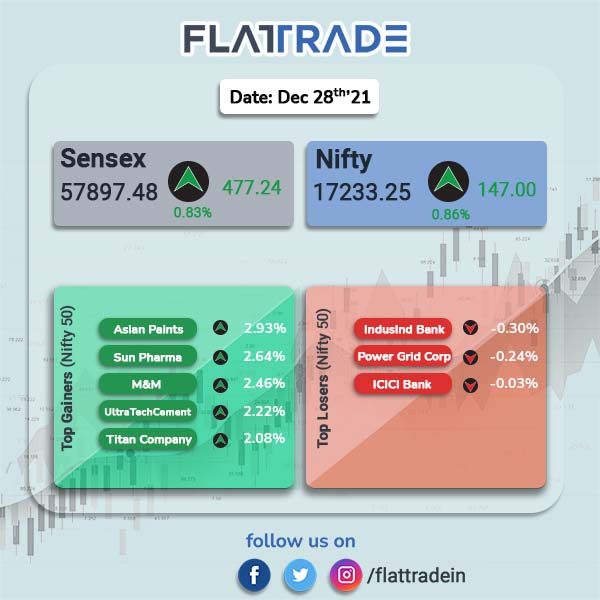

Benchmark indices closed higher as the threat of Omicron variant of the coronavirus waned and boosted by gains in auto, energy, technology and pharma stocks. The Sensex closed 0.83% higher to 57897.48 and Nifty rose 0.86% to 17233.25.

Top gainers among Nifty sector indices were Auto [1.34%], Energy [1.13%], PSU Bank [1.04%], Nifty IT [0.97%] and Pharma [0.90%]. The gains were broad based as all sectoral indices in BSE and NSE closed in the green. Nifty Midcap 100 index jumped 1.18% and BSE SmallCap index advanced 1.43%.

Indian rupee rose 35 paise to 74.65 against the US dollar on Tuesday.

Supriya Lifescience had a strong stock market debut. Shares on NSE opened at Rs 421, which was over 53% higher than its issue price of Rs 274 apiece. However, the company pared some gains to close at Rs 390.85.

Stock in News Today

Reliance Industries Ltd: The company’s retail arm may buy minority stake in robotics firm, Addverb Technologies, according to a Mint news report. The deal is expected to be around Rs 300 crore, reported Mint, citing two people familiar with the matter.

Bharti Airtel and Tata Consultancy Services (TCS): The telecom operator and IT major have partnered to build a 5G-based remote working technology using robotics, according to sources. Both the companies are currently running the trials in Airtel’s 5G lab at Manesar, Haryana.

Sun Pharmaceutical Industries and Cipla Limited: The company said that its subsidiary has received emergency use authorisation (EUA) from the Drugs Controller General of India (DCGI) to manufacture and market a generic version of MSD and Ridgeback’s antiviral drug molnupiravir under the brand name Molxvir in India. The DCGI has approved molnupiravir for treatment of adult patients with COVID-19 and who have high risk of hospitalisation or death.

Similarly, Cipla announced that it has been granted Emergency Use Authorization (EUA) permission by the Drug Controller General of India (DCGI) for the launch of Molnupiravir, an anti-viral drug to treat mild-to-moderate Covid-19. Cipla plans to launch Molnupiravir under the brand name Cipmolnu.

IndusInd Bank: The private lender launched ‘Green Fixed Deposits’ and the proceeds will be used to finance projects and firms supporting UN Sustainable Development Goals (SDGs) such as renewable energy, green transport, greenhouse gas reduction. The deposits will be available for both retail and corporate customers.

KPIT Technologies: Shares of the company closed nearly 5% higher due to heavy volumes on expectation of strong earnings. The company had said that it is witnessing a robust demand environment resulting in strong order inflow and pipeline. The company also improved its revenue and profit outlook for the year.

Nucleus Software: The company will buy back up to 22.7 lakh shares at Rs 700 apiece. The share buyback will open on January 3 and close on January 14.

Torrent Pharmaceuticals Ltd: The drugmaker has announced that it will introduce MSD and Ridgeback’s Molnupiravir under the brand name ‘Molnutor’ in India. The company has rights to manufacture, market and distribute Molnupiravir in over 100 markets including India.

ITC Limited: The conglomerate has commissioned its first off-site solar plant in Tamil Nadu at an investment of Rs 76 crore, the company said. The 14.9 MW solar plant spread over 59 acre in Dindigul would help reduce the carbon dioxide emissions over the course of the time and it has already helped ITC to achieve the feat of meeting 90 per cent of its electricity requirement, a company statement said.

BSE Limited: The company’s shares clsoed 5.97% higher on Tueday after the company said it would consider proposal for issue of bonus shares on February 8 next year. The company also said it will also approve the financial results for the quarter ended December 31, 2021 on February 8.

Greenlam Industries Ltd: Shares of the company closed nearly 2% higher after the company approved raising of funds and issuance of equity shares through QIP basis or any other permissible modes for an amount aggregating up to Rs 500 crore.