Topline of two-wheeler manufacturers is likely to grow 13-14% in the current financial year after rising 19-20% last fiscal, driven by increasing preference for executive and premium motorcycles (>110 cc capacity) that yield higher realisations, according to rating agency CRISIL Ratings. The rise in revenue is despite a modest volume growth.

Overall two-wheeler sale volumes are expected to rise by about 8% year-on-year this fiscal to around 20.6 million units, driven by about 11% growth in the domestic markets, which accounted for 81% of overall volumes in fiscal 2023. In contrast, exports will be impacted for the second year in a row due to economic challenges and sustained high inflation in key markets such as Africa, Latin America, Bangladesh and Sri Lanka. Further, overall domestic sale of two-wheelers, in volume terms, would still be lower than the peak of 24.5 million units sold in fiscal 2019.

Motorcycles accounted for about 69% of two-wheeler sales volume last fiscal, and scooters and mopeds 29% and 2%, respectively. Demand for scooters, including high-speed electric ones, is also expected to grow at a healthy clip, driven by sustained orders from urban markets.

“Improving per capita income, especially in the urban and semi-urban markets, and the launch of more models are pushing consumer preference towards executive and premium motorcycles,” said Anuj Sethi, Senior Director, CRISIL Ratings.

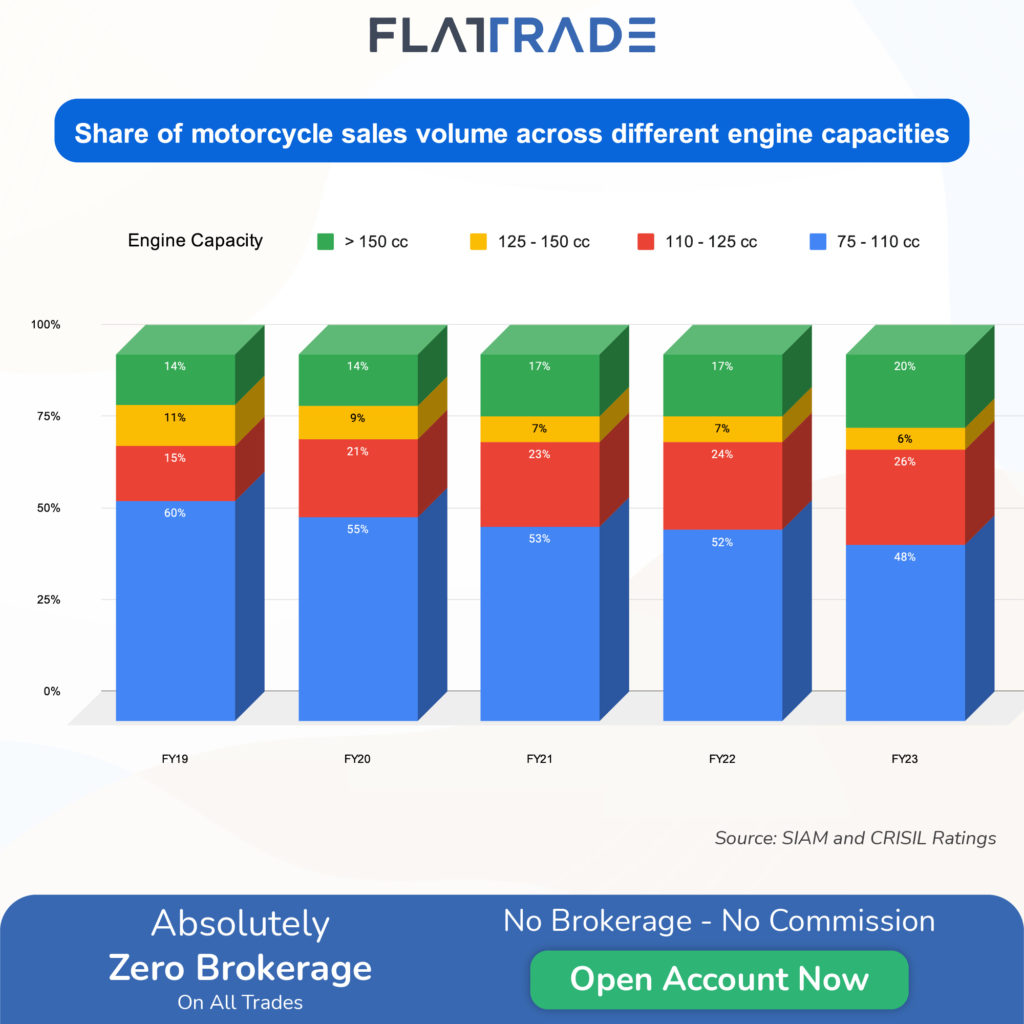

CRISIL Ratings stated that the share of premium motorcycles in overall motorcycle volume has increased to 52% last fiscal from 40% in fiscal 2019. On the other hand, demand for price sensitive entry-level motorcycles, which has an engine capacity of up to 110cc, has been slowing due to steep increase in the cost of ownership between fiscals 2019 and 2023, the rating agency said. The increase in cost is due to higher commodity prices and strict emission regulations.

Though the industry has witnessed a volume growth for the third straight year, it would still be about 14% lower than the fiscal 2019 peak. Meanwhile, this fiscal is unlikely to see major production capacity increase for traditional internal combustion engine (ICE) vehicles, the rating agency added.

“We expect investments to be largely for PLI commitments and to enhance capacity for EVs, which saw exponential growth last fiscal – albeit on a low base – despite wafer-thin margins,” Poonam Upadhyay, Director, CRISIL Ratings.

Meanwhile, improving operating leverage and premiumisation in product mix will help manufacturers sustain operating profitability at 13-14%, leading to healthy cash accrual, CRISIL Ratings noted. In addition, strong balance sheets will keep the credit profiles of manufacturers healthy despite higher capital spend, including for PLI-related investments and electric vehicle (EV) components.

Going forward, CRISIL Ratings said that sustainability of demand as well as supply-chain management, especially for semi-conductors used widely in executive and premium motorcycles, will be a key monitorable. The rating agency also said that a weak monsoon could dent rural demand.