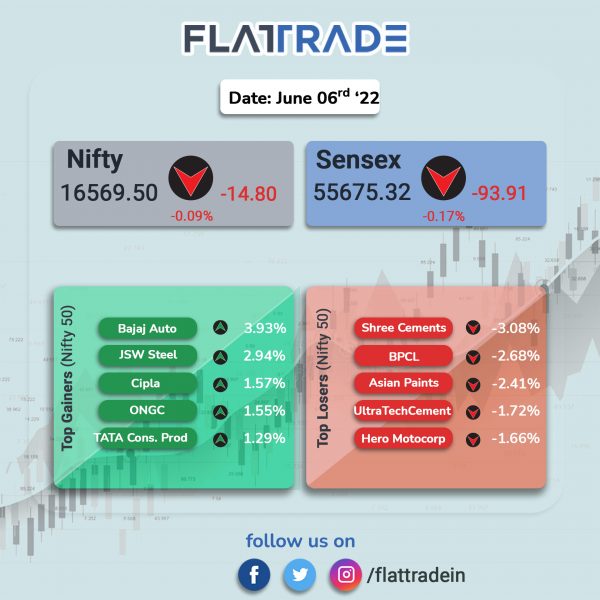

Benchmark stock indices registered losses on Monday amid rising crude prices and worries over increasing inflation ahead of RBI’s monetary policy decision on Wednesday. The Sensex fell 0.17% and the Nifty 50 slipped 0.09%.

In broader markets, Nifty Midcap 100 was down 0.11% and BSE Smallcap dropped 0.54%.

Top Nifty sectoral gainers were Metal [1.12%], Private Bank [0.21%] and Auto [0.19%]. Top losers were Media [-1.25%], Realty [-0.82%] and PSU Bank [-0.31%].

Stock in News Today

IDBI Bank: The Indian government may allow merges along with consortia bids as part of its attempt for the privatisation of the IDBI Bank, CNBC-TV18 reported citing sources. The government has allowed private equity investors to put in their bids for the IDBI Bank stake sale. The RBI has stayed the 26% voting rights cap for private bank promoters for IDBI Bank bids. Further discussions with RBI on IDBI Bank sale will continue.

Meanwhile, Canadian millionaire Prem Watsa is interested in acquiring a controlling stake in IDBI Bank, Hindu Businessline quoted sources. Fairfax India Holdings, Watsa’s investment arm, has reached an agreement with officials from the Finance Ministry to buy the government’s 45.48 percent interest in the bank.

Reliance Industries Ltd (RIL): The company is expected to be the biggest beneficiary of rising crude oil imports from Russia, according to Citi Research. Among refiners, RIL’s superior complexity, high product export ratio, and relatively minor domestic retail operations, with potential added benefits from sourcing discounted crude stand to aid its gross refining margins the most”, the research report said.

Meanwhile, global research firm Morgan Stanley put an ‘overweight’ rating on RIL’s stock with a target price of Rs 3,253 per share.

Tata Motors: The automaker has secured an order for 10,000 EVs from Blusmart. Tata Motors will supply 10,000 XPRES T vehicles to Blusmart and the latest order is on top of the order to supply 3,500 units between the two companies last year.

Larsen & Toubro (L&T): The company’s construction arm received an order valued between Rs 2500 crore and Rs 5000 crore from Brihanmumbai Municipal Corporation (BMC) to execute the Bandra Wastewater Treatment Facility. The scope of the project includes Design, Build, Operation and Maintenance of the 360 MLD sewage plant.

Cement Companies: Shares of cement companies fell for the second day after Ultratech announcement a capex plan of Rs 12,890 crore. Ultratech made the announcement after Adani Group’s foray into cement industry and concerns over weak demand. Brokerage firm Emkay Global said that industry volumes are likely to have declined in mid-to-high single digits month-on-month.

SpiceJet: The budget carrier in an exchange filing said that it has restricted 90 pilots from flying MAX aircraft. The development comes after the Directorate General of Civil Aviation (DGCA) imposed a Rs 10-lakh fine on SpiceJet for training 737 Max aircraft pilots on a faulty simulator. The company said that the restriction does not impact the operations of MAX aircraft and it has adequate trained pilots available for its operations.