Market Opening - An Overview

SGX Nifty futures were trading 0.28% higher at 15,888, signalling that Dalal Street was headed for a positive start on Tuesday.

Asian shares were trading higher helped by gains in some technology firms and as investors evaluated China’s efforts to tackle the fresh Covid outbreak. Japan’s Nikkei 225 edged up 0.2%, Topic rose 0.14%. China’s Hang Seng jumped 1.67% and CSI 300 was up 0.2%.

Indian rupee was little changed at 77.45 against ths US dollar on Tuesday.

Shares of Life Insurance Corporation of India will debut in the stock exchanges today. The grey market premium trading at discount of Rs 30 a share. LIC is likely to list at flat to negative on exchanges amid volatility in the global equity markets.

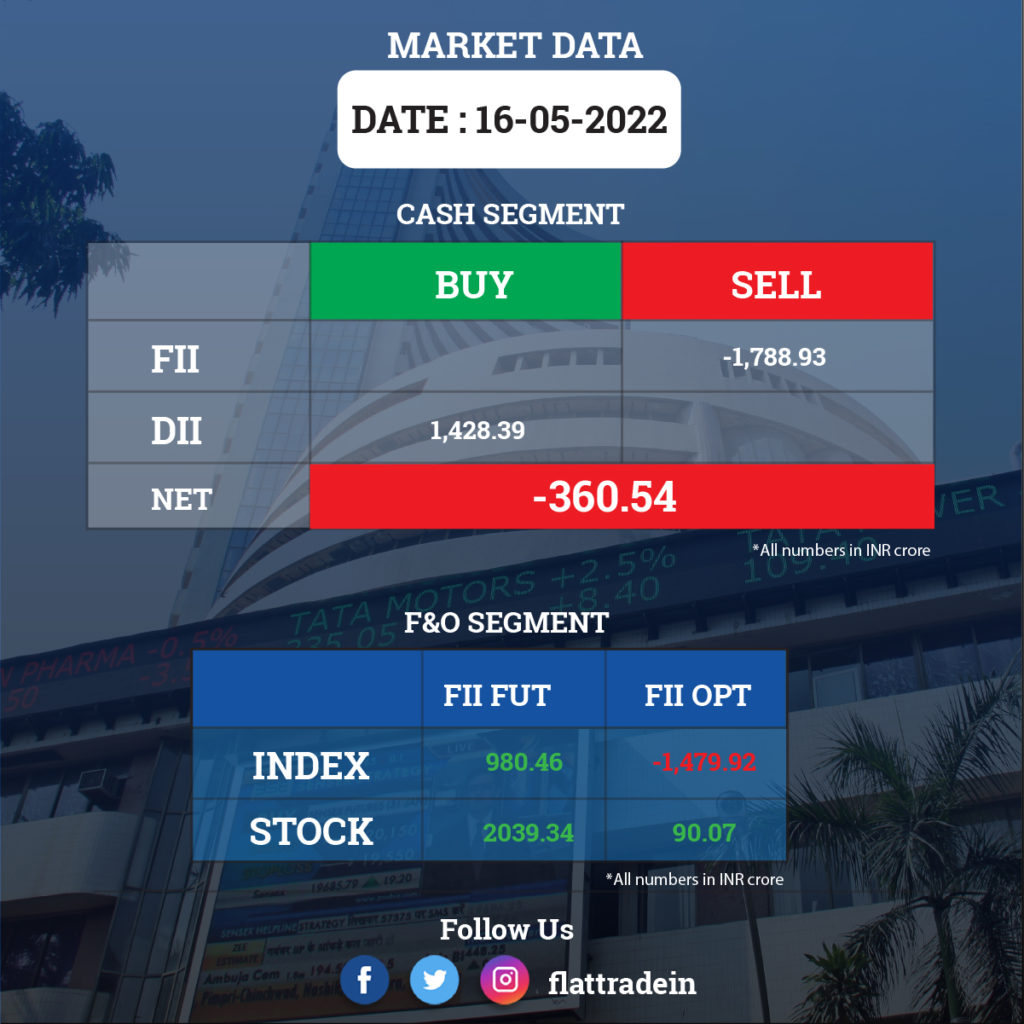

FII/DII Trading Data

Upcoming Results

Bharti Airtel, Indian Oil Corporation, DLF, PI Industries, Abbott India, Bajaj Electricals, Bajaj Healthcare, EID Parry (India), Indoco Remedies, IRB Infrastructure Developers, Jubilant Ingrevia, Kajaria Ceramics, Dr Lal PathLabs, Minda Corporation, Sapphire Foods India, Fairchem Organics, Galaxy Surfactants, GMR Infrastructure, NOCIL, Nucleus Software Exports, Sun Pharma Advanced Research Company, and Zydus Wellness will be in focus ahead of March quarter results on May 17.

Stocks in News Today

Adani Group: The group has made an open offer to acquire a 26% stake each in its two listed companies Ambuja Cements and ACC Ltd from public shareholders. Through its Mauritius-based subsidiary Endeavour Trade and Investment, the group has made an open offer at Rs 385 per share for Ambuja Cements Ltd and Rs 2,300 per share for ACC Ltd. The open offer comes a day after Adani announced $10.5 billion deal to acquire Holcim’s India business.

KEC International: The company has won orders worth Rs 1,150 crore across its various businesses. The company said the diverse orders in the Civil business, further strengthen its portfolio diversification and reaffirms the company’s confidence in the continued growth of this businesses.

Raymond Ltd: The company reported over four-fold jump in its consolidated net profit to Rs 264.97 crore for the fourth quarter ended in March 2022, helped by a robust demand and strong consumer sentiments during the period. The company had posted a net profit of Rs 58.36 crore during the January-March quarter of the previous fiscal. Its revenue from operations was up 43.38% to Rs 1,958.10 crore during the quarter under review as against Rs 1,365.66 crore in the corresponding period of the previous fiscal.

Canara Bank: The public-sector bank is expecting an 8-10% growth in advances as well as a healthy double-digit rise in corporate loan portfolio in the current financial year, its Managing Director and CEO L V Prabhakar said. “Overall we are targeting that by March 2023 our balance sheet size will be more than Rs 20 lakh crore as compared to Rs 18.27 lakh crore today”, Prabhakar added.

GlaxoSmithKline Pharmaceuticals: The drugmaker reported a Rs 55 crore consolidated net loss from continuing operations for the fourth quarter of FY22. The drug firm had reported a net profit of Rs 4 crore for the January-March quarter of the FY21. Revenue from operations rose to Rs 810 crore for the fourth quarter compared to Rs 744 crore in the year-ago period.

InterGlobe Aviation (IndiGo): The airline said it has got DGCA communications on handling of special child at Ranchi Airport. DGCA prima facie found IndiGo’s handling of special child at Ranchi Airport inappropriate. DGCA will issue a show cause notice to Indigo to explain. The firm said it will respond the matter in due course.

Aditya Birla Capital: The company said that the firm has received whistleblower complaint where allegations were made against Aditya Birla Sun Life and employees. The firm said an independent committee investigating the complaint did not find any merit in any allegations. The firm also said that the complaint did not level allegations against CEO Ajay Srinivasan.

IRB Infrastructure: The company said that its April gross toll collections stood at Rs 327 crore versus Rs 306.66 crore in March. The gross toll collections in April 2021 was at Rs 196.64 crore.

SJVN Ltd: The state-owned company will develop another hydro power project Arun-4 worth Rs 4,900 crore in Nepal. A Memorandum of Understanding (MoU) for the development of the 490 MW Arun-4 hydro electric project in Nepal has been signed in Lumbini, Nepal in the presence of Prime Minister Narendra Modi and Prime Minister of Nepal Sher Bahadur Deuba, the company said.

VIP Industries: The company posted a profit of Rs 12 crore in the Q4FY22 compared with a loss of Rs 4 crore in the corresponding quarter a year ago. Revenue for the quarter stood at Rs 356 crore as against Rs 243 crore in the year-ago period. EBITDA rose to Rs 33 crore in the quarter under review against Rs 3 crore in the year-ago period.

Jet Airways: The airline is set to conduct its final phase of proving flights on Tuesday and it is expected to get its Air Operator Certificate (AOC) revalidated this week, according to a senior DGCA official. The carrier is being revived under the ownership of the Jalan Kalrock consortium and completed its first phase of proving flights on Sunday.