Market Opening - An Overview

SGX Nifty futures were trading 0.71 per cent higher at 17,116.5, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian shares were trading higher as China’s central bank pledged to support the country’s economy amid Covid lockdowns. Japan’s Nikkei 225 was up 0.51%, Topix rose 0.19%, while China’s Hang Seng index and CSI 300 index jumped 1.16% and 1.01%, respectively.

The Indian rupee depreciated by 21 paise to 76.69 against the US dollar on Monday.

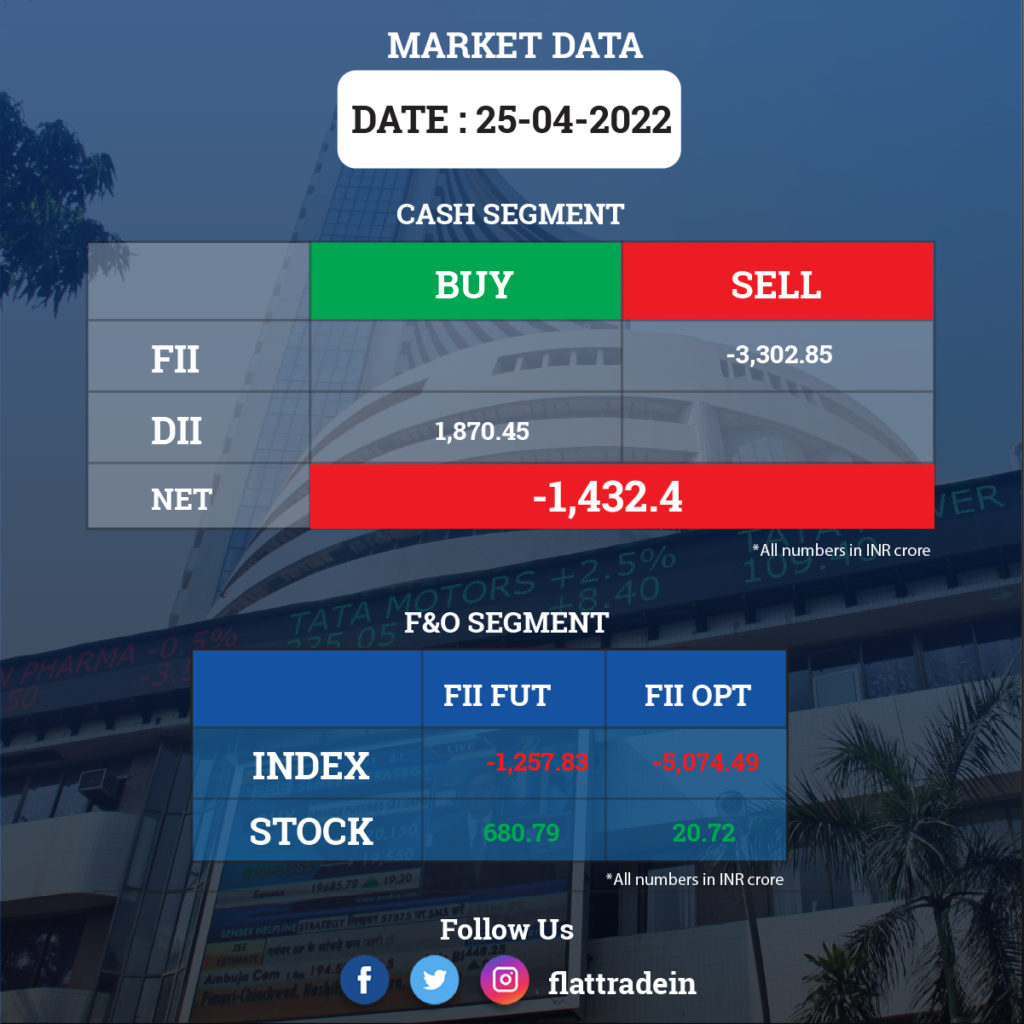

FII/DII Trading Data (25-4-2022)

Upcoming Results

Bajaj Finance, HDFC Life Insurance Company, Aditya Birla Sun Life AMC, KPIT Technologies, Macrotech Developers, Mahindra Logistics, Nippon Life India Asset Management, NELCO, Atul, AU Small Finance Bank, Gateway Distriparks, IIFL Securities, Sanofi India, Schaeffler India, Som Distilleries & Breweries, Tata Coffee, Tata Teleservices (Maharashtra), United Breweries, UTI Asset Management Company, VST Industries, D-Link (India), International Travel House, Gujarat Hotels, Jindal Hotels, JK Agri Genetics, and Jumbo Bag will release their quarterly results.

Stocks in News Today

Veranda Learning Solutions: The learning solutions provider has acquired T.I.M.E. (Advanced Educational Activities Pvt Ltd), the leading test-prep institute with a pan-India presence operating through 188 centres. The company acquired T. I. M. E. for Rs 287 crore.

YES Bank and Zee Learn Ltd: The private sector lender has moved National Company Law Tribunal (NCLT) seeking initiation of insolvency proceedings against Zee Learn, according to a regulatory filing. The company said that the bank has allegedly claimed that the total amount in default with respect to a financial facility is Rs 468 crore.

Eveready Industries India Ltd: Battery and flashlights maker reported narrowing of its consolidated net loss to Rs 38.41 crore in Q4FY22. The company had posted a net loss of Rs 442.53 crore in the January-March period a year ago. Its revenue from operations rose 17.82 per cent to Rs 294.33 crore during the quarter under review, from Rs 249.81 crore in the year-ago period.

Bharat Heavy Electricals Limited (BHEL): The state-owned company said it has received an order from NTPC for six electric locomotives to be used for industrial application. The locomotives will be manufactured at the company’s facility in Jhansi, Uttar Pradesh.

Mahindra CIE Automotive: Profit in the quarter ended March 2022 grew by 1,499 percent year-on-year to Rs 161.43 crore due to lower tax expenses and higher revenue growth. Topline increased 18.2 percent to Rs 2,588.4 crore compared to corresponding period last fiscal.

Gujarat Mineral Development Corporation: The company recorded consolidated profit at Rs 177 crore for the quarter ended March 2022, against loss of Rs 184.64 crore in same period last year, driven by topline. Revenue grew by 87 percent year-on-year to Rs 1,057.3 crore in the same period.

Shriram Properties Ltd: The realty firm said it plans to sell up to 90 acres of land in Kolkata to Logos for development of logistics and warehousing park. An MoU for the proposed transaction was signed at the Global Investor Summit organised by the West Bengal government in Kolkata.

Tatva Chintan Pharma Chem: The company reported a 17 percent year-on-year decline in profit at Rs 17.51 crore for March 2022 quarter, dented by lower topline and operating income. Revenue fell 9.3 percent to Rs 98.53 crore during the same period, with margin declining 200 bps YoY.

Lemon Tree Hotels: The company has signed an agreement for a 60 room hotel at Kharar, near Chandigarh under the brand ‘Lemon Tree Hotel’. The hotel is expected to be operational by November, 2025. Its subsidiary Carnation Hotels will be operating and marketing this hotel.

Bank of Maharashtra: The Reserve Bank of India (RBI) has imposed a penalty of Rs 1.12 crore on the lender for non-compliance with certain regulatory directions, including those for KYC norms.