Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.49% lower at 16,643.50, signaling that Dalal Street was headed for a negative start on Monday.

Asian stocks lost ground on Monday, as investors were worried over a global economic downturn. Japan’s Nikkei 225 index fell 0.73% and Topix dropped 0.66%. China’s Hang Seng was down 0.88% and CSI 300 index declined 0.56%.

Indian rupee rose 9 paise to 79.86 against the US dollar on Friday.

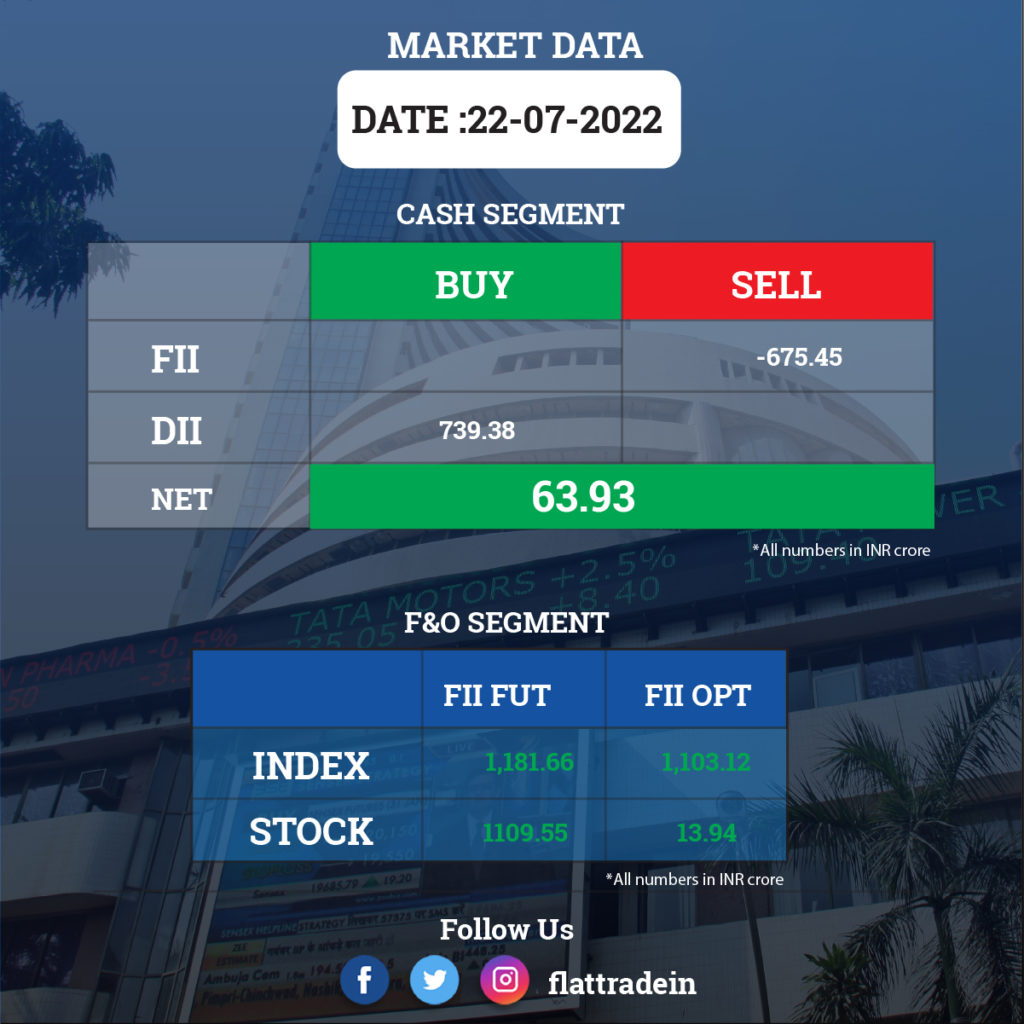

FII/DII Trading Data

Upcoming Results

Axis Bank, Tata Steel, Tech Mahindra, Canara Bank, Macrotech Developers, KPIT Technologies, Aether Industries, Anupam Rasayan India, Aurionpro Solutions, Central Bank of India, Century Textiles & Industries, Chennai Petroleum Corporation, Craftsman Automation, Glaxosmithkline Pharmaceuticals, Indian Energy Exchange, IIFL Wealth Management, Jindal Stainless, Jyothy Labs, Lakshmi Machine Works, Orient Electric, RattanIndia Power, Sterlite Technologies, Tanla Platforms, Tatva Chintan Pharma Chem, and Tejas Networks will report their June quarter earnings on July 25.

Stocks in News Today

Reliance Industries Ltd (RIL): The conglomerate posted a 41% year-on-year growth in consolidated profit after tax at Rs 19,443 crore in Q1FY23, and gross revenue jumped by 53% to Rs 2,42,982 crore for the quarter YoY, while EBITDA surged by 45.8% to Rs 40,179 crore during the reported quarter.

Infosys: The IT services firm reported a net profit of Rs 5,360 crore for Q1FY23, up 3.2 per cent year-on-year (YoY). Sequentially, it was down 5.7%. The company reported revenue growth of 23.6% YoY to 34,470 crore. Infosys has increased its revenue growth forecast to 14-16% for FY23, from the earlier projection of 13-15%.

ICICI Bank: The private sector lender registered a 50% year-on-year growth in standalone profit at Rs 6,905 crore for the quarter ended June 2022, as bad loan provisions declined sharply YoY. Net interest income increased by 20.8% to Rs 13,210 crore, compared to Rs 10,936 crore reported in corresponding period previous fiscal. The advances grew by 21% and deposits rose by 13% on-year. Asset quality showed improvement on sequential basis.

Kotak Mahindra Bank: The bank clocked 26.1% year-on-year increase in standalone profit at Rs 2,071.15 crore for the quarter ended June 2022, aided by lower provisioning and improving asset quality performance. Net interest income grew by 19.2% YoY to Rs 4,697 crore for the quarter.

Tata Motors: The automaker said it has bagged an order for 1,500 electric buses from Delhi Transport Corporation (DTC) as part of a tender by Convergence Energy Services Ltd. The company will supply, operate and maintain air-conditioned, low-floor, 12-metre fully-built electric buses for 12 years, as per the contract, it said in a statement.

Yes Bank: The private sector lender reported a 50.17% year-on-year growth in profit after tax at Rs 310.63 crore for Q1FY23, with significant fall in bad loan provisions and higher net interest income. Net interest income for the quarter rose 32% YoY to Rs 1,850 crore, with 14% YoY credit growth and 18% increase in deposits.

GAIL India: The state-owned natural gas company said the board will hold a meeting on July 27 to consider issuance of bonus shares. Hence, the trading window for dealing in securities of GAIL for designated persons and their immediate relatives will remain closed till the approval of financial results for the quarter ended June 2022.

JSW Steel: The steel company has recorded a 86% year-on-year decline in consolidated profit at Rs 839 crore for the quarter ended June 2022 impacted by weak operating performance. It had reported a profit of Rs 5900 crore in the year-ago period. Its operating expenses were higher including higher input cost, finance cost, and power & fuel cost. Revenue increased 32% to Rs 38,086 crore during the quarter YoY.

Vodafone Idea: The company said that its chief financial officer Akshaya Moondra has been appointed as the new CEO of the company. Moondra will takes over the responsibilities from Ravinder Takkar, whose three-year tenure as CEO ends on August 18. The company is yet to name a chief financial officer to take Moondra’s place.

Granules India: The US FDA has completed an inspection of the facility of Granules Pharmaceuticals Inc, with six observations. Granules Pharmaceuticals Inc is a wholly-owned foreign subsidiary of the company located at Virginia, USA and inspection of the said facility by USFDA completed on July 22.

HFCL: The telecom equipment & optical fiber solutions provider has registered 42% year-on-year decline in profit at Rs 53 crore in Q1FY23 due to continued shortage of semiconductors and spill over of service billing. Revenue declined 13% to Rs 1,051 crore during the same period, but exports grew by 167% YoY, with strong order book worth more than Rs 5,300 crore as of June 2022.

PB Fintech (Policybazaar): The company that the IT system of the firm was hacked on July 19 and subsequent corrective action was taken. The company identified certain vulnerabilities on July 19 in a part of Policybazaar Insurance Brokers IT systems leading to illegal and unauthorized access to the network.

Vardhman Textiles: The company reported a standalone net profit of Rs 313.35 crore in Q1FY23, a rise of 4.13% from Rs 300.92 crore in the corresponding quarter of previous year. Its standalone revenue from operations stood at Rs 2,731 crore, higher by 44.25% over the corresponding quarter of the previous fiscal. The EBIDTA margin for the reported quarter stood at 19.36%, as against 26.55% during the corresponding quarter of the previous fiscal year.

Karnataka Bank: The company reported a 7.7% YoY increase in net profit at Rs 114.05 crore in Q1FY23 on improved interest margins. It had posted a net profit of Rs 105.9 crore during the same period last year. The lender’s net interest income (NII) rose by 19.62% in Q1FY23 to Rs 687.56 crore from Rs 574.79 crore in Q1FY22. Its net interest margin (NIM) improved to 3.33% in Q1FY23 from 2.98% in the same period a year ago.