Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.10 per cent higher at 17,672, indicating that Dalal Street was headed for a muted start on Thursday.

Asian shares were mixed as Japanese shares were trading higher and shares in the Chinesese market were trading lower. The Nikkei 225 index soared 2.37% and the Topix was up 1.83%. China’s Hang Seng slipped 0.05% and CSI 300 inched down 0.01%.

The Indian rupee fell 11 paise to 79.64 against the US dollar on Thursday.

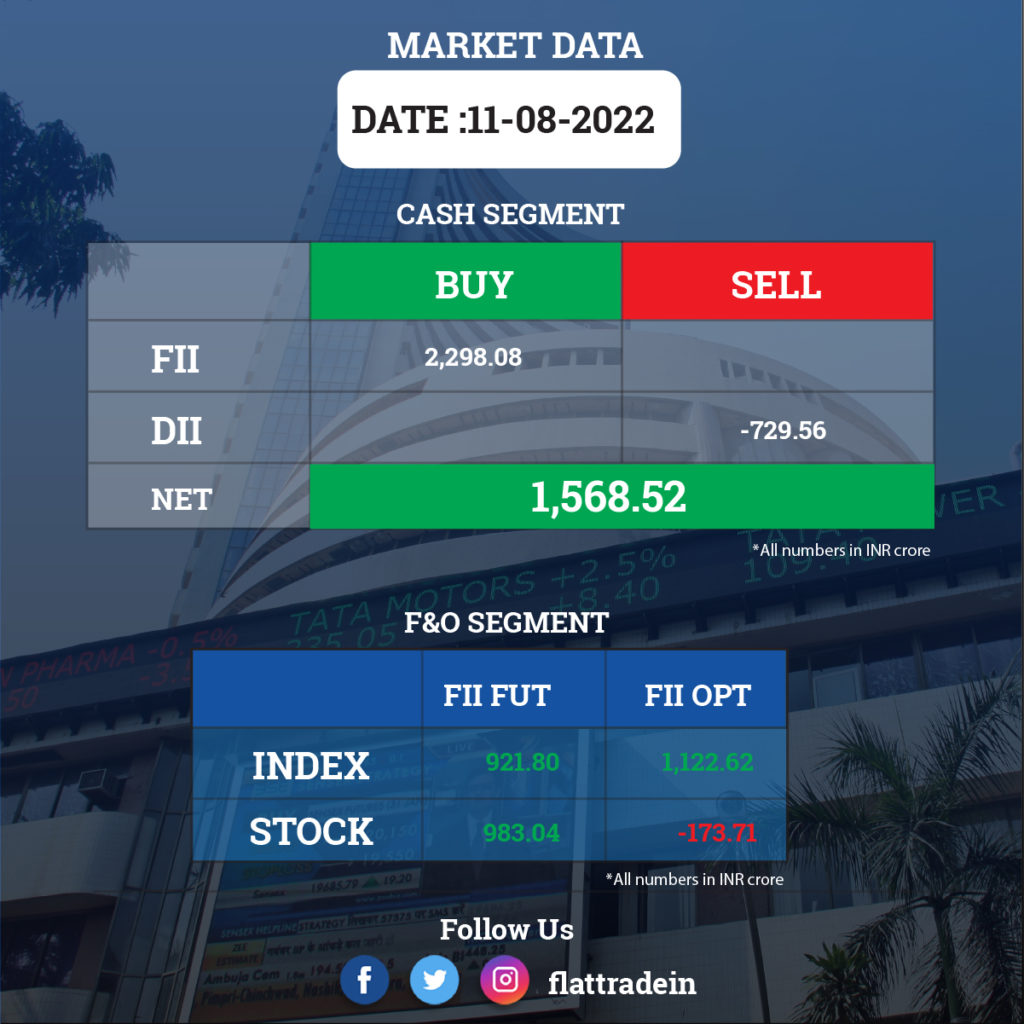

FII/DII Trading Data

Upcoming Results

ONGC, Life Insurance Corporation of India, Hero MotoCorp, Grasim Industries, Hindustan Aeronautics, Divis Labs, Apollo Tyres, Zee Entertainment Enterprises, Aegis Logistics, Ahluwalia Contracts, Astral, Bajaj Electricals, Bajaj Healthcare, Bajaj Hindusthan Sugar, Balaji Amines, Bharat Dynamics, Campus Activewear, Dilip Buildcon, Dhani Services, Finolex Cables, Godrej Industries, Indiabulls Real Estate, India Cements, Kolte-Patil Developers, Muthoot Finance, Info Edge India, Power Finance Corporation, SJVN, Sun TV Network, Supriya Lifescience, Timken India, Varroc Engineering, Voltamp Transformers, and Wockhardt will report their June quarter earnings on August 12.

Stocks in News Today

Apollo Hospitals Enterprise: The company has posted a 35 per cent drop in net profit for the April to June quarter of the financial year 2022-23 at Rs 323.78 crore, compared to Rs 500.68 crore during the same period last financial year. The company’s revenue from operations fell marginally by 1 per cent during the quarter under review to Rs 3,795.60 crore, as against Rs 3,760.21 crore. Apollo’s healthcare segment revenue stood at Rs 2,032.07 crore, a rise of 5 per cent from Rs 1,941 crore during the April to June quarter in FY22.

Aurobindo Pharma: The drugmaker said that its consolidated net profit for the quarter ended June 2022 was down by 32.4 per cent to Rs 520.5 crore compared to Rs 770 in the first quarter of the last fiscal. Revenues from operations were up by 9.4 per cent to Rs 6,236 crore during the quarter under discussion compared to Rs 5,702 crore a year ago. In the Q1FY23, its revenue from the US increased by 10.8 per cent YoY to Rs 2,971.1 crore and accounted for 47.7 per cent of consolidated revenues.

Page Industries: The Apparel manufacturer reported a multi-fold increase in its net profit at Rs 207.03 crore for the quarter ended June 2022. It had posted a net profit of Rs 10.94 crore during the April-June period a year ago. Its revenue from operations during the quarter under review was at Rs 1,341.26 crore, up over two-fold compared to a lower base of the pandemic-affected Q1FY22.

Godrej Properties: The realty firm plans to launch a new luxury housing project in Delhi’s Ashok Vihar this year, which has a potential to generate about Rs 8,000 crore sales revenue, executive chairman Pirojsha Godrej said. The company is waiting for some pending government approvals to launch this 27-acre luxury residential project in Delhi-NCR, its best performing market last fiscal.

Life Insurance Corporation of India (LIC): The insurer has roped in Milliman Advisors to determine its embedded value (EV) as on September 2022. Milliman had ascertained the embedded value for the insurer before its initial public offering (IPO).

Phoenix Mills: The asset developer and operator has reported a consolidated net profit of Rs 718.7 crore for the quarter ended June 2022 as against a loss of Rs 26.2 crore in the year-ago period. Income from operations for the quarter rose 181% YoY to Rs 574.4 crore. Retail consumption rose 123% during the quarter to around Rs 2,190.5 crore, a 123% rise from first quarter of FY20.

Allcargo Logistics: The company has reported over two-fold growth in its consolidated profit after tax (PAT) to Rs 280 crore for the June quarter. It had posted a PAT of Rs 106 crore in the first quarter of the previous fiscal. Its consolidated revenue rose 65 per cent to Rs 5,675 crore in Q1FY23 from Rs 3,449 crore in Q1 FY22. Allcargo said that there has been a sustained increase in revenues coming through the digital platform ECU360, which now accounts for over 60 per cent of export bookings across all key markets.

Spencer’s Retail: The company on Thursday said its consolidated net loss widened to Rs 33.63 crore for the first quarter ended June 30. The company had posted a net loss of Rs 23.55 crore in the April-June period a year ago. Its revenue from operations increased 12.5 per cent to Rs 621 crore during the quarter under review against Rs 552 crore in the year-ago period.

Southern Petrochemicals Industries Corporation Ltd (SPIC): The fertiliser company has reported profit after tax for the April-June 2023 quarter at Rs 66.85 crore compared to a PAT of Rs 27.68 crore during corresponding quarter previous year. The total income during the quarter under review grew to Rs 753.07 crore from Rs 499.16 crore registered during the same period last year.

Go Fashion (India): The company reported a profit after tax of Rs 24.4 crore during the April-June quarter as against a net loss of Rs 19 crore during the corresponding quarter of previous year. Total revenue during the quarter under review surged to Rs 165.2 crore from Rs 31 crore registered in the same period year ago. The company that owns women’s wear brand Go Colors said that it plans to strengthen foot print across geographies by adding about 120-130 stores ever year.

Jet Airways: The company reported a standalone net loss of Rs 390.1 crore in Q1FY23 as compared to Rs 129 crore in the year-ago period. Its revenue from operations declined 83% to Rs 12.53 crore for the quarter under review. It had posted a revenue of Rs 73.83 crore in the same quarter last year.

Aster DM Healthcare: The company reported a 35% year-on-year increase in consolidated profit at Rs 79.77 crore in Q1FY23, driven by better operating performance. Revenue grew by 12% YoY to Rs 2,662 crore.