Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.57% lower at 16,494, indicating that Dalal Street was headed for a negative start on Monday.

Asian shares were trading higher as the Chinese government eased Covid retrictions. Japan’s Nikkei was up 0.30% and Topix edged up 0.10%. China’s Hang Seng climbed 1.14% and CSI 300 was up 1.07%.

Indian rupee fell 3 paise to 77.63 against the US dollar on Friday.

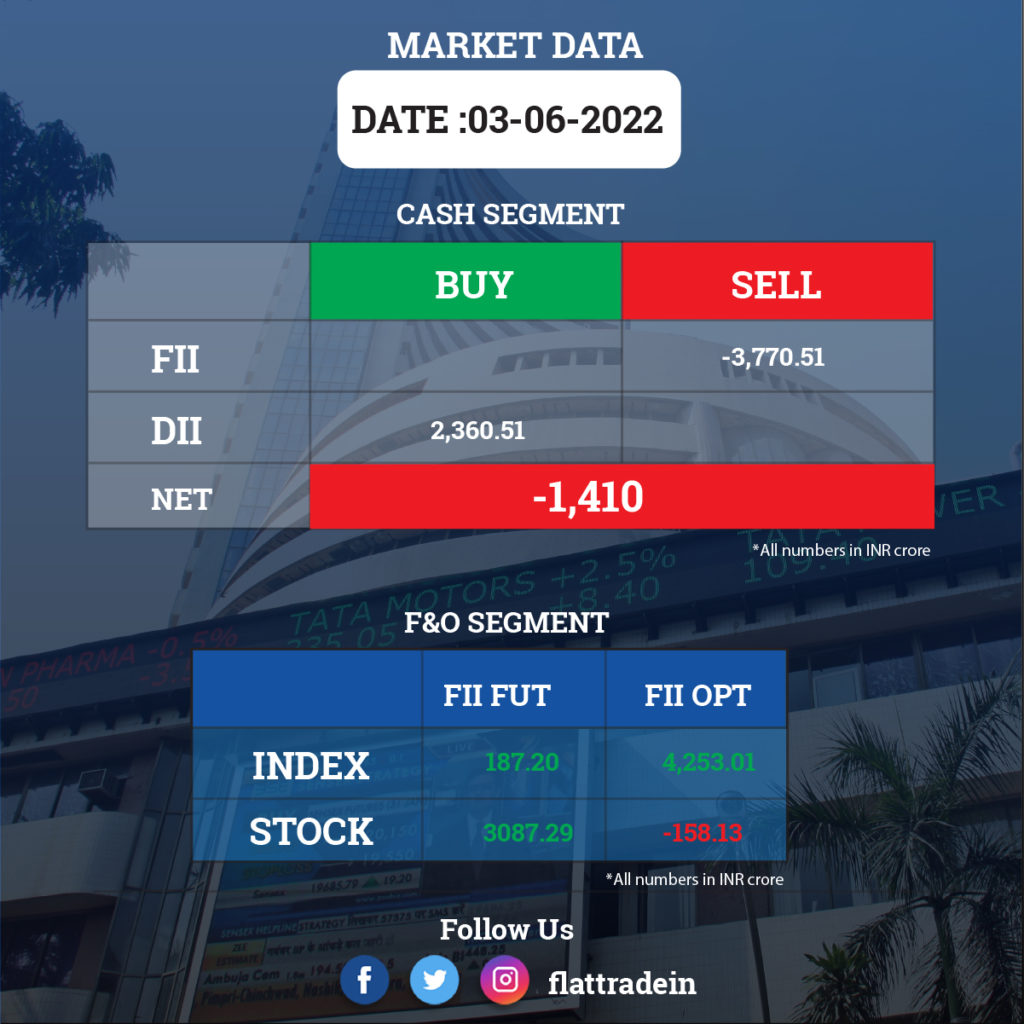

FII/DII Trading Data

Stocks in News Today

Adani Transmission: The company has signed Share Purchase agreement with Essar Power to acquire its 100% stake in Essar Power Transmission Company (EPTCL). The acquisition is in line with the company’s value added growth strategy through organic as well as inorganic growth opportunities. The acquisition cost is Rs 1,913 crore.

Tata Motors: The automaker is gearing up to strengthen its R&D with fresh hiring as well as upskilling of the current employees this fiscal year in order to scale up capabilities across various business verticals, including the electric vehicle segment, as per a top company official. In the EV space, the company is looking to enhance its expertise in the area of battery packs and vehicle architecture, among others.

Larsen and Toubro Infotech: The company on Saturday said its Chief Executive Officer and Managing Director Sanjay Jalona has relinquished office. The company is yet to announce Jalona’s successor.

Vedanta: The company on Saturday said a committee of directors has approved raising up to Rs 4,089 crore via debentures on a private placement basis. The company will issue 40,890 non-convertible debentures (NCDs) of face value Rs 10,00,000 each aggregating up to Rs 4,089 crore.

NTPC and Adani Enterprises: NTPC, a state-owned power generatin company, has awarded multiple contracts to import 6.25 million tonne (mt) of coal to Adani Enterprises at a cumulative value of Rs 6,585 crore. NTPC is importing coal to meet the recent directive of the Union power ministry to blend 10% imported coal in order to tackle domestic coal shortage. The company placed six different tenders and received technical bids from four players — Ahmedabad-based Adi Tradelink, Chennai-based Chettinad Logistics, and Delhi-based Mohit Minerals, along with Adani Enterprises.

Oil Marketing Companies (OMCs): The OMCs will set up 900 e-charging stations in the state of Tamil Nadu with Indian Oil Corporation (IOC), Hindustan Petroleum Corporation Ltd (HPCL) and Bharat Petroleum Corporation Ltd (BPCL) taking the lead. IOC has 133 e-charging stations in Tamil Nadu and is planning to install 400 more e-stations by the end of this financial year. HPCL will set up 175 more e-charging stations from the 79 it has now. BPCL will be install 145 more e-charging stations by the end of this financial year.

Sun Pharma: The Drug manufacturer plans to increase its field force in the domestic market by 10% in the current fiscal to drive twin objectives of brand focus and geographical expansion, according to a senior company official. It currently employs around 11,000 Medical Representatives and related staff in India.

Tata Consumer Products Ltd (TCPL): The company’s coffee chain Tata Starbucks Ltd has reported a 76% growth in revenue to Rs 636 crore for 2021-22 and reduced its net loss, driven by normalisation of operations following easing of Covid-related restrictions. Its revenue growth was led by higher realisation from existing stores and new stores added during the financial year ended on March 31, 2022, as per its latest annual report.

TVS Motor Company: the company aims to build a “sustained dominant play” in the electric vehicle segment by leveraging various government initiatives like production-linked incentive scheme, among others. As per its annual report for 2021-22, the company has robust plans to scale up its play in the electric segment.

Ujjivan Small Finance Bank: The company said the board will meet on June 8 to consider the proposal for raising of funds by way of issuance of debt securities on a private placement basis, in one or more tranches.

RattanIndia Power: Vibhav Agarwal has resigned as Managing Director of the company due to his personal reasons. Asim Kumar De, Whole Time Director of the company, has been assigned additional responsibilities to discharge the functions which were earlier assigned to Managing Director, for interim period, till the time a new Managing Director is appointed by the company.

V-Guard Industries: SBI Mutual Fund through its several schemes acquired 59,171 equity shares in the company via open market transactions on June 2. With this, its shareholding in V-Guard has increased to 9.04%, up from 9.027% earlier.

Poonawala Fincorp: Sebi revoked the securities market ban imposed on Abhay Bhutada, Managing Director of Poonawalla Finance, in a case pertaining to alleged insider trading activities in the shares of Magma Fincorp (which is now known as Poonawalla Fincorp). After conducting a detailed investigation in the matter, Sebi said found that Bhutada had not communicated unpublished price sensitive information.

Valiant Organics: The company said in an exchange filing that a blast in reactor in chlorination section of its plant at GIDC, Sarigam, Gujarat, had occured on June 3. There has been no loss to human life, but, minor injury reported to one person, who is under medical treatment.