Market Opening - An Overview

SGX Nifty futures were trading 1.36% lower at 16,462.5, signalling Dalal Street was headed for a gap-down opening.

Asian stocks opened lower on Friday and the US dollar rose against major currencies as inflation, rising borrowing costs and China’s Covid lockdowns dampened investors’ sentiment. However, Japanese stocks recouped losses to trade in the positive territory.

Japan’s Nikkei rose 0.12% and Topix was up 0.55%. China’s Hang Seng tumbled 3.27% bad CSI 300 index slumped 1.99%.

Indian Rupee rose 15 paise to 76.25 against the US Dollar on Thursday.

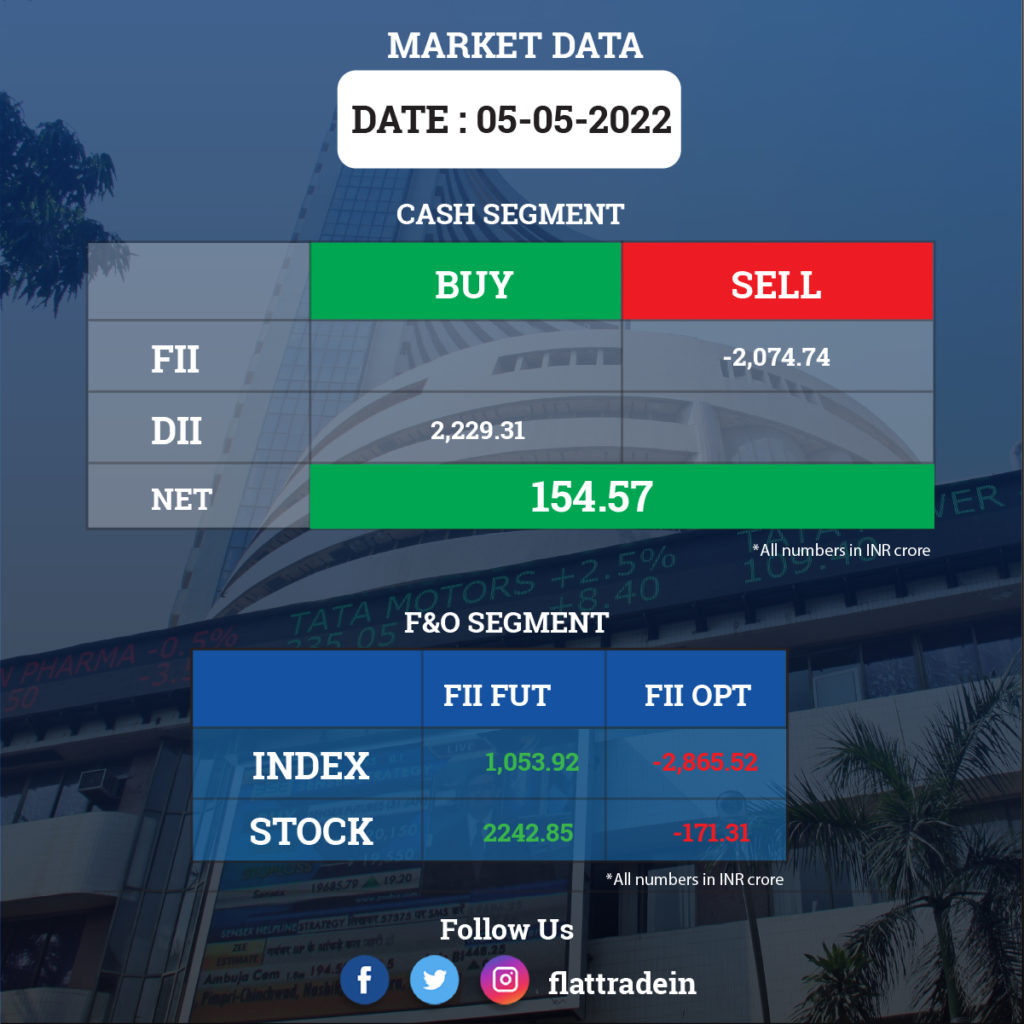

FII/DII Trading Data

Upcoming Results

Reliance Industries, Canara Bank, Sundaram-Clayton, Tata Power Company, CSB Bank, Federal Bank, Great Eastern Shipping Company, Bajaj Consumer Care, Apollo Pipes, Apollo Tricoat Tubes, Greenpanel Industries, Grindwell Norton, Hariom Pipe Industries, Kokuyo Camlin, Shipping Corporation of India, Paisalo Digital, Paushak, Reliance Home Finance, Vesuvius India, and Vikas EcoTech will release their quarterly results today.

Stocks in News Today

Adani Power: Adani Power’s consolidated net profit jumped to Rs 4,645.47 crore in the Jan-Mar quarter of FY22 from Rs 13.13 crore in the year-ago period. Total revenue of the company rose to Rs 13,307.92 crore in the reported quarter from Rs 6,902.01 crore in the same period a year ago.

Dabur India: The FMCG major reported a 21.98% decline in consolidated net profit at Rs 294.34 crore for the fourth quarter ended March 2022. The company had posted a net profit of Rs 377.29 crore in the January-March period a year ago. Its revenue from operations rose 7.74% to Rs 2,517.81 crore during the quarter under review, as against Rs 2,336.79 crore in the year-ago period.

Marico: The company reported an increase of 13.2% YoY in its consolidated net profit to Rs 257 crore for the fourth quarter of FY22. Its revenue from operations during the quarter under review rose 7% to Rs 2,161 crore, compared with Rs 2012 crore in the year-ago period.

TVS Motor: The two-wheeler company reported a 5% year-on-year decline in standalone profit after tax at Rs 275 crore as compared to a profit of Rs 289 crore. Revenues for the automobile company registered a YoY growth of 4% to Rs 5,530 crore as compared to Rs 5,322 crore registered during the same period a year ago.

Wipro and HFCL: IT company Wipro and telecom gear maker HFCL have entered into a partnership to develop 5G product portfolio, mainly the routers required to connect mobile sites with the core network of telecom operators. Both the companies in a joint statement said that they will collaborate on a portfolio of 5G products for the telecommunications sector.

Airtel, Reliance Jio, Vodafone Idea: Telecom service providers’ gross revenue declined by 2.64% to Rs 69,695 crore in December 2021 quarter, according to TRAI data. The gross revenue of the telecom service providers (TSPs) was Rs 71,588 crore in the same period a year ago. Reliance Jio registered the highest AGR of Rs 19,063.75 crore in the December 2022 quarter. It was followed by Bharti Airtel with Rs 4,484.48 crore and Vodafone Idea with Rs 6,541.83 crore.

Firstsource Solutions: The technology services company’s net sales stood at Rs 1,543.93 crore in March 2022 up 5.54% from Rs. 1,462.84 crore in March 2021. Its Q4FY22 net profit was Rs 132.39 crore, up 183.64% from Rs 46.68 crore in the year-ago period.

Blue Dart Express: The company posted a growth of 20.7% YoY in its standalone profit after tax of Rs 135 crore for Q4FY22 as compared to a profit of Rs 89 crore during the same period last fiscal. Revenue from operations for the quarter jumped 21% YoY to Rs 1,166 crore as compared to Rs 966 crore in the year ago period. The company declared a total dividend of Rs 60 per equity share for FY21-22.

DCM Shriram: The company registered a 73% increase in its net profit at Rs 401 crore for Q4FY22 as compared to Rs 232 crore during the same period last year. Its net revenue from operations grew 28% year-on-year to Rs 2,796 crore as compared to Rs 2,191 crore in the same period last year. The company declared a final dividend of 245% taking the total dividend for the year to 735 percent.

CEAT: The tyre maker posted a decline of 83% in its consolidated net profit for Q4FY22 at Rs 25.25 crore as compared with Rs 153 crore during the year-ago period. The surge in input costs led to the decline in profits. The revenues increased 13% on year to Rs 2,592 crore. The company declared a dividend of Rs 3 per equity share for FY22.

Blue Star: The company’s consolidated net profit for the quarter increased by 12% on year to Rs 76.27 crore compared to Rs 68.09 crore during the same period a year ago. Revenue from operations for the company jumped 39.5% to all-time high of Rs 2,247.58 crore compared to Rs 1,611.56 crore in Q4FY21. The company recommended a dividend of Rs 10 per equity share of Rs 2 each for FY22.

Sona BLW Precision Forgings: The auto ancillary company’s PAT for the fourth quarter of FY22 surged 76% to Rs 105 crore as compared to Rs 60 crore reported during the same period last year. The revenues improved 2% on year to Rs 550 crore compared to Rs 539 crore during last year quarter. The company has declared a dividend of Rs 0.77 per equity share for FY22.