |

IPO Lot Size

Application | Lots | Shares | Amount |

Retail (Minimum) | 1 | 50 | Rs 15,000 |

Retail (Maximum) | 13 | 650 | Rs 1,95,000 |

Small HNI (Minimum) | 14 | 700 | Rs 2,10,000 |

Small HNI (Maximum) | 66 | 3,300 | Rs 9,90,000 |

Large HNI (Minimum) | 67 | 3,350 | Rs 10,05,000 |

Allotment Details

Event | Date |

Basis of Allotment | August 2, 2023 |

Initiation of Refunds | August 3, 2023 |

Credit of Shares to Demat | August 4, 2023 |

Listing Date | August 7, 2023 |

To check allotment, click here