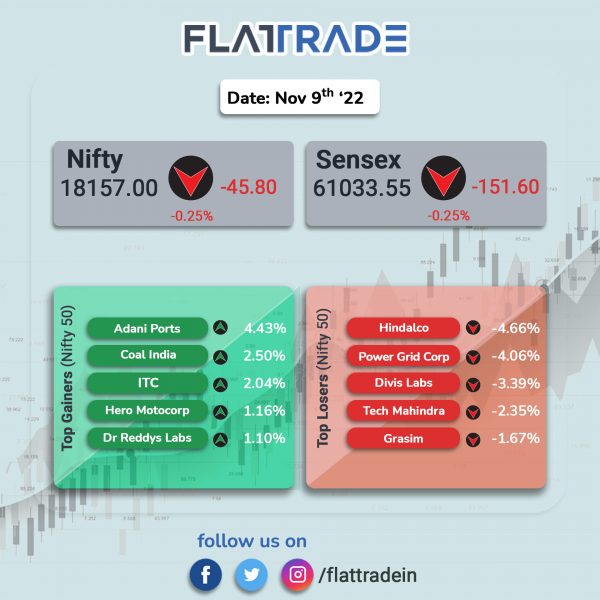

Benchmark stock indices closed lower as realty, pharma, metal and auto stocks fell. The Sensex lost 0.25% and the Nifty 50 index also fell 0.25%.

In broader markets, Nifty Midcap 100 index declined 0.74% and the BSE Smallcap index was down 0.33%.

Top losers among Nifty sectoral indices were Realty [-1.37%], Pharma [-1.14%], Metal [-0.93%], Auto [-0.76%], Energy [-0.59%] and Oil & Gas [-0.47%]. Top gainer was PSU Bank [3.93%] and FMCG [0.26%].

Indian rupee strengthened by 48 paise to 81.44 against the US dollar on Wednesday.

Stock in News Today

Nalco: The company reported 83.2% decline in consolidated profit at Rs 125.43 crore for the quarter ended September 30, on the back of higher expenses and lower income. The company had posted a consolidated profit of Rs 747.80 crore in the year-ago period. The consolidated income of the company during the July-September period dropped to Rs 3,558.83 crore, compared to Rs 3,634.59 crore in the year-ago period. The consolidated expenses of the company during the second quarter increased to Rs 3,312.95 crore, over Rs 2,618.52 crore in the year-ago period.

Godrej Properties: The company said its consolidated revenue from operations rose Rs 165.09 crore in Q2FY23 as agaisnt Rs 129.32 crore in the year-ago period. Consolidated net profit rose to Rs 54.96 crore in Q2FY23 as against Rs 35.73 crore in the same period last year. Ebitda stood at Rs 67.4 crore in the reported quarter.

Union Bank of India: Shares of the company rose 10.16% in intraday trade. Finally, the shares closed at Rs 64.05 per share, up 9.4% from Monday’s closing price.

Avanti Feeds: Shares of the company surged after the USFDA lifted alert on shrimp exports to USA. The stock rose 8.48% intraday. With this development, Avanti Frozen Foods can increase the export of value added shrimp products to USA. The US drug regulator had imposed an alert in March 2021, due to presence of Salmonella in the shrimp produced and exported by Avanti Frozen Foods to USA.

Godrej Consumer Products (GCPL): The FMCG company reported a decline of 25.06% in its consolidated net profit at Rs 358.86 crore for the second quarter ended September 2022. It had posted a net profit of Rs 478.89 crore in the July-September quarter a year ago. The revenue from the sale of products was up 7% at Rs 3,364.45 crore during the quarter under review, as against Rs 3,143.61 crore in the corresponding period last fiscal.”Our overall EBITDA declined by 15% driven by consumption of high cost inventory, upfront marketing investments and a weak performance in our Indonesia and Latin America & SAARC businesses,” GCPL Managing Director and CEO Sudhir Sitapati said.

Phoenix Mills: The company reported over 212% YoY rise in consolidated net profit at Rs 185.8 crore for the quarter ended September 2022. Revenue from operations for the quarter under review rose 75% YoY to Rs 651.1 crore. Revenue from retail operations for the quarter rose 95% to Rs 456 crore, while income from residential business saw 5% decline to Rs 57.9 crore. Total income from office business rose 3% to Rs 43.5 crore, the company said in an exchange filing. The company said that robust leasing continued during the year-to-date October 2022, with gross leasing of nearly 2 lakh sq ft over this period.

Birla Corp: The company posted a loss of Rs 56 crore in Q2FY23 as against a net profit of Rs 86 crore in the same period last fiscal, due to higher power and fuel costs which could not be passed on to the consumers. Revenue increased 19.3% at Rs 2,042 crore during the second quarter of FY23 compared to Rs 1,711 crore in the same period last year. EBITDA in the second quarter of FY23 declined 51.6% to Rs 136 crore from Rs 281 crore in the same period last fiscal. The company said that the newly-commissioned Mukutban plant in Maharashtra is yet to stabilise operations and also had a negative impact on profitability. Shares of the company fell 5.3%.

Dr Lal Path Labs: Shares of the company said that its consolidated profit after tax declined 24.%8to Rs 72.4 crore in the second quarter ended September 2022. The company had posted a profit after tax (PAT) of Rs 96.3 crore in the year-ago period. Its revenue from operations grew 7.1 % to Rs 533.8 crore during the period under review, from Rs 498.4 crore in the corresponding quarter of the previous year. Dr Lal Path Labs said its non-COVID revenue increased 14.8 per cent in Q2 FY23 to Rs 514 crore, from Rs 448 crore in the year-ago period.

Zee Media Corp: The company reported narrowing of its consolidated net loss to Rs 12.08 crore in Q2FY23 from a net loss of Rs 102.67 crore during the same quarter of FY22. Its revenue from operations was down 5.51% to Rs 194.77 crore during the quarter under review. It stood at Rs 206.14 crore in the corresponding period a year ago. Its total expenses rose 17.7% at Rs 204.23 crore in the September quarter.

Bajaj Consumer: The company said that its consolidated revenue rose by 9% to Rs 232.4 crore in Q3FY23 from Rs 213.2 crore in the year-ago period. Net profit fell by 31.9% to Rs 31.65 crore in the reported quarter as against Rs 46.5 crore in the same period last quarter.

Aptus Value Housing: The company reported a 52% jump in its net profit at Rs 242 crore for the first half ended September 2022 of FY23. The company had posted a net profit of Rs 159 crore in the same period last year. Total disbursements during H1FY23 jumped by 69% to Rs 1,129 crore as against Rs 668 crore in the same period of FY22. The assets under management grew by 33 per cent to Rs 5,932 crore at end of September 2022, from Rs 4,480 crore a year ago. Gross non-performing assets (NPAs/bad loans) were higher at 1.47% as against 0.81% in the corresponding period last year, up by 66 basis points.

Usha Martin: The wire ropes manufacturer posted about 7% growth in its standalone net profit at Rs 45.09 crore during the quarter ended September 2022. The company had registeres a net profit of Rs 42.05 crore during the July-September period of the preceding fiscal. Its total income rose to Rs 522.47 crore in Q2FY23 from Rs 434.11 crore in the year-ago quarter. Expenses were also increased to Rs 461.39 crore in Q2FY23 as against Rs 381.36 crore in the same period last year.

Bajaj Electrical: The company reported a marginal decline in its consolidated net profit to Rs 62 crore for the second quarter ended September 2022, due to lower revenue and high-cost inventories. The company had posted a net profit of Rs 62.55 crore in the year-ago period. Its net sales slipped 6.41% to Rs 1,201.14 crore during the quarter under review against Rs 1,283.44 crore a year ago. Bajaj Electricals’ total expenses fell 6.81% to Rs 1,159.22 crore in Q2FY23 as against Rs 1,243.94 crore in the same period last fiscal.

Arvind Ltd: The textile manufacturer reported an increase of 79.07% in its consolidated net profit of Rs 125.02 crore for the quarter ended September 2022 helped by gains from exceptional items. The company had posted a net profit of Rs 69.58 crore in the year-ago period. Arvind had a gain of Rs 40.52 crore from exceptional items, which includes profit on the sale of a subsidiary and provision from the value of land in Gujarat. Its revenue from operations was up 2.93% at Rs 2,169.81 crore compared to Rs 2,107.97 crore in the corresponding period of the previous fiscal. Its total expenses were at Rs 2,072.45 crore, up 3.50 per cent in the September quarter of FY23 against Rs 2,002.31 crore a year ago.