Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.22 per cent lower at 18,627.50, signalling that Dalal Street was headed for a negative start on Friday.

Most Asian shares were trading lower as losses in Chinese technology stocks dampened investor sentiments. Japan’s Nikkei 225 index fell 0.29% and the Topix index slipped 0.07%. Hang Seng dropped 1.19% and the CSI 300 index rose 0.36%.

Indian rupee strengthened by 21 paise to 81.63 against the US dollar on Thursday.

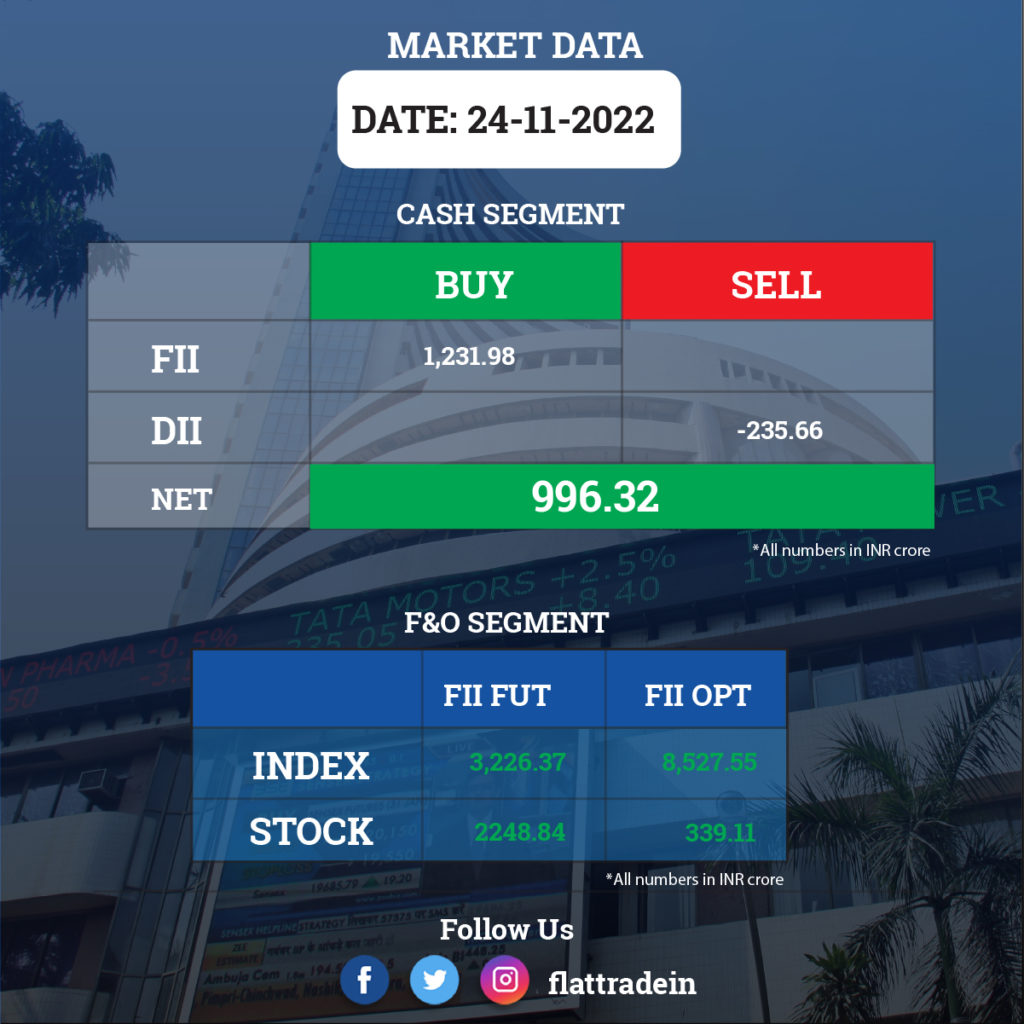

FII/DII Trading Data

Stocks in News Today

State Bank of India (SBI): The state-owned lender said it would consider raising funds by issuing up to Rs 10,000 crore of infrastructure bonds. This will also include a greenshoe option of Rs 5,000 crore, the bank said in a regulatory filing. The fundraising would be through a public issue or private placement during fiscal 2023, SBI said. Its executive committee of the central board will meet on November 29 to consider the fundraising.

Biocon: The biotechnology major said its subsidiary Biocon Biologics has allotted equity shares worth Rs 2,205.63 crore to it as part of an equity infusion to fund the latter’s acquisition of Viatris Inc’s biosimilars business. In February 2022, Biocon Biologics inked a pact to acquire Viatris Inc’s biosimilars business for consideration of up to $3.335 billion (about Rs 24,990 crore). Biocon has subscribed to the equity shares and allotment has been made by Biocon Biologics on November 23 for a cash consideration of Rs 2,205.63 crore

Punjab National Bank (PNB): The public sector lender has received approval of DIPAM, Ministry of Finance, for selling its stake in UTI Asset Management Company in one or more tranches. With this, PNB plans to book profits on its investments. As of now, PNB holds 15.22 per cent stake in UTI AMC.

PVR: The company announced the opening of its first and biggest 12-screen superplex at Lulu Mall in Thiruvananthapuram, Kerala. The operation for this cinema will start on December 5, 2022. The 12-screen property will host international formats like IMAX and 4DX, two of PVR’s luxury formats, LUXE.

Tube Investments of India: The auto ancillary company will buy 50 per cent stake in X2Fuels and Energy, a start-up company engaged in developing processes to convert waste to liquid/solid fuels, for Rs 6.15 crore. Tube Investments has signed shares’ subscription agreement with X2Fuels and Energy, and its founders.

Laurus Labs: The company has entered into Share Subscription Agreement and Shareholders’ Agreement with Ethan Energy India for buying 26 per cent stake in Ethan Energy India. This will enable the company to consume 100 per cent of the solar energy to be supplied by Ethan Energy India from their 10 MW solar energy plant.

Lupin: The USFDA has issued Form-483 with eight observations for the drug product facility and API facility at Mandideep. The US drug regulator has inspected company’s Mandideep unit-1 facility during November 14-23, 2022. “We do not believe this will have an impact on disruption of supplies or the existing revenues from operations of this facility,” the company said.

Hariom Pipe Industries: The company has completed the setting up of its 15 ton electric melting furnace and the commercial production from the same will commence from November 25, 2022. This will increase the company’s production of MS billets from the current 95,832 MTPA to 1.04 lakh MTPA.

Kintech Renewables: Promoters Gaurank Singhal & Aditya Singhal will sell 1.96 lakh shares or 19.69 per cent stake via offer for sale on November 25 and November 28. The floor price for the sale would be Rs 480 per share.

PTC India: The power trading solution provider said its consolidated net profit umped three-fold to Rs 157.11 crore in the March 2022 quarter on the back of lower expenses. The consolidated net profit of the company was Rs 49.77 crore in the quarter ended March 31, 2021.

SJVN: The state-run utility company said it has commissioned a 75 MW solar power project at Parasan Solar Park in Uttar Pradesh. With the said project achieving commercial operation, the power producer’s installed generation capacity stands at 2,091.5 MW.

Veranda Learning Solutions: IIM Raipur is collaborating with the edtech company and the Society for Human Resource Management (SHRM) to launch an Executive Post Graduate Programme (online MBA) in HR management.

Hi-Tech Pipes: The company’s board has approved issuance of 57 lakh fully convertible equity warrants which can be subscribed at Rs 692 apiece to promoters, non-promoters and qualified institutional buyers. The company has also issue 3 lakh equity shares at Rs 692 apiece to non-promoter shareholders.

Dev Information Technology: The smallcap IT company will trade ex-stock split on Friday as the company has decided to split its shares with a face value of Rs 10 each into two shares with a face value of Rs 5 each.