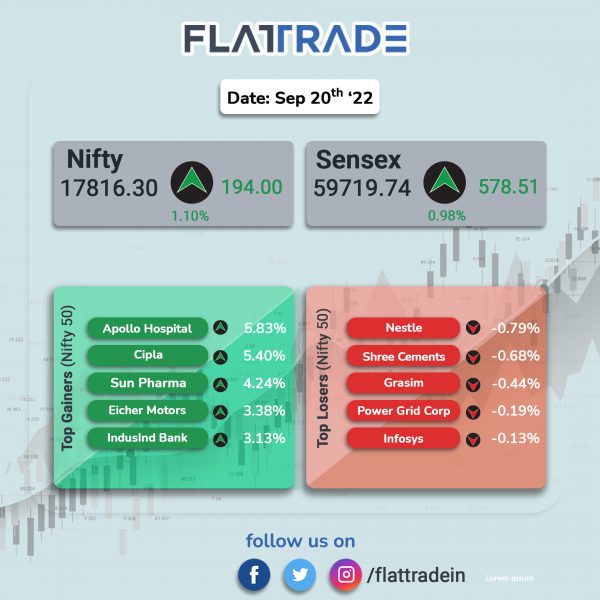

Benchmark stock indices pared some of their morning gains but ended in the green, tracking its global peers. The Sensex rose 0.98% and the Nifty 50 index gained 1.1%.

Broader markets mirrored headline indices. The Nifty MidCap 100 index was up 1.43% and the BSE SmallCap rose 1.01%.

All indices ended in the green. Top Nifty sectoral index gainers were Pharma [3.08%], Private Bank [1.67%], Auto [1.66%], Realty [1.6%] and Metal [1.56%]

The Indian rupee rose 2 paise to 79.75 against the US dollar on Tuesday.

Stock in News Today

Hero Group: The group along with the US-based private equity giant KKR will invest $450 million in the motorcycle maker’s renewable energy arm, the companies said on Tuesday. “This investment will position HFE for continued growth and support its efforts to expand its renewable energy capacity and capabilities across technologies such as solar, wind, battery storage, and green hydrogen, and into new markets over time,” the companies said in a statement.

Mahindra & Mahindra (M&M): Fiat Chrysler received a second chance to permanently block the US sales of redesigned Roxor off-road vehicles made by M&M. The 6th U.S. Circuit Court of Appeals said that a Detroit federal court applied the wrong standard when it found that Mahindra’s post-2020 Roxors were unlikely to cause consumer confusion. A spokesperson for M&M said it was confident that the outcome of the case will be “consistent with the previous rulings” in its favor.

IDBI Bank: The Centre is tightening disclosures bidders must make as it gears up for the next leg of privatisation that will include IDBI Bank, according to Economic Times report. Bidders will have to disclose any legal proceedings they face until the scheduled completion of sale transactions, according to an official familiar with the matter, the report added.

Telecom Companies: The Department of Telecommunications (DoT) is set to incorporate provisions in the upcoming telecom Bill that would allow it to waive statutory dues and penalties, according to Economic Times report. The waiver is likely to benefit small internet or telecom companies that owe modest sums to the department, officials aware of the matter said. The bill also has the potential to enable DoT to waive off some dues of bigger telcos like Vodafone Idea (Vi) or Bharti Airtel, the report said.

Zydus Lifesciences: Shares of jumped over 3% after the company launched Lenalidomide capsules in the US. The drug is used to treat various types of cancers and also anemia in patients with blood/bone marrow disorders. The drug had an annual sales of $2.86 billion in the U.S., according to IQVIA.

HCL Technologies: Shares of the company rose 1.8% after brokerage firm Kotak Institutional Equities maintained a ‘buy’ rating. The brokerage firm noted that the company’s Apps business, aided by organically built Apps digital practice’ is getting better and has potential to grow in high-teens.

Piramal Enterprises: The company informed exchanges that its board of directors approved raising up to Rs 750 crore non-convertible debentures. The company will raise market linked non-convertible debentures on private placement, up to Rs 100 crore along with an option to retain over subscription of up to Rs 650 crores, aggregating up to Rs 750 crores.

Venus Pipes & Tubes: Shares of the company rose over 11% in intraday trading before retreating to close 3.6% higher. Recently, the company became the first Indian company to receive Bureau of Indian Standards (BIS) approval for stainless steel seamless and welded pipes and tubes that led to a rally of 47% in the past two weeks.

Hatsun Agro: The company has agreed to issue equity shares worth about Rs 400 crore by means of rights issue to its existing shareholders. The company has also decided to form a committee of directors to oversee the rights issue and authorize terms and conditions.

Advanced Enzyme Technologies: Shares of the company surged 12% after a portfolio investor bought the company shares via a block deal. Nalanda India Equity Fund purchased 2.91 million equity shares, representing 2.6 per cent stake in Advanced Enzyme Technologies, worth Rs 78.62 crore via block deal, NSE data showed. The foreign portfolio investor bought shares at weighted average price of Rs 270.03 per equity share.

Olectra Greentech: Shares of the company rose 3.83% in intraday trading after the company announced that it had received Letter of Award, as part of a consortium with Evey Trans, from one of the state transport corporations. The order for supply of 123 Electric Buses is on Gross Cost Contract (GCC) / OPEX model basis for a contract period of 15 years. The value of this contract is approximately Rs 185 crore.