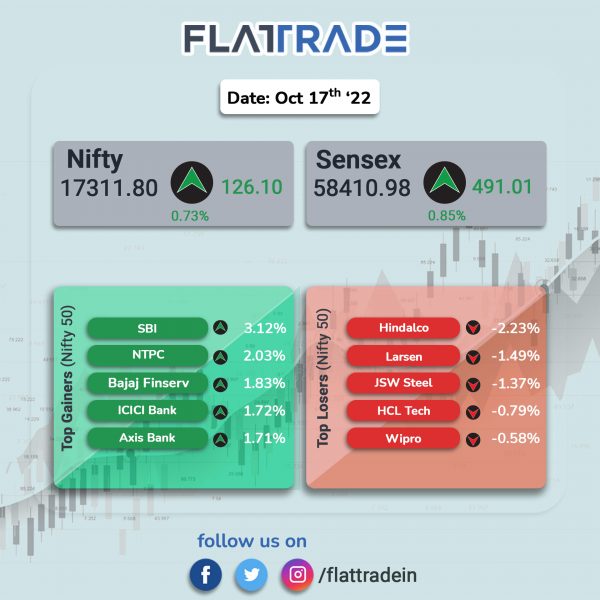

Benchmark indices closed higher, aided by gains in banking and energy stocks. The Sensex closed 0.85% higher and the Nifty gained 0.73%.

In broader markets, the Nifty Midcap 100 index edged up 0.16% and the BSE Smallcap inched up 0.09%.

Top gainers among Nifty sectoral indices were PSU Bank [3.47%], Bank [1.56%], Energy [1.52%], Private Bank [1.42%] and Financial Services [1.15%]. Top losers were Metal [-0.97%], Media [-0.8%] and Realty [-0.43%].

The Indian rupee was unchanged at 82.35 against the US dollar on Monday.

Stock in News Today

ACC: The cement manufacturer reported a consolidated net loss of Rs 87.32 crore in Q3 September 2022 as against a net profit of Rs 450.21 crore in Q3 September 2022. The Net sales rose 7.04% to Rs 3910.49 crore in Q3 September 2022 in the same period last fiscal. During the quarter ended 30 September 2022, cement volume grew by 4% compared with the same quarter last year.

Ready Mix Concrete volume grew over 10% in the reported quarter over the same quarter last year. Power and fuel expenses in Q3 September 2022 stood at Rs 1,317.53 crore, up 67.14% YoY. EBITDA tanked 97.75% YoY to Rs 16 crore in Q3 September 2022, largely due to steep rise in fuel cost. EBITDA margin was 0.4% in Q3 September 2022 as against 19.5% in the corresponding quarter last year.

PVR: The theatre operator’ consolidated revenue fell 30% QoQ to Rs 686.72 crore in Q2FY23 from Rs 981.4 crore in the prior quarter. Net loss stood at Rs 71.23 crore in the reported quarter as against a net profit of Rs 53.38 crore in the second quarter of FY23. EBITDA fell 55% to Rs 153.65 crore in the reported quarter from Rs 341.57 crore in Q2FY23.

Bank of Maharashtra: Net profit of the lender rose 94.97% to Rs 534.74 crore in the quarter ended September 2022 as against Rs 274.27 crore during the same quarter ended September 2021. Total Business grew by 15.92% YoY to Rs 344,065 crore in the reported quarter as against. Total Deposits up by 7.86% YoY to Rs 195,849 crore. Net NPA reduced to 0.68% at the end of second quarter of FY23. Net Interest Income increased by 25.84% YoY and 11.94% QoQ to Rs 1,887 crore. Shares of the company jumped 5%.

Axis Bank: The lender said that the insurance regulator — Insurance Regulatory and Development Authority of India — has imposed a penalty aggregating to Rs 2 crore alleging violations related to transfer of shares of Max Life Insurance Company between Max Financial Services and Axis Bank and its subsidiaries. Axis Bank also said that the penalty does not have any material impact on the bank or its corporate agency operations.

JSW Steel: The manufacturer signed a memorandum of understanding (MOU) with Smartex to promote innovation and turnkey approaches from financing to technology availability and market access aimed at de-carbonisation of the steel sector in India. The steel maker said that de-carbonisation of the steel sector includes de-risking industry investment, accelerating climate action and addressing social equity.

Inox Wind: The company’s board is scheduled to meet on October 19, 2022, to consider proposal for raising of funds through issuance of securities including but not limited to non-convertible securities under private placement basis. Shares jum by 4.2% in intraday trading but pared most of its gains.

Birlasoft: The IT firm announced a partnership with Coursera, one of the largest online learning platforms in the world, to further enhance the technical skills of more than 12,500 employees, broadening their knowledge base. With this collaboration, all the employees of Birlasoft, will have complete access to Coursera’s library of more than 9,000 courses and Guided Projects.

Anupam Rasayan India: The company has signed two contracts with a European crop protection company for the supply of two new life science-related specialty chemicals. The company will supply these products for the next three years under the contract and will be manufactured at its existing manufacturing facilities.

Zydus Lifesciences: The pharma company’s subsidiary, Zydus Worldwide DMCC, has received tentative approval from the US FDA to market Valbenazine Capsules USP 40 mg, 60 mg, 80 mg. Valbenazine capsules are for treatment of tardine dyskinesia in adults. Valbenazine capsules had annual sales of $781 million in the US according to the latest IQVIA data.

Ksolves India: The company’s net profit rose 93.20% to Rs 5.97 crore in the quarter ended September 2022 as against Rs 3.09 crore during the same quarter ended September 2021. Revenue increased 79.20% to Rs 18.26 crore in the quarter ended September 2022 as against Rs 10.19 crore during the corresponding quarter ended September 2021.

The Anup Engineering: Net profit declined 17.85% to Rs 12.93 crore in the quarter ended September 2022 as against Rs 15.74 crore during the same quarter last fiscal. Sales rose 13.37% to Rs 100.96 crore in the quarter ended September 2022 as against Rs 89.05 crore during the corresponding period last year.

Craftsman Automation: The company reported a 36% rise in revenue at Rs 776.2 crore in Q2FY23 against Rs 571 crore in the same period last fiscal. The company’s net profit also rose 25% YoY to Rs 62.5 crore in the reported quarter from Rs 50 crore in the year-ago period.

Snowman Logistics: The company announced the launch of Fifth-Party Logistics or 5PL services in India. The company will offer distribution and consolidation services, including sourcing on behalf of its customers, in addition to the existing bouquet of 3PL services of transportation and warehousing.