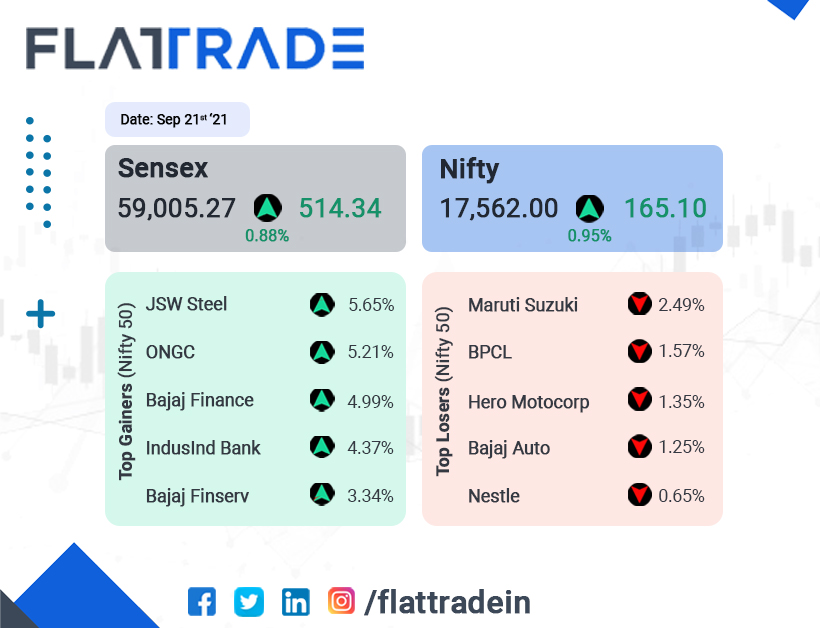

Benchmarks Indian indices closed higher in an extremely volatile session and snapped a two-day losing streak. Gains in metal, technology, pharma and FMCG stocks helped the indices to close in the green. The Sensex closed 0.88% higher at 59005.27 and Nifty was up 0.95% at 17562.

Nifty Metal, IT, Pharma and FMCG indices rose 2.55%, 1.94%, 1.29% and 1.09%, respectively. Auto (-0.46%) index was the biggest loser.

Indian rupee gained 12 paise to close at 73.61 against the US dollar.

Stock in News Today

Adani Group: Gautam Adani, chairman of the group, said that he has envisioned an investment of $20 billion over the next decade in renewable energy production, component manufacturing, transmission and distribution. Adani said that he has plans to triple its renewable power generation capacity in the next four years, venture into green hydrogen production, power all data centres with renewable energy, turn its ports into net carbon zero by 2025. He added that he aims to spend over 75% of capital expenditure until 2025 in green technologies.

HCL Tech: Shares of the company rose 3% in intraday trade to hit a new high of Rs 1,315.10 on the BSE after the IT services major announced a five-year digital transformation deal with US-based MKS Instruments, a global provider of instruments, systems, subsystems and solutions for advanced manufacturing processes. HCL will provide digital and cloud-enabled transformation through AI/ML-led automation and enhanced user experience with end-to-end infrastructure services.

HDFC Bank: The lender plans to double the loan amount given to retail borrowers over the next two years as consumer demand improves from a pandemic-induced slowdown, said Arvind Kapil, the bank’s country head for retail assets, in an interview to Bloomberg. Kapil said retail borrowing is expected to reach almost Rs 8 trillion within the next two years, from Rs 3.7 trillion.

IndusInd Bank: The bank’s CEO Sumant Kathpalia told CNBC-TV18 that the lender is hopeful of clocking double-digit growth in the future. He also said that vehicle financing saw better growth in July. Gross collections stood at 110 % in August, he added. “The bank is seeing robust growth in car loan market and used car segment,” he noted.

Tata Motors: The automaker said that it will hike prices of its commercial vehicles by about 2% from October 1, in order to offset the impact of rising input costs. The company said that it has made efforts to minimise the price rise by absorbing some portion of the cost at various stages of manufacturing.

ONGC: Shares of the company rose 5% to close at Rs 135.2 on improved forecast and higher gas prices. Globally, prices have continued to rise, driven by various factors, including fundamentals like more extreme weather, post-Covid recovery and lower inventories. In addition, hurricanes in the US, supply issues in Russia and low wind power in Europe has pushed prices higher.