Market Opening - An Overview

Nifty futures on the Singapore Exchange were trading 0.09% lower at 17,142.50, signalling a marginally negative start for Dalal Street.

Asian shares were mixed after the US Fed raised interest rates by 25 basis points on Wednesday. The Nikkei 225 index was down 0.24% and the Topix was down 0.44%. The Hang Seng gained 0.56% and the CSI 300 index rose 0.44%.

Indian rupee fell by 2 paise to close 82.66 against the US dollar on Wednesday.

The US Federal Reserve hiked the interest rate by 25 basis points to fight persistently high inflation. The Fed increased its funds target rate to a range of 4.75%-5%, a level last seen prior to the 2007-08 global financial crisis. The rate hike will further add to the cost of funds and refuel the risks of a potential recession that will have rippling effects not only in the world’s largest economy but elsewhere on the globe.

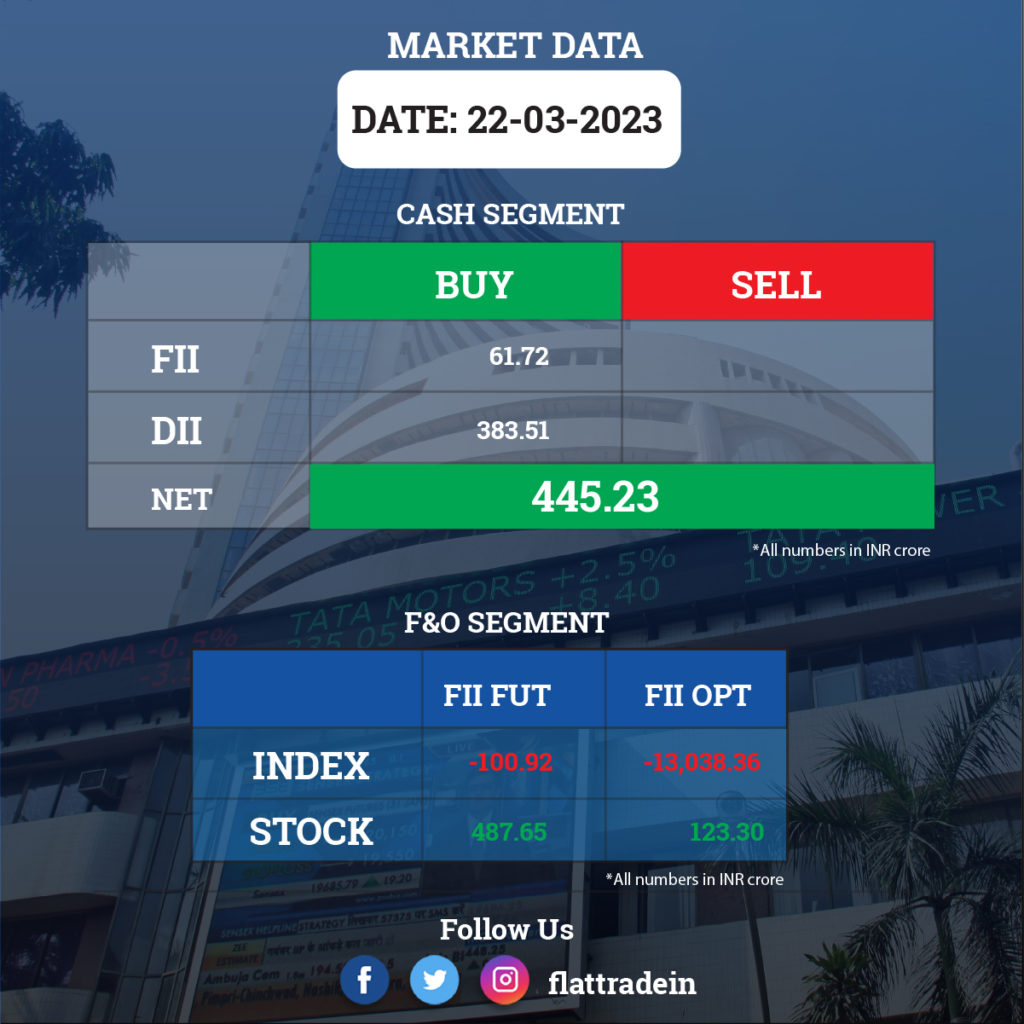

FII/DII Trading Data

Stocks in News Today

Hindustan Aeronautics (HAL): The Indian Government plans to sell 1.75% of its equity shares of face value of Rs 10 each on March 23 and March 24 for non-retail investors and an additional 1.75% stake in event the oversubscription option is exercised. The government owns a 75% stake in HAL. With this Offer For Sale, the government intends to raise about Rs 2,867 crore. The floor price for the offer will be Rs 2,450 per share, which is at a discount of 6.7% to the closing price of March 22.

Hero MotoCorp: The two-wheeler manufacturer said it will increase prices of its model range by around 2% from April 1, 2023, to offset the impact of rise in production cost and conform to stricter emission norms. The price revision will vary depending on specific models and markets, it added.

Reliance Industries (RIL): Reliance Consumer Products, the FMCG arm of the company’s retail subsidiary Reliance Retail Ventures, expanded its FMCG portfolio with the launch of personal and home care products.

Larsen & Toubro (L&T): The company signed an agreement with France-based McPhy Energy for a long-term partnership where the latter will grant an exclusive manufacturing license of its pressurised alkaline electrolyser technology to the former, including future product upgrades.

Nazara Technologies: The company’s subsidiary, Absolute Sports (Sportskeeda), has signed an agreement to acquire a 73.27% stake in Pro Football Network LLC (PFN), a premier source of coverage and analysis of the NFL (United States’ most watched sport) and college football. This marks the first acquisition of Absolute Sports in the US sports media market. The acquisition cost is $1.82 million (Rs 16 crore). In CY22, PFN had revenues of $2.1 million.

Power Grid Corporation: The company acquired six special purpose vehicles (SPVs) from REC Power Development and Consultancy for a cumulative consideration of Rs 80.23 crore. The SPVs have been mostly formed for the construction of Transmission Projects in Khavda region of Gujarat.

Power Finance Corporation (PFC): The company has inked a pact with Japan Bank for International Cooperation (JBIC) for a project loan of JPY 2.65 billion or about Rs 165 crore. Under this facility, JBIC has proposed to finance some of PFC’s projects which ensure effective reduction of greenhouse gas emissions and conservation of the global environment. This pact was executed under a general agreement signed between PFC and JBIC for JPY (Japanese Yen) 30 billion.

Mahindra & Mahindra (M&M): World Bank arm IFC will invest Rs 600 crore in a new last-mile mobility company wholly owned by Mahindra and Mahindra (M&M). The firm will be a newly incorporated company. The investment will be in the form of compulsory convertible instruments at a valuation of up to Rs 6,020 crore. The Rs 600 crore investments will give IFC an ownership of 9.97-13.64% in the new mobility company.

Spencer’s Retail: The company has appointed Anuj Singh as its chief executive officer (CEO) and managing director (MD). The company’s board approved the appointment based on the recommendation of the nomination and remuneration committee. Singh will be an additional director of the company from March 22, 2023, and the CEO and MD for three years.

GR Infraprojects: Dibang Power consortium, a joint venture between GR Infraprojects and Patel Engineering, has emerged as the lowest bidder for the construction of civil works for LOT-4 comprising head race tunnels including intake, pressure shafts, penstocks, power house and transformer cavern, tail race tunnels, pothead yard, adits etc. for Dibang Multipurpose Project 2880 MW (12 X 240 MW) in Arunachal Pradesh. The bid project cost is Rs 3,637.12 crore and the share of GR Infraprojects in the contract is 50%. In addition, GR Infraprojects has emerged as the L-1 bidder for a road project worth Rs 872.17 crore in Maharashtra to be executed in Hybrid Annuity Mode under Bharatmala Pariyojana.

PNC Infratech: The company’s subsidiary, Sonauli Gorakhpur Highways, received the appointed date (March 6) for the HAM project of National Highways Authority of India (NHAI). The project comprises the four-laning of the Sonauli – Gorakhpur section of NH-29E in Hybrid Annuity Mode in Uttar Pradesh and the construction period is 912 days.

HG Infra Engineering: HG Infra Engineering has been declared as the lowest bidder by National Highways Authority of India for the project in Jharkhand. The road project cost is Rs 764.01 crore and the construction period is 730 days.

Coromandel International: The board approved the company’s plan to expand operations in crop protection chemicals and foray into the contract development and manufacturing organisation (CDMO) business. The board further approved the plan to diversify into new growth areas – specialty and industrial chemicals. The company also plans to invest Rs 1,000 crore over the next two years in these businesses and leverage the macro tailwinds in the chemicals sector to build a business of scale.

IGL: The company and Bharat Heavy Electricals (BHEL) have signed an MoU for the development, manufacturing & deployment of Type-IV cylinders, hydrogen blending in city gas distribution (CGD) and fuel cell-based power backup systems.

Chalet Hotels: The company will acquire 100% stake of Sonmil Industries for 74.65 crore and 82.28% stake in The Dukes Retreat. Sonmil owns the land in Khandala where The Dukes Retreat runs a property.