Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.19% higher at 17,008, indicating that Dalal Street was headed for a higher opening on Thursday.

Asian shares werer trading lower, led by losses in banking stocks after investors were spooked by the crisis in Credit Suisse and Silicon Valley Bank. The Nikkei 225 index fell 0.98% and the Topix tanked 1.34%. The Hang Seng declined 1.43% and the CSI 300 index was down 0.60%.

Indian rupee fell 10 paise to 82.59 against the US dollar on Wednesday.

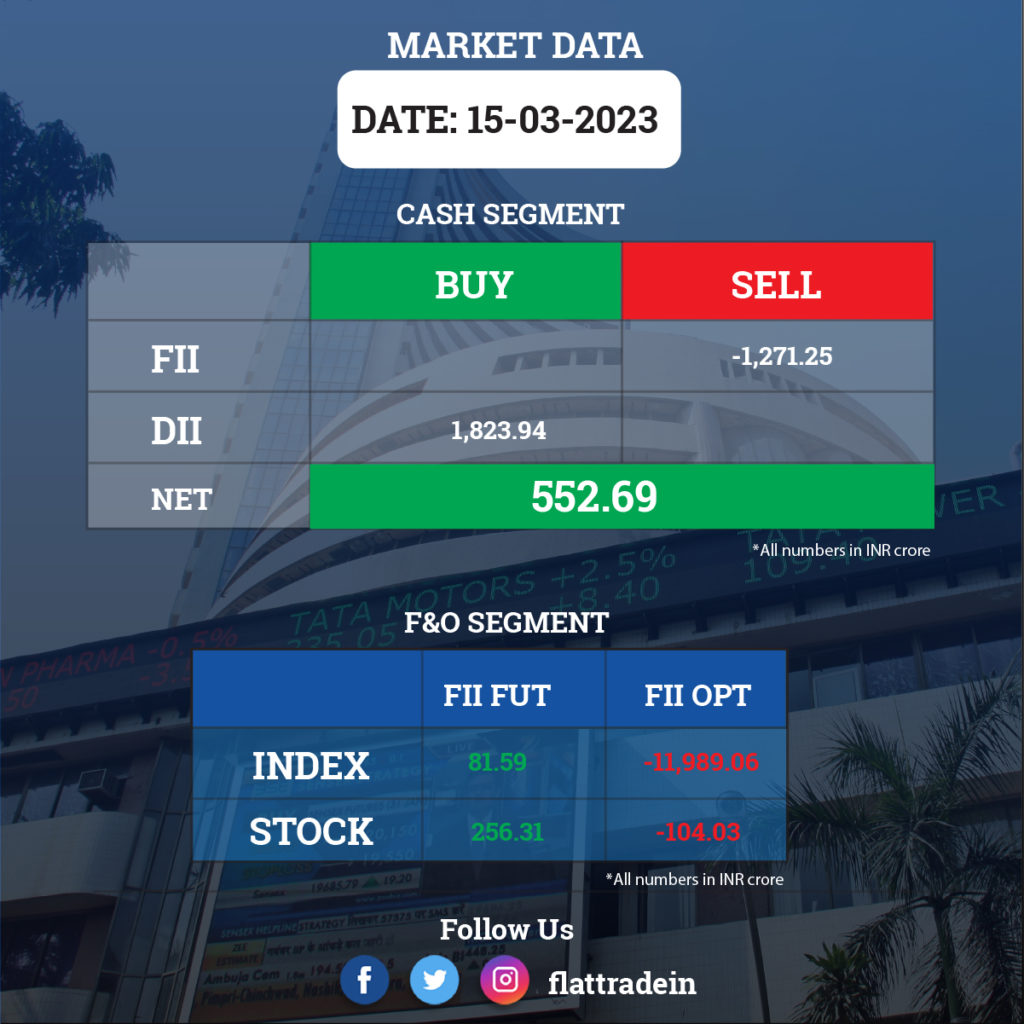

FII/DII Trading Data

Stocks in News Today

JSW Energy: The company has raised Rs 250 crore via NCDs after its Finance Committee approved the allotment of 25,000 NCDs of Rs 1 lakh each. In October 2022, the board had approved raising of funds up to Rs 2,500 crore via NCDs on private placement basis. The date of maturity is March 13, 2026.

Shriram Finance: The NBFC is looking to sell up to 15% stake in its housing finance arm at a valuation of 10 billion rupees ($121.35 million), Reuters reported citing two senior sources with direct knowledge of the matter. Shriram Housing Finance has received interest from several private equity players, including BPEA EQT, formerly Baring PE Asia The company could take a final call on the deal by March-end after evaluating all the offers, one of the sources added.

Life Insurance Corporation (LIC): The insurer said that it has sold 2% of its equity stake in state-owned NMDC, taking its total shareholding in the public sector unit to 11.69% as of March 14. In a regulatory filing, LIC said its holding in NMDC has decreased from 13.69% to 11.69% during the period between December 29, 2022 and March 14, 2023, at an average price of Rs 119.37 a share. The sale of 2% stake or a little over 5.88 crore shares in open market has fetched over Rs 700 crore to LIC.

Jubilant FoodWorks: The company, which operates US fried-chicken chain Popeyes in India, plans to expand Popeyes India restaurant chain to 50 restaurants in the next one year and 250 restaurants in the medium-term. “We are confident that, we will scale Popeyes progressively in other regions across the country and recreate the same excitement and loyalty for the brand,” said Sameer Khetarpal, chief executive director and managing director of Jubilant FoodWorks Limited.

Indian Oil Corp: The oil marketing company said that it aims to raise its renewable energy portfolio to 200 gigawatts (GW) by 2050 from the current 239 megawatts, to help the company achieve its 2046 net-zero goal.

Adani Transmission: The company has been recognised as a ‘single-use plastic-free’ company by the Confederation of Indian Industry-ITC Centre of Excellence for Sustainable Development. The company has been certified for its successful voluntary implementation of single-use plastic-free measures within its 37 operational locations spread across 10 states of the country. This certificate is valid from February 22, 2023 to February 21, 2024, according to a company statement.

Vedanta: The metals and mining conglomerate said that it has repaid $100 million to Standard Chartered Bank through release of encumbrance on March 10.

Sona BLW Precision Forgings: GIC Private Ltd on account of Government of Singapore and the Monetary Authority of Singapore acquired additional 5.13% stake in the auto ancillary company via open market transactions on March 13. With this, their shareholding in the company increased to 6.6%, up from 1.47% earlier.

Mindspace Business Parks REIT: The company has completed the first REIT level green bond issuance in India. Mindspace REIT has raised Rs 550 crore with a tenor of three years and thirty days at a fixed quarterly coupon of 8.02% per annum payable quarterly. The issuance is rated AAA/Stable each by CRISIL Ratings and ICRA.

Federal Bank: The lender’s board will meet on March 18 to consider the proposal to raise funds by way of issue of unsecured Basel III Tier-II subordinate bonds in the nature of debentures, amounting to Rs 1,000 crore on a private placement basis.

Zuari Industries: The company entered into an agreement with Envien International and Zuari Envien Bioenergy to jointly build and operate a fully-grain based 150 kilo litres per day Anhydrous Alcohol Distillery and further explore organic and inorganic business opportunities in bio-fuel space.

Ceat: Ceat Specialty, a division of Ceat Tires, has entered into an agreement with CNH Industrial to supply agricultural radial tires for their machines being produced in Brazil and Argentina, the company said in a statement.

ITC: ITC Infotech India, a wholly owned subsidiary of the company, incorporated a subsidiary in Germany under the name ITC Infotech GmbH.

Samvardhana Motherson: Japanese promoter company Sumitomo Wiring Systems will likely sell 3.4% stake in Samvardhana Motherson International through a block deal on Thursday, according to reports.

3i Infotech: The IT firm has incorporated a wholly-owned subsidiary in Singapore NuRe Infotech Solutions Pte Ltd. The subsidiary will engage in information technology products related business.

KPI Green Energy: The company has received commissioning certificates from Gujarat Energy Development Agency (GEDA) for capacity of 31 MWdc solar power project under captive power producer (CPP) segment of the company.

Patanjali Foods: The stock exchanges have frozen promoter holding of Patanjali Foods after the company failed to meet 25% public shareholding requirement within the said time frame. Currently, the promoter-backed in the stake comprises of 80.82%.

TIL: Life Insurance Corporation of India sold 2.12% stake or 2.12 lakh shares in the material handling equipment manufacturer via open market transactions. After stake sale, its shareholding in the company dropped to 8.07% , down from 10.199% earlier.

Sarda Energy & Minerals: The company has received the consent to operate from Chhattisgarh Environment Conservation Board, Raipur, for expansion in existing rolling mill from 1.8 lakh tonnes per annum to 2.5 lakh tonnes per annum.

Future Retail: Kishor Biyani withdrew his resignation from the position of executive chairman and director of the after the resolution professional of the embattled firm objected to the contents of his resignation letter and requested him to recall the same.