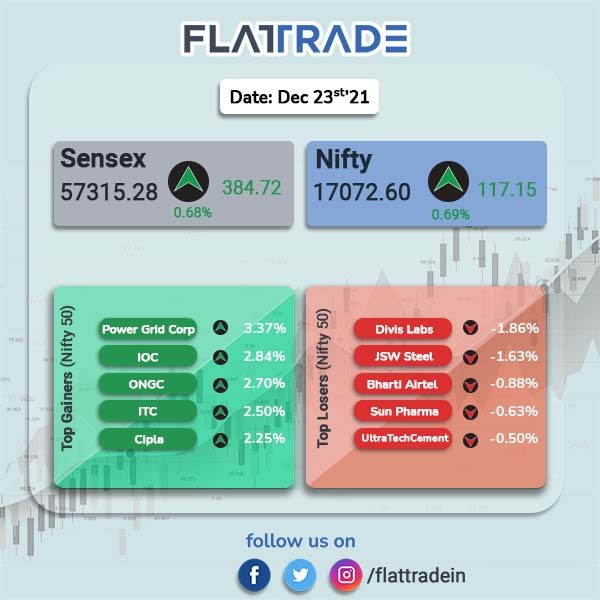

Benchmark equity indices closed higher as investors took calculated bets on quality stocks as concerns eased over the omicron strain. Gains in technology, FMCG, power and realty stocks helped the indices to close in positive territory. The Sensex closed 0.68% higher at 57315.28 and Nifty advanced 0.69% at 17072.60.

The gains were broad based as Nifty Midcap rose 0.90% and Nifty Smallcap 100 closed 1.27% higher.

Top gainers were Nifty Realty [2.31%], FMCG [1.34%], energy [1.28%] and Nifty IT [1.01%]. Nifty Metal index inched down 0.02% and Media fell 1.10%.

Indian rupee rose 32 paise to 75.24 against the US dollar on Thursday.

Stock in News Today

Zomato Ltd: Shares of the company closed more than 4% lower after the company received a copy of writ petition filed by Indian Federation of App-Based Transport Workers (IFAT). The petition which included Zomato, Uber India, Swiggy and Ola as respondents sought directions from court to government to notify or recognise app-based workers as ‘workers’ or alternatively as ‘unorganised workers’ or ‘wage workers’ under various labour laws. Zomato said that it is reviewing the petition and will present all relevant facts before the apex court.

Paytm: The company’s three senior executives have quit the fintech firm, according to a Mint news report. According to the report, Abhishek Arun, chief operating officer (COO) of Paytm Payments Bank; Renu Satti, COO, offline payments; and Abhishek Gupta, senior vice-president and COO, lending, have quit the firm.

IndiGo: Shares of the domestic airline company rose 2.82% after IndiGo and Air France-KLM announced that they are launching an extensive codeshare agreement. With this new partnership, Air France and KLM will offer their customers access to 25 new Indian destinations.

Jubilant Foodworks: Shares of the company rose more than 3% after brokerage firm Morgan Stanley reiterated its “overweight” stance on the stock. The research firm also raised the target price to Rs 5,000. The report also said that the company is in a sweet spot to capitalise on the company’s growth prospects in the sector.

Hero Motocorp: The two-wheeler maker will hike prices of motorcycles and scooters up to Rs 2,000 from January 4 next year. In an exchange filing, the company said that the price revision has been done to partially offset higher raw materials.

MedPlus Health: The pharmacy retail chain had positive stock markt debut as the shares got listed at 31% premium to its issue price. The listing price of the share was Rs 1,040 apiece, on the National Stock Exchanged, a 30.65% premium to its IPO issue price of Rs 796.

Nucleus Software Exports Ltd: The IT company rose after the company’s lending and transaction banking products’ consortium was awarded the contract for its retail loan origination system. The contract was awarded by Join Stock Commercial Bank of Vietcombank. The company’s FinnOne Neo software will provide end-to-end digitisation and launch innovative loan products.

Quess Corp: Shares of the company rose after its subsidiary Monster.com raised Rs 137.5 crore from two venture capitalist. Brokerage firm Motilal Oswal also reiterated its “Buy” recommendation after the fund infusion. It gave a price target of Rs 1100.

Great Eastern Shipping Company: Shares of the company closed over 7% higher a day after the company in an exchange filing said that it will consider a proposal to buy-back fully paid-up equity shares on December 27.

Transformers and Rectifiers India Ltd: The company secured orders of transformers for a total contract value of Rs 72 crore from Gujarat Energy Transmission Corporation Ltd. (GETCO). With this order, the company’s order book stood around Rs. 816 crore.

Havells India Ltd: The company inaugurated its state-of-the-art manufacturing plant for Lloyd’s ACs in Ghiloth, Rajasthan. The company will also produce washing machines with an annual production capacity of 3 lakh units at Ghiloth.

Macrotech Developers Ltd: The company announced its partnership with Morgan Stanley Real Estate Investing (MSREI) to develop premium warehousing project near Mumbai. The company said that it closed a deal with MSREI to develop 1.9 million square feet area at Palava Industrial and Logistics Park with an investment of Rs 600 crore. Macrotech will act as the development manager for the project, responsible for leasing, project development and asset management.

Mold-Tek Packaging Ltd: The company said that it successfully completed the QIP at 2.44% premium over floor price aggregating to Rs 103.6 crore. In an exchange filing, the company said it received overwhelming response for its QIP issue, from many marquee investors including Goldman Sachs India Equity, White Oak India Equity Fund, Aditya Birla Sun Life Trustee Private Limited, ICICI Prudential SmallCap fund.

Jindal Saw Ltd: The company entered into a joint venture agreement with Hunting Energy Services, Singapore. The JV company will be incorporated in India and Jindal Saw will hold 51% stake, while the remaining 49% will be held by Hunting Energy. With this deal, Jindal Saw aims to set up state-of-the-art precision machine shop to thread premium connections in India for OCTG (Oil Country Tubular Goods), used in deep drilling activities in oil and gas sector.

Ceinsys Tech Ltd: Shared of the company closed 19.91% higher after the company said that it had acquired acquired Allygrow Technologies Pvt Ltd., a tech company with presence in U.S., Europe and India. Ceinsys is geospatial, engineering and enterprise IT solutions provider and Allygrow Technologies specialises in robotics automation and product design services.

Dilip Buildcon: Shares of the company climbed 3.2% after Dilip Buildcon said that it has received completion certificate for its Rs 1,141 crore four-lane Sangli-Solapur project from Maharashtra government. The project has already been declared fit to entry into commercial operations as on December 14, 2021.

GAIL India Ltd: Shares of the company rose 2.04% after the company approved payment of interim dividend of Rs 4 per equity share for FY22. The record date for the purpose of payment of interim dividend has been fixed at December 31, 2021.

Ami Organics: Shares of the company closed 9.25% after the company announced plans to restructure its Ankleshwar production facility and utilize the same for the expansion of pharma intermediate business to support future growth requirement. The company will transfer its current production operations of speciality chemical business at Ankleshwar facility to Jhagadia facility in Gujarat. The shifting of speciality chemicals business at single location will help the company achieve better utilization of the plant and improve operational efficiency.