Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.13% lower at 17,817, signalling that Dalal Street was headed for a negative start on Monday.

Japanese shares were higher with the Nikkei 25 index trading 1.06% higher and the Topix up 0.61%. Meanwhile, Chinese shares tumbled 2.1% and the Hang Seng index fell 1.44%.

Indian rupee rose 34 paise to 81.83 against the US dollar on Friday.

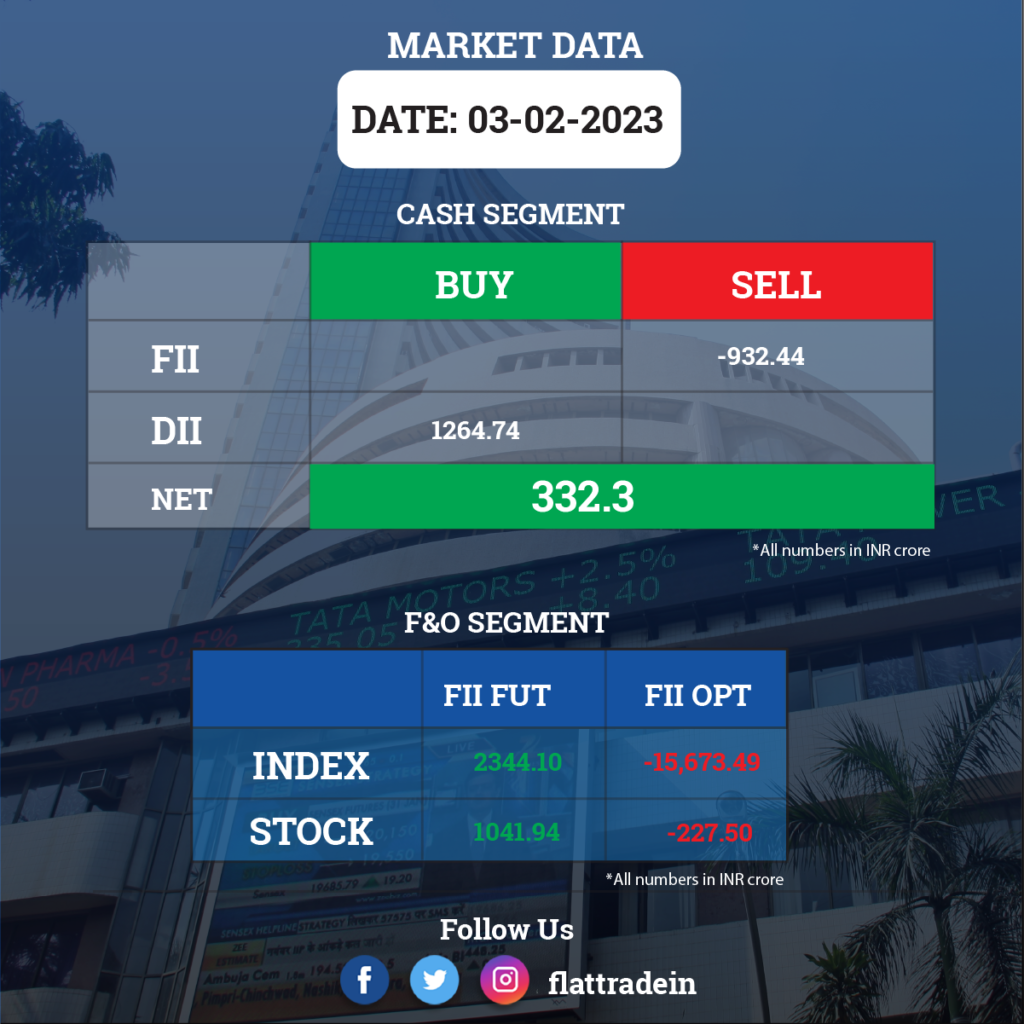

FII/DII Trading Data

Upcoming Results

Tata Steel, Adani Transmission, AGS Transact Technologies, Balaji Amines, Easy Trip Planners, Infibeam Avenues, JK Paper, Kolte-Patil Developers, LIC Housing Finance, Monte Carlo Fashions, Muthoot Finance, Nuvoco Vistas Corporation, OnMobile Global, Shankara Building Products, SJVN, Tejas Networks, Unichem Laboratories, and Varun Beverages will report their quarterly results on February 6.

Stocks in News Today

State Bank of India (SBI): The country’s largest lender has recorded a massive 68.5% year-on-year growth in standalone profit at Rs 14,205 crore for the December FY23 quarter. Its net interest income rose 24% to Rs 38,069 crore for the quarter. Higher other income and operating income along with fall in provisions boosted profitability. Its loan growth was 17.6% YoY and deposits grew by 9.5% YoY for the quarter. Asset quality improved on a sequential basis, with gross non-performing assets falling 38 bps QoQ to 3.14% and net NPA declining 3 bps to 0.77%. SBI’s exposure to Adani group in absolute terms is close to Rs 27,000 crore.

ITC: The cigarette-to-FMCG-to-hotel major has registered a 21% year-on-year growth in profit at Rs 5,031 crore for the quarter ended December FY23 despite tepid revenue growth, supported by healthy operating performance. Revenue for the quarter at Rs 16,226 crore grew by 2.3% aided by cigarettes, FMCG, hotels and paper segments, but agribusiness tanked 37% YoY to Rs 3,124 crore. At the operating level, EBITDA jumped 22% to Rs 6,223 crore with the margin expanding by 620 bps compared to the year-ago period.

InterGlobe Aviation (IndiGo): The carrier has recorded a multi-fold increase in profit at Rs 1,422.6 crore and revenue for the quarter rose 60.7% to Rs 14,933 crore. EBITDAR stood at Rs 3,399 crore up by 70.3% YoY. EBITDAR margin expanded by 130 bps YoY. The margin was hit by higher fuel costs. Profit excluding foreign exchange loss (Rs 586.5 crore) came in at Rs 2,009.1 crore for the quarter, rising 16-fold YoY. Passenger traffic increased by 25.8% to 2.23 crore and yield improved by 21.9% to Rs 5.38 and load factor improved by 5.4 points to 85.1 percent.

Vodafone Idea: The Government of India has directed the telecom operator to convert AGR dues of Rs 16,133 crore into equity shares. The company has been directed by the Ministry of Communications to issue 1,613.31 crore equity shares of the face value of Rs 10 each at an issue price of Rs 10 each. The Government passed the said order for the conversion of AGR dues into shares on February 3.

Tata Power: The power generation and distribution company has reported a 91% year-on-year growth in consolidated profit at Rs 1,052 crore for the three-month period ended December FY23 led by better performance across all businesses. Consolidated revenue grew by 30% YoY to Rs 14,339 crore for the quarter driven by capacity addition in renewables, higher generation in thermal plants and higher sales in distribution companies. EBITDA for the quarter at Rs 2,818 crore surged by 53% YoY on capacity addition in renewables and better performance across all businesses.

M&M Financial Services: The financial services provider has recorded a standalone profit at Rs 629 crore for the three-month period ended December FY23, down 30% YoY due to a high base in the year-ago period. The Q3FY22 had seen a significant reversal of impairment provisions as a result of improvement in asset quality which had deteriorated during Q1 FY22 due to the second wave of COVID-19. Net interest income grew by 7% YoY to Rs 1,650 crore with loan book increasing by 21% to Rs 77,344 crore. As of December-end, the company carried a total liquidity buffer of approximately Rs 10,800 crore, covering more than 3 months’ obligations. M&M Financial has approved the appointment of Raul Rebello, currently the Chief Operating Officer of the company, as the MD & CEO -Designate.

Marico: The FMCG company has registered a 5.04% year-on-year growth in consolidated profit at Rs 333 crore for the October-December period of FY23 led by higher operating margin performance and other income. Revenue for the quarter at Rs 2,470 crore grew by 2.6% compared to the year-ago period with India’s business rising 1.9% YoY to Rs 1,851 crore and the international segment growing 5% to Rs 619 crore. At the operating level, EBITDA increased by 5.8% YoY to Rs 456 crore and the margin expanded by 56 bps YoY to 18.46% on lower input costs.

One 97 Communications (Paytm): The financial services comapny reported a consolidated loss of Rs 392 crore for the quarter ended December FY23, falling from a loss of Rs 778.5 crore in the year-ago period and a loss of Rs 571.5 crore in the previous quarter. Consolidated revenue from operations at Rs 2,062 crore for the quarter grew by 42% YoY and up 7.7% sequentially. Merchants paying subscriptions for payment devices stood at 5.8 million during the quarter, up by 3.8 million YoY, while in Q3FY2023, the number of loans disbursed through the platform grew to 10.5 million, up 137% YoY, and the value of loans disbursed grew to Rs 9,958 crore, a growth of 357% YoY.

TV Today Network: The company reported a decline of 55.08% in its consolidated net profit at Rs 27.62 crore for the third quarter ended December 31, 2022. The company had reported a net profit of Rs 61.50 crore in the October-December period a year ago. Its revenue from operations was at Rs 231.31 crore, down 10.33% during the period under review, as against Rs 257.97 crore in the corresponding quarter of the previous fiscal. Revenue from television and other media operations stood at Rs 228.93 crore, while Rs 2.38 crore came in from radio broadcasting. TV Today Network’s total expenses rose 11.96 per cent to Rs 206.30 crore in Q3 of FY23. In a separate filing, TV Today Network said its board on Friday approved a special interim dividend of Rs 67 per equity share, which is at the rate of 1,340 per cent on the face value of Rs 5 each fully paid-up share, for FY23.

Emami: The FMCG reported a 6.12% increase in consolidated Profit after Tax (PAT) to Rs 232.97 crore for the third quarter ended December 2022 amid contraction of gross margins due to inflationary pressure. The company had posted a PAT of Rs 219.52 crore during the October-December quarter of the previous fiscal. Its revenue from operations rose 1.2 per cent to Rs 982.72 crore as against Rs 971.06 crore in the corresponding period of the previous fiscal. Its gross margins stood at 65.9% down by 150 basis points due to inflationary pressure. EBIDTA stood at Rs 294 crore declined by 14 per cent over the previous year due to the inclusion of new subsidiary costs, and strategic outlay on distribution expansion in rural, digital and modern trade channels.

Sun TV Network: The media company has regiteres a 9.8% year-on-year decline in consolidated profit at Rs 425.1 crore for quarter ended December FY23. Revenue fell 16.4% YoY to Rs 887 crore and EBITDA dropped 20.5% YoY to Rs 584.3 crore for the quarter with margin declining 364 bps YoY.

JK Tyre & Industries: The tyre manufacturer has reported a 15.2% year-on-year growth in consolidated profit at Rs 65.6 crore for quarter ended December FY23, with EBITDA growing 24% YoY to Rs 339 crore with margin expansion of 50 bps. Revenue from operations at Rs 3,613 crore for the quarter grew by 17.5% compared to year-ago period.

Aarti Industries: The speciality chemicals company has recorded a 81.3% YoY decline in profit at Rs 135.2 crore for three-month period ended December FY23 as revenue fell by 20.5% to Rs 1,635 crore and EBITDA dropped 68% to Rs 286 crore with 2,580 bps contraction in margin compared to year-ago period.

Orient Paper & Industries: The company has reported profit at Rs 39.5 crore for October-December period of FY23 against loss of Rs 3.5 crore. Revenue for the quarter grew by 54.2% YoY to Rs 253.1 crore. EBITDA surged to Rs 68.8 crore for the quarter against Rs 1.2 crore in year-ago period with margin expansion of 2,650 bps to 27.2% in Q3FY23 YoY.