Market Opening - An Overview

SGX Nifty Futures were trading 1.43% lower at 16,236, indicating Dalal Street was headed for a gap-down opening.

Asian stocks were trading lower as high inflation and slowing economic growth dampened investors’ optimism. Japan’s Nikkei 225 dropped 1.41% and Topix fell 0.98%. China’s Hang Seng was down 0.65% and CSI 300 slipped 0.03%.

The Indian rupee ended 3 paise lower at 77.77 against the US dollar on Thursday.

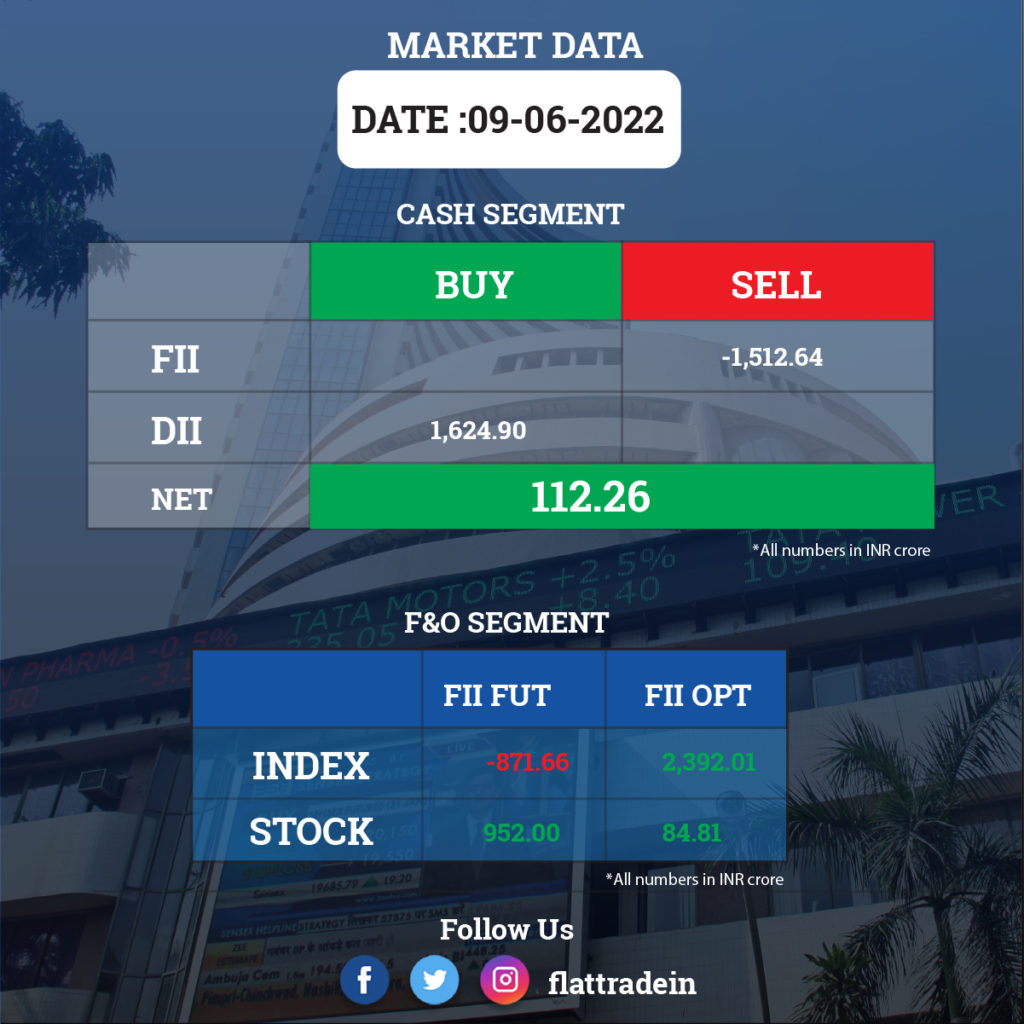

FII/DII Trading Data

Stocks in News Today

Housing Development Finance Corporation (HDFC): The company said it will raise Retail Prime Lending Rate on housing loans by 50 basis points from June 10, 2022.

Dr Reddy’s Laboratories: The company said its subsidiary has inked a pact with US-based Olema Pharmaceuticals Inc to research, develop and commercialise novel small molecule inhibitors of an undisclosed oncology target. Under the terms of the agreement, Olema will make an upfront licensing payment of USD 8 million for the rights to a pre-existing Aurigene programme.

Reliance Industries Ltd: Jio-bp – the fuel retailing joint venture between Reliance Industries and BP – will set up EV charging and battery swapping stations at properties of real estate developer Omaxe in 12 cities as it looks to take mobility solutions to doorstep of users.

Bajaj Auto: The company’s board will meet on June 14 to consider a buyback of its fully paid-up equity shares, said the company in a notification to the exchanges.

IIFL Finance Limited: The NBFC’s wholly-owned subsidiary, IIFL Home Finance Limited, has entered into definitive agreements for raising Rs 2,200 crore for a 20% stake from a wholly-owned subsidiary of the Abu Dhabi Investment Authority (ADIA). The deal completion is subject to regulatory approvals.

Shriram Transport Finance Company (STFC): The company has secured long-term funding of $250 million from the International Development Finance Corporation (DFC), the US government’s development finance institution. The company said the funding will be used for vehicle financing for commercial purposes, alternate fuel financing, employment generation, loans for small businesses, specifically for women entrepreneurs and socially and economically backward communities in India.

Havells India: The company’s Chairman and Managing Director Anil Rai Gupta said that there is no respite from inflationary pressure on raw material and supply chain costs in the near term, and this could create pressure on the customer’s wallet.

Escorts: The farm machinery and construction equipment maker said it has received requisite approvals for changing its name to Escorts Kubota Ltd. The developments comes after Japan’s Kubota Corporation increased its stake in Escorts to 44.8% by subscribing to new equity shares and through an open offer to the public shareholders of Escorts.

Sona BLW Precision Forgings: The company said in an exchanges filing that its board has re-appointed Vivek Vikram Singh as the Managing Director and Group CEO of the company for a period of 5 year starting from July 5, 2022 to July 4, 2027. This is subject to the approval of the shareholders.

HFCL: The company has received orders worth Rs 73.39 crore consisting of Rs 51.09 crore from one of the leading private telecom operators of the country for supply of unlicensed band radio along with accessories. The order worth Rs 22.30 crore has been bagged from one of the leading EPC players of India for supply of optical fibre cables.