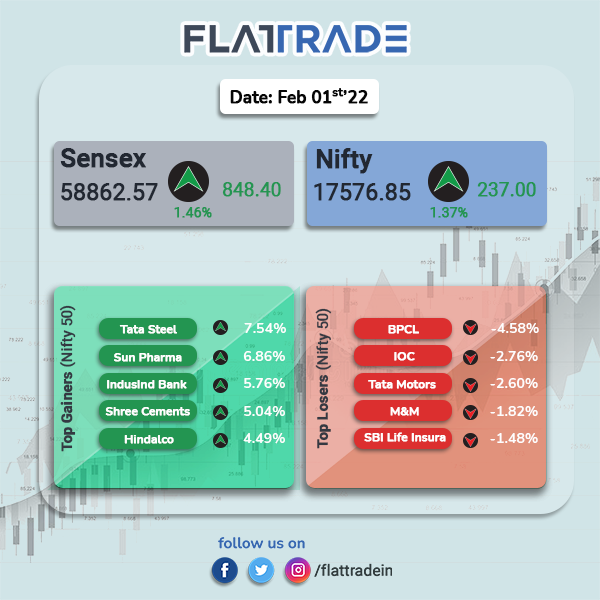

Equity indices closed higher as investors cheered pro-growth Budget 2022. Government increased its capital expenditure by 35 percent for FY23 announced a slew of investments for the infrastructure, housing, defence and agriculture sector to boost growth amid rising inflation in the Indian economy. The Sensex closed 1.46% higher and Nifty rose 1.37%.

In the broader markets, Nifty Midcap 100 climbed 1.12% and BSE Smallcap rose 0.92%.

Top gainers in Nifty sectoral indices were Metal [4.49%], Pharma [2.26%], Commodities [2.08%], FMCG [1.96%] and Private Bank [1.93%]. Top losers were Auto [-0.75%], PSU Bank [-0.58%], Energy [-0.38%].

Indian rupee fell 18 paise to 74.79 against the US dollar.

Stock in News Today

Tata Steel, JSPL and SAIL: Shares of metal companies jumped after the government announced Rs 7.5 trillion capex plans for the financial year 2023. All companies in the Nifty Metal index closed higher. Tata steel led the Metal index and closed 7.54% higher.

ITC and Godfrey Phillips: Shares of cigarette manufacturers rose after the Indian government did not propose to raise taxation of tobacco products in the recently concluded budget session.

Tech Mahindra: The IT firm’s profit rose 2.2% QoQ to Rs 1368.5 crore from Rs 1338.7 crore in the previous quarter. Revenue stood at Rs 11451 crore in the reported quarter, up 5.25% from Rs 10881.3 in Q2FY22

Maruti Suzuki India: The carmaker reported a 3.96 per cent fall in total wholesales at 1,54,379 units in January 2022 as compared to a sale of 1,60,752 units in January 2021.

Tata Motors: The automaker reported 27 per cent year-on-year growth in total vehicle sales, including in international markets, at 76,210 units in January 2022. The company’s total sales stood at 59,866 vehicles in January 2021.

Future Retail: Supreme Court has asked lenders of Future Retail the reason for their opposition to the company’s petition against possible NPA classification. Supreme Court has asked 27 banks which have been made party to Future’s petition to file a short affidavit within two days.

PB Fintech and Paytm: Shares of fintech services providers in India gained as the federal budget focuses on expanding digital financial services. PB Fintech, parent of PolicyBazaar, advanced 8.5% and Paytm closed 5.32%.

HFCL and Tejas Networks: Telecom infrastructure providers gained after the Finance Minister announced plans for 5G roll-out in the budget session. India will auction 5G spectrum in 2022.