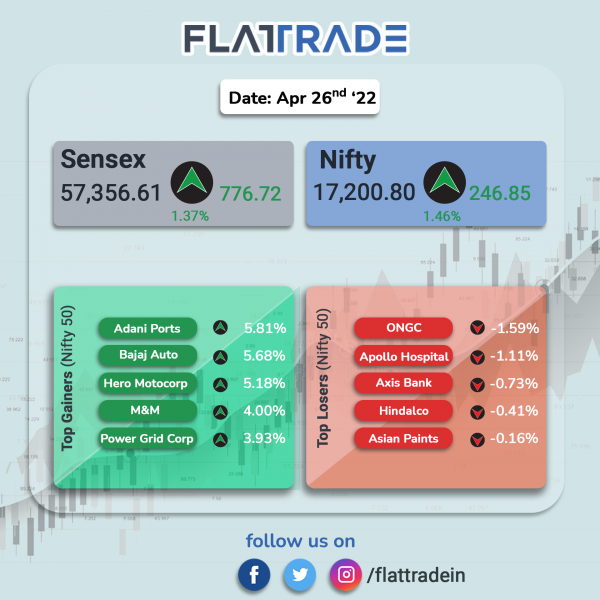

Equity indices rose on the back of strong buying interest from investors. Reliance Industries and Baja Finance were top gainers among benchmark indices. The Sensex jumped 1.37% and the Nifty 50 climbed 1.46%.

Broader markets rose with the Nifty Midcap 100 rising 1.62% and BSE SmallCap gaining 0.76%.

Top gainers among Nifty sector indices were Realty [3.57%], Auto [2.8%], Energy [2.65%], PSU Bank [2.32%] and FMCG [1.88%]. All other Nifty sectoral indices closed in the green.

Indian rupee rose by 11 paise to 76.58 against the US dollar on Tuesday.

Stock in News Today

Adani Group and Ambuja Cements: The group is in advanced talks to buy Holcim’s cement business in India, Bloomberg News reported on Tuesday, citing people familiar with the matter. Adani could sign a deal to buy a controlling stake in Ambuja Cements from Switzerland’s Holcim, Bloomberg News said. Holcim owns 63.1% stake in Ambuja.

Adani Wilmar (AWL) joined the group of companies with market capitalisation (m-cap) of Rs 1 trillion after the stock of edible oil company hit a new high on Tuesday. .

HDFC Life Insurance Company: The company reported a standalone net profit of Rs 357.52 crore for the quarter ended March, up 13% as compared to Rs 317.94 crore reported in the last year period. Net premium income rose to Rs 14,289.66 crore lakh in the said quarter, from Rs 12,868.01 crore in the year-ago period. The company’s board has recommended a final dividend of ₹1.70 for fiscal 2022.

Bharat Petroleum Corporation Ltd (BPCL): The oil marketing compnay has partnered with automaker MG Motor India to bolster EV charging infrastructure across the country. BPCL Chairman and Managing Director Arun Kumar Singh, said sustainable consumption is the present and future, as the country moves into the era of mass electric mobility.

Larsen & Toubro (L&T) The construction and engineering company has signed an agreement with Indian Institute of Technology Bombay to jointly pursue research and development work in the Green Hydrogen value chain. L&T’s engineering expertise, product scale-up and commercialization know-how and IIT Bombay’s cutting-edge research in hydrogen technologies will help this partnership accomplish its goal.

Bank of India: The PSB said that its board has approved the capital raising plan up to Rs 2,500 crore by issue of fresh equity capital via qualified institutional placement (QIP) or follow on public offer (FPO) or preferential issue. The purpose of capital raising plan is to increase the minimum public shareholding from the present 18.59% to 25% or above in order to comply with the minimum public shareholding requirements.

Sanofi India: The company’s net profit rose 63.40% to Rs 238.40 crore in the quarter ended March 2022 as against Rs 145.90 crore during the same quarter last fiscal. Sales declined 2.50% YoY to Rs 707.00 crore in the reported quarter.

Tata Investment Corporation: The company’s net profit doubled to Rs 33.02 crore in the quarter ended March 2022 as against Rs 16.51 crore in the year-ago period. Sales rose 86.86% to Rs 46.21 crore in the reported quarter from Rs 24.73 crore in the same period last fiscal.

Jindal Stainless (JSL) and Jindal Stainless (Hisar) (JSHL): The merger of both the companies have been approved by majority shareholders. .

Steel Exchange India: The company’s net profit rose 286.26% to Rs 112.48 crore in the quarter ended March 2022 as against Rs 29.12 crore in the year-ago period. Sales rose 12.21% to Rs 366.87 crore in the quarter ended March 2022 as against Rs 326.96 crore during the corresponding quarter last fiscal.

Biocon Ltd: The company’s subsidiary Biocon Biologics has been awarded a three-year contract valued at nearly $90 million (Rs 688.45 crore), for its recombinant human insulin brand Insugen by Malaysia’s Health Ministry.

Sinclairs Hotels: The company’s board has approved a proposal to buy back up to 7,00,000 shares at Rs 143 apiece, amounting to Rs 10.01 crore. The company has fixed May 13 as the record date for the purpose of determining the equity shareholders eligible for the buyback.

Premier Explosives Ltd: Shares of the company rose 5% after the company said it has received an order for 50 MM MTV flares from the Ministry of Defence. The order is worth Rs 57.9 crore and it is expected to be executed within 12 months.

Ruby Mills: Shares of the Ruby rose after the company said it has repaid entire term loans and all unsecured loans aggregating Rs 145 crore.

Atul Ltd: The company’s net profit fell 22% to Rs 136.26 crore in Q4FY22 as against Rs 175.05 crore in the year-ago period. Revenue rose 22% to Rs 1,370.42 crore in the reported quarter from Rs 1,115.93 crore in the same period last financial year. The company has approved a proposal to buy-back fully paid shares of face value of Rs 10 each at price not exceeding Rs 11,000 per share for Rs 70 crore from open market. The company also recommended a dividend of Rs 25 per share subject to shareholders’ approval.