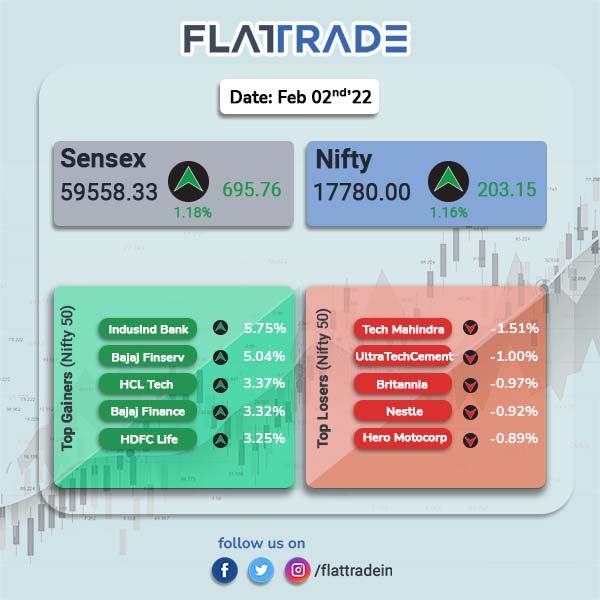

Dalal Street closed higher tracking global cues and gains in banking, pharma and technology stocks. Investors continued to cheer the Budget as all sectors gained on investors’ optimism. The Sensex closed 1.18% higher at 59558.33 and Nifty rose 1.16% to 17780.

The gains were broad-based as smallcap and midcap stocks gained. Nifty Midcap 100 climbed 1.18% and BSE Smallcap index jumped 1.54%.

Top gainers were Nifty PSU Bank [3.41%], Private Bank [2.33%], Bank [2.14%], Financial Services [1.93%] and Media [1.77%]. Nifty IT advanced 1.18% and Pharma stocks rose 1.23%. All indices closed in green a day after Budget 2022.

Indian rupee fell 5 paise to 74.84 against the US dollar.

Stock in News Today

HDFC: The mortgage lender reported a 11% rise in standalone net profit at Rs 3,261 crore in Q3FY22 compared with a standalone net profit of Rs 2,926 crore in the year-ago period. Net interest income rose 5% to Rs 4,284 crore in the reported quarter as against Rs 4,068 crore in Q3FY21.

Adani Green Energy: The company posted a nearly 20 per cent rise in its consolidated net profit to Rs 49 crore in the October-December 2021 quarter compared to the year-ago period. The company had reported a consolidated net profit of Rs 41 crore in the quarter ended on December 2020. Total income of the company rose to Rs 1,471 crore in the quarter from Rs 843 crore in the same period a year ago.

Jubilant FoodWorks: The QSR chain operator reported 9.8% growth in net profit at Rs 1,373 crore. Revenue from operations rose by 12.9% YoY to Rs 11,935 crore in Q3 FY22. EBITDA in Q3FY22 was Rs 3,174 crore, up by 13.9% from Rs 2,786 crore in Q3FY21.

Indian Overseas Bank: The public-sector lender posted a net profit of Rs 454.11 crore in the quarter ended December 2021, up 113.33% from Rs 212.87 crore in the year-ago period. Total operating income declined 1.08% to Rs 4197.69 crore in the quarter ended December 2021 as against Rs 4243.72 crore during the same quarter ended December 2020.

Alkyl Amines Chemicals: Net profit of the company declined 45.70% to Rs 45.88 crore in Q3FY22 as against Rs 84.49 crore during the same quarter last fiscal. Sales rose 16.30% to Rs 376.66 crore in the quarter ended December 2021 as against Rs 323.88 crore during the year-ago quarter.

Bandhan Bank and IndusInd Bank: The banks are among various bidders for IDFC Mutual Fund before the Feb. 1 deadline, reports Moneycontrol, citing unidentified people familiar with the matter. Most aggressive bids came from Bandhan Bank and IndusInd Bank, according to the report.

Anupam Rasayan India Ltd: Shares of the company rose after the company approved the acquisition of 24.96% of total equity shareholding and joint control of Tanfac Industries Ltd (TIL) from Birla Group Holdings Pvt Ltd. and other promoter groups of TIL for Rs 148.14 crore. Post the acquisition, Anupam Rasayan will become a promoter and will have joint control in TIL.

V-Guard Industries: The company’s net profit declined 31.78% to Rs 53.16 crore in the quarter ended December 2021 as against Rs 77.92 crore during the year-ago period. Sales rose 15.85% to Rs 967.38 crore in the reported quarter as against Rs 835.04 crore during the corresponding quarter last fiscal.

VRL Logistics: The company’s net profit rose 52.21% to Rs 60.49 crore in Q3FY22 as against Rs 39.74 crore in Q#FY21. Sales rose 20.41% to Rs 678.39 crore in the reported quarter as against Rs 563.42 crore during the corresponding quarter last fiscal.

Windlas Biotech: The company’s net profit declined 32.33% to Rs 8.31 crore in the quarter ended December 2021 as against Rs 12.28 crore during the quarter ended December 2020. Sales rose 0.33% to Rs 117.59 crore in Q3FY22 as against Rs 117.20 crore during the same quarter last financial year.