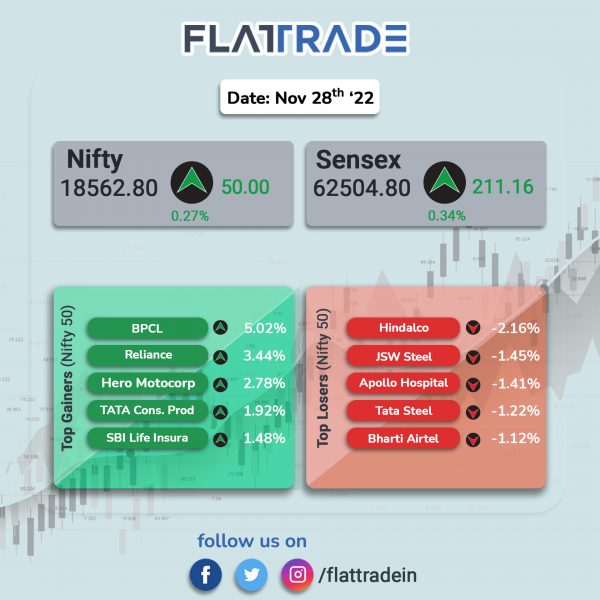

Nifty zoomed to touch a lifetime high of 18614.25 as heavyweights such as Bharat Petroleum, Reliance Industries, Hero MotoCorp rallied despite weak global sentiments. The Sensex rose 0.34% and the Nifty was up 0.27%.

In broader markets, Nifty Midcap 100 rose 0.73% and the BSE Smallcap advanced 0.77%.

Top gainers among Nifty sectoral indices were Oil & Gas [1.6%], Energy [1.33%], Auto [0.61%], FMCG [0.34%] and Private Bank [0.27%]. Top losers were Metal [-1.14%], Financial Services [-0.09%] and IT [-0.08%].

Indian rupee strengthened to 81.67 against the Us dollar on Monday.

Stock in News Today

Railway Stocks: Shares related to Indian railways continued to rally. Rail Vikas Nigam (RVN) surged as much as 10% in intraday trade. RVN shares soared more than 100% in November 2022 compared to October 2022 close.

Texmaco Rail & Engineering jumped more than 126% in the current calendar year. Further, Indian Railway Finance shares surged more than 50% month-on-month.

Oil Refiners: Shares of oil refining companies such as Bharat Petroleum and Hindustan Petroleum Corp jumped amid global oil prices falling with West Texas Intermediate declining to $73.82, and Brent Crude dropping to $81.16. Moreover, strict Covid-19 restrictions in China fuelled demand concerns.

HCLTech: The IT major has signed a multi-year contract with SR Technics, a leading maintenance, repair and overhaul (MRO) service provider in the civil aviation industry, to digitally transform SR Technics’ operations. HCLTech will implement a new greenfield SAP S/4HANA environment hosted on Microsoft Azure using RISE with SAP.

Bharti Airtel: Th telecom firm announced the launch of its 5G services in Patna. Airtel 5G Plus services will be available to customers in a phased manner as the company continues to construct its network and complete the roll out. Customers with 5G enabled devices will enjoy high speed Airtel 5G Plus network at no extra cost until the roll out is more widespread. Patna airport will be the first airport in the state to have ultrafast 5G service.

Max Financial Services: Shares of the company surged after IRDAI granted approval to acquire the balance 5.17% stake in Max Life Insurance from Mitsui Sumitomo Insurance Company. Max Financial will acquire 9.91 crore shares of Max Life Insurance for Rs 85 per piece. Post the acquisition, Max Financial’s shareholding in Max Life will increase to 87%. The transaction is expected to be conclude in the next fortnight, company said in the exchange filings.

Aditya Birla Group: The group’s venture, TMRW, announced partnership with 8 Digital-First lifestyle brands. With these 8 brands on board, TMRW has achieved a revenue run-rate of more than Rs 700 crore and is on a path to cross an annual revenue rate of over Rs 1500 crore in the next 12 months.

Gateway Distriparks: The logistics company in an exchange filing said that the Income Tax Department conducted surveys at the company’s office and some locations from November 24-27. The company, further, said that it fully cooperated with the Department and handed over the documents and information as requested. Business and operations continued without any disruptions, it added.

Ganesh Benzoplast: The company announced that 19% of its new and upcoming capacity at the JNPT terminal has been locked in through the closure of a long-term contract for storage and handling, prior to its scheduled commencement in March 2023. The contract is signed with a leading chemical manufacturer starting with a 3-year renewable term, for storing and handling two tanks totalling up to 3640 metric tonnes.

The annual revenue is fixed at approximately at Rs 4 crore subject to a certain throughput. The new and upcoming special chemical grade terminal at JNPT for 17,876 KL has been constructed to meet long term demands for storing and handling specialty chemicals such as Dilute Nitric Acid.

APL Apollo Tubes: The company announced that it stood at the 80th percentile in industry rankings on ESG in S&P Global Corporate Sustainability Assessment, up from 56th percentile in 2021. APL Apollo is part of the S&P Dow Jones Sustainability Index (DJSI) for the Emerging Markets for 2022 and the company received a score of 29.

Techno Electric & Engineering Company: The company announced that it has received orders of Rs 700 crore. The order includes setting up 2.5 lakh smart meters in Jammu & Kashmir on design build finance own operate transfer (DBFOOT) basis worth Rs 338 crore from REC power development and consultancy (RECPDCL). Further, the company also bagged GOA Tamanar Transmission Project worth Rs 126 crore and Tripura State Electricity Corporation transmission project worth Rs 230 crore.